Whirlpool Corp (WHR) Reports Solid Q4 Earnings and Outlines 2024 Guidance

Net Sales Growth: Q4 net sales increased by 3.4% year-over-year, with a notable 1 point of North America share gains.

GAAP Net Earnings Margin: Improved significantly to 9.7% in Q4 from (32.6)% in the prior year, largely due to the Europe transaction impact.

Ongoing EBIT Margin: Increased by 170 basis points year-over-year to 5.2% in Q4.

Earnings Per Share: Full-year GAAP and ongoing (non-GAAP) earnings per diluted share stood at $8.72 and $16.16, respectively.

Dividends and Debt Repayment: Paid $384 million in dividends and repaid $500 million of term loan in 2023.

2024 Financial Outlook: Expects GAAP and ongoing earnings per diluted share of $8.50 to $10.50 and $13.00 to $15.00, respectively.

Free Cash Flow: Projected to be between $550 to $650 million for 2024.

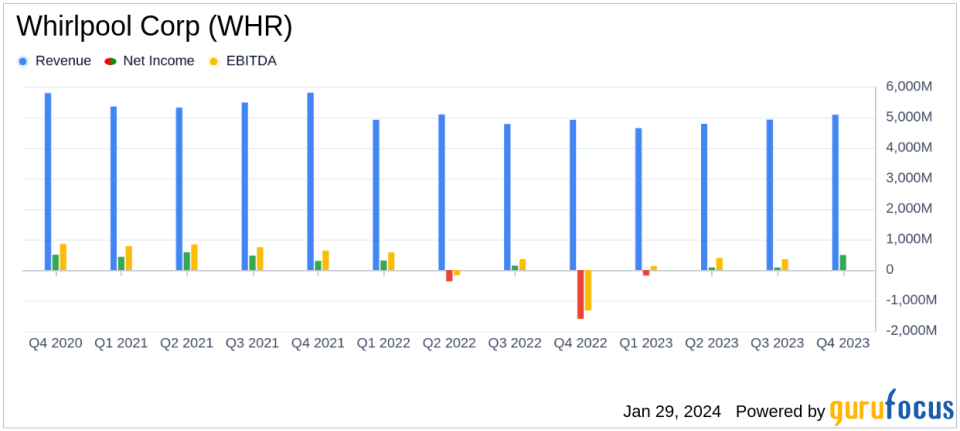

On January 29, 2024, Whirlpool Corp (NYSE:WHR) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a leading manufacturer and marketer of home appliances, reported a net sales growth of approximately 3% in Q4, with a significant recovery in GAAP net earnings margin to 9.7% compared to the prior year's (32.6)%, which was impacted by the Europe transaction.

Whirlpool Corp's performance in Q4 reflects a robust turnaround, especially in the North American market where it achieved a 1 point share gain. The company's ongoing (non-GAAP) EBIT margin also saw a year-over-year increase of 170 basis points, reaching 5.2%. For the full year, Whirlpool reported GAAP and ongoing (non-GAAP) earnings per diluted share of $8.72 and $16.16, respectively, which includes a substantial $800 million cost reduction.

Chairman and CEO Marc Bitzer highlighted the company's achievements, stating,

In 2023, we delivered over a point of North America share gains and approximately $800 million of cost take out as expected."

He also expressed optimism for 2024, anticipating further cost structure resets and margin improvements following the closure of the Europe transaction.

Whirlpool's financial achievements are particularly important in the context of the Furnishings, Fixtures & Appliances industry, where competition is intense and operational efficiency is key to maintaining profitability. The company's ability to cut costs while growing market share in North America is indicative of strong management and strategic planning.

Chief Financial Officer Jim Peters emphasized the company's financial health,

We continue to create balance sheet flexibility and prioritize debt reduction with $500 million repayment of debt in 2023."

He also noted the company's strong cash position and its plans to fund dividends and further reduce debt in 2024.

Whirlpool's regional performance varied, with North America showing a 1.3% increase in net sales and a significant 45.8% increase in EBIT. Europe, the Middle East, and Africa (EMEA) experienced a net sales decline of 3.2%, but EBIT improved from a loss in the prior year to a positive margin. Latin America and Asia also reported net sales and EBIT growth.

Looking ahead to 2024, Whirlpool expects to maintain its net sales at approximately $16.9 billion, reflecting a flat like-for-like basis and a 13% decrease compared to the prior year's reported results. The company's full-year guidance includes anticipated cost reductions of $300-$400 million and a projected free cash flow of $550 to $650 million.

Overall, Whirlpool Corp's financial results demonstrate resilience in a challenging market, with strategic cost reductions and a focus on maintaining a strong balance sheet. The company's outlook for 2024 suggests a continued commitment to improving profitability and shareholder value.

For more detailed information about Whirlpool Corp's financial performance and future outlook, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Whirlpool Corp for further details.

This article first appeared on GuruFocus.