Where Reckitt Benckiser Group plc (LON:RB.) Stands In Terms Of Earnings Growth Against Its Industry

When Reckitt Benckiser Group plc (LSE:RB.) announced its most recent earnings (30 June 2017), I compared it against two factor: its historical earnings track record, and the performance of its industry peers on average. Being able to interpret how well Reckitt Benckiser Group has done so far requires weighing its performance against a benchmark, rather than looking at a standalone number at a point in time. In this article, I’ve summarized the key takeaways on how I see RB. has performed. See our latest analysis for Reckitt Benckiser Group

How Did RB.’s Recent Performance Stack Up Against Its Past?

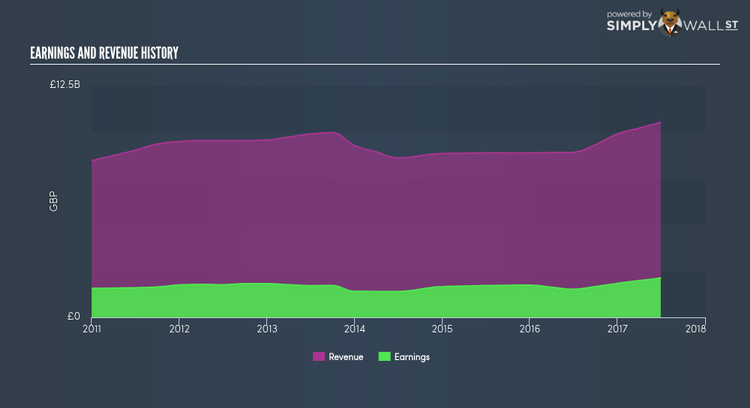

To account for any quarterly or half-yearly updates, I use data from the most recent 12 months, which either annualizes the most recent 6-month earnings update, or in some cases, the most recent annual report is already the latest available financial data. This technique allows me to assess many different companies on a similar basis, using the most relevant data points. “For Reckitt Benckiser Group, its “, latest twelve-month earnings is £2,125.0M, which, relative to the prior year’s figure, has moved up by 39.99%. Given that these values may be somewhat short-term thinking, I’ve estimated an annualized five-year figure for Reckitt Benckiser Group’s net income, which stands at £1,691.3M. This shows that, generally, Reckitt Benckiser Group has been able to increasingly grow its net income over the past couple of years as well.

What’s the driver of this growth? Let’s see whether it is merely a result of industry tailwinds, or if Reckitt Benckiser Group has experienced some company-specific growth. In the last couple of years, Reckitt Benckiser Group grew its bottom line faster than revenue by successfully controlling its costs. This resulted in a margin expansion and profitability over time. Eyeballing growth from a sector-level, the UK household products industry has been growing, albeit, at a muted single-digit rate of 8.23% over the previous twelve months, and 7.43% over the past five years. This shows that any tailwind the industry is profiting from, Reckitt Benckiser Group is able to amplify this to its advantage.

What does this mean?

Though Reckitt Benckiser Group’s past data is helpful, it is only one aspect of my investment thesis. Positive growth and profitability are what investors like to see in a company’s track record, but how do we properly assess sustainability? You should continue to research Reckitt Benckiser Group to get a more holistic view of the stock by looking at:

1. Future Outlook: What are well-informed industry analysts predicting for RB.’s future growth? Take a look at our free research report of analyst consensus for RB.’s outlook.

2. Financial Health: Is RB.’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.