While shareholders of R1 RCM (NASDAQ:RCM) are in the black over 5 years, those who bought a week ago aren't so fortunate

R1 RCM Inc. (NASDAQ:RCM) shareholders might be concerned after seeing the share price drop 22% in the last month. But that does not change the realty that the stock's performance has been terrific, over five years. Indeed, the share price is up a whopping 533% in that time. So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term. It really delights us to see such great share price performance for investors.

Although R1 RCM has shed US$761m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for R1 RCM

While R1 RCM made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years R1 RCM saw its revenue grow at 23% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 45% per year in that time. Despite the strong run, top performers like R1 RCM have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

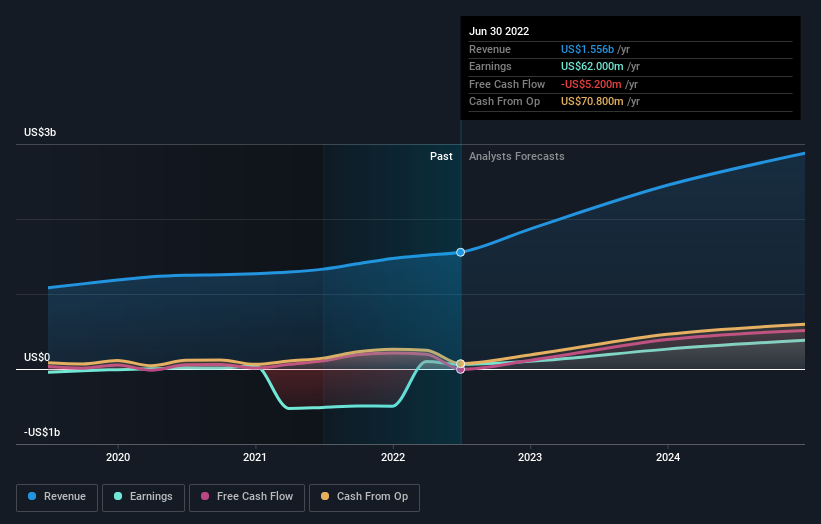

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that R1 RCM has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that R1 RCM has rewarded shareholders with a total shareholder return of 4.0% in the last twelve months. Having said that, the five-year TSR of 45% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for R1 RCM (of which 2 are significant!) you should know about.

But note: R1 RCM may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here