While shareholders of Cimpress (NASDAQ:CMPR) are in the black over 1 year, those who bought a week ago aren't so fortunate

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Cimpress plc (NASDAQ:CMPR) share price has soared 167% return in just a single year. It's also good to see the share price up 14% over the last quarter. But this could be related to the strong market, which is up 9.4% in the last three months. Zooming out, the stock is actually down 12% in the last three years.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Cimpress

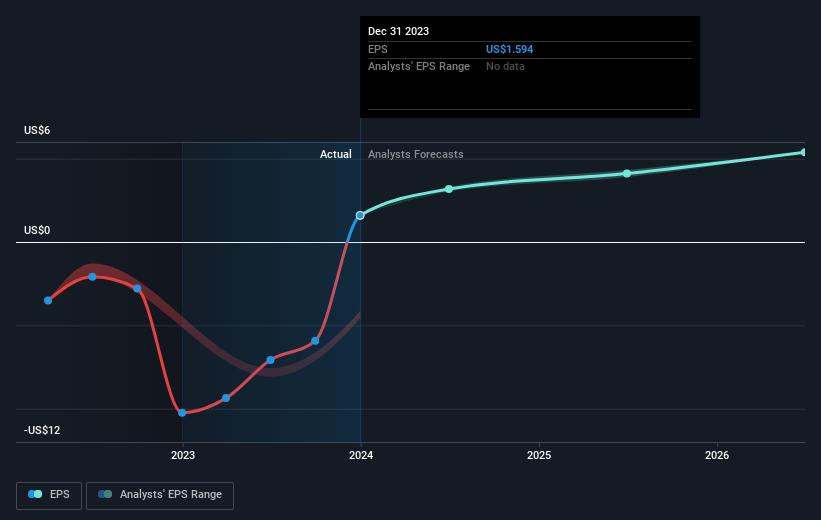

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Cimpress grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Inflection points like this can be a great time to take a closer look at a company.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Cimpress has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Cimpress will grow revenue in the future.

A Different Perspective

It's nice to see that Cimpress shareholders have received a total shareholder return of 167% over the last year. That gain is better than the annual TSR over five years, which is 3%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Cimpress (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.