Whitbread PLC's Dividend Analysis

A Comprehensive Examination of Whitbread PLC's Dividend Performance and Sustainability

Whitbread PLC (WTBCF) recently announced a dividend of $0.34 per share, payable on 2023-12-08, with the ex-dividend date set for 2023-11-02. Investors are keen to understand the implications of this forthcoming payment, prompting a closer look at the company's dividend history, yield, and growth rates. Drawing on data from GuruFocus, this article provides an in-depth analysis of Whitbread PLC's dividend performance and assesses its sustainability.

Whitbread PLC: A Brief Overview

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

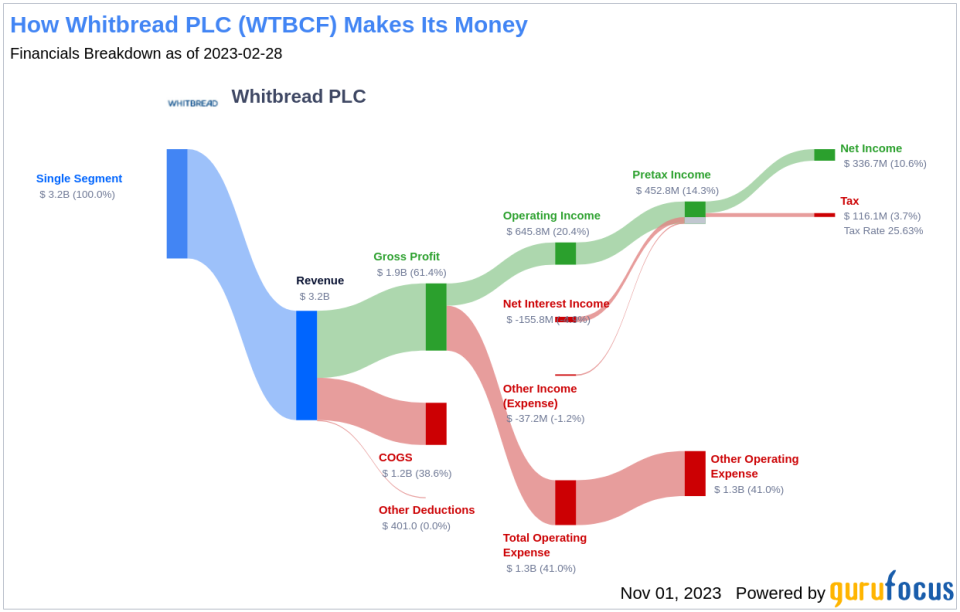

Whitbread PLC operates hotels and restaurants predominantly in the United Kingdom. The company manages over 800 hotels under the Premier Inn brand, offering accommodation and food services both domestically and internationally. Its restaurant brands include Beefeater, Brewers Fayre, Cookhouse & Pub, Bar Block, and others. The majority of the company's revenue is derived from its UK division.

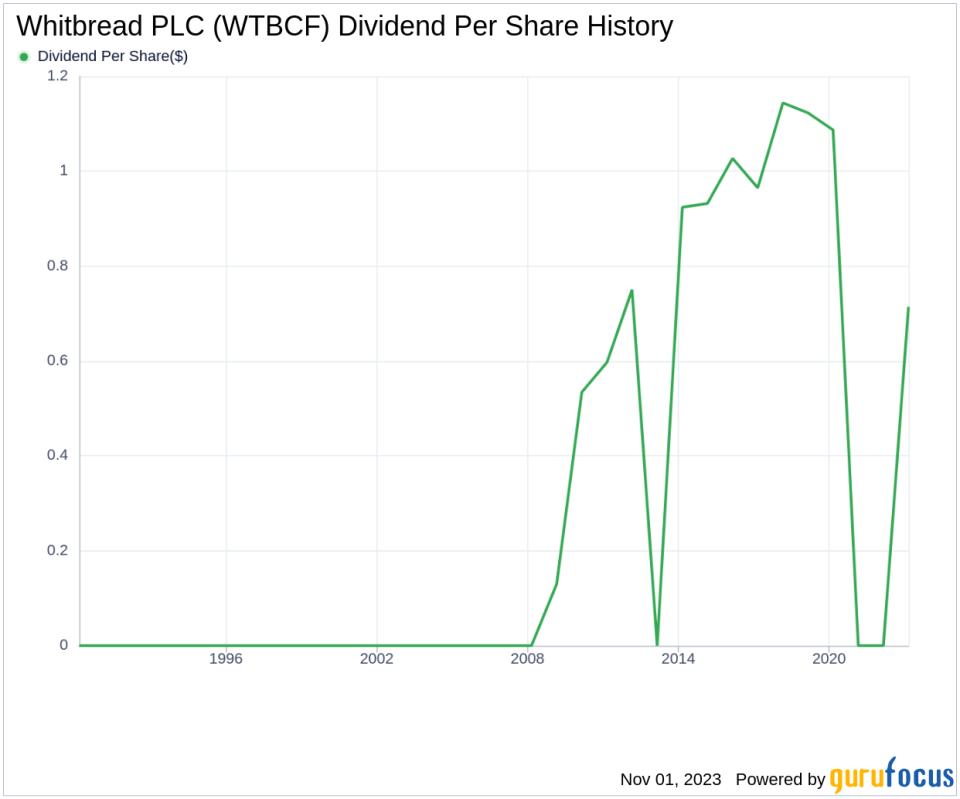

Whitbread PLC's Dividend History

Since 2022, Whitbread PLC has maintained a consistent dividend payment record, with distributions occurring bi-annually. The chart below provides a historical perspective on the company's annual Dividends Per Share.

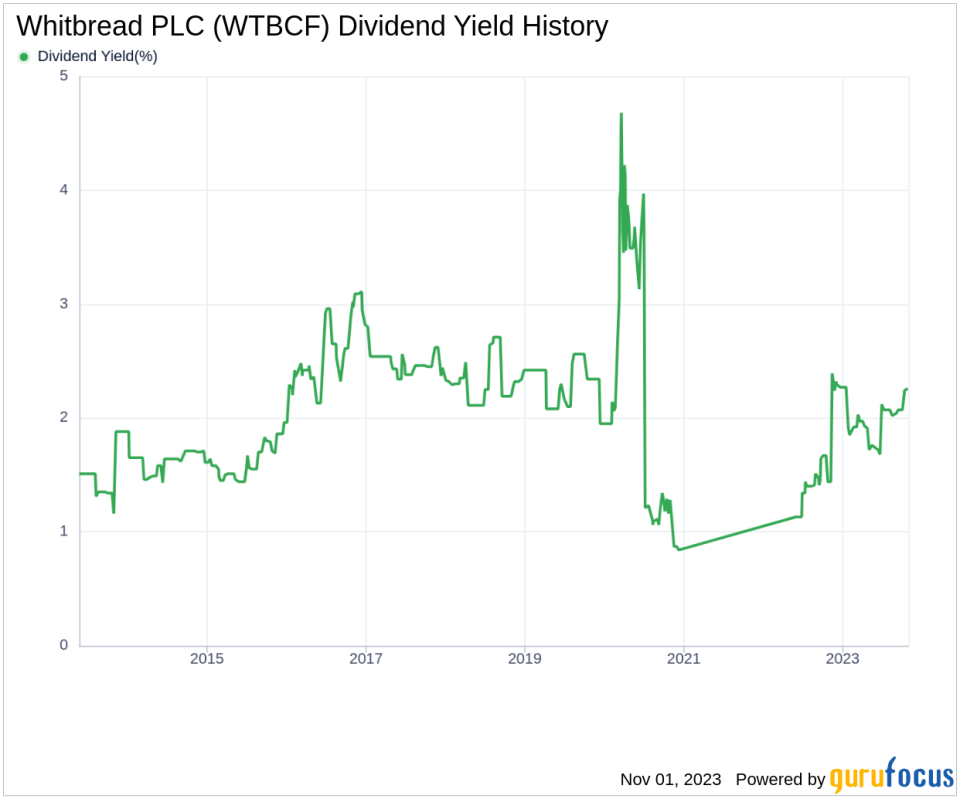

Whitbread PLC's Dividend Yield and Growth

As of today, Whitbread PLC has a 12-month trailing dividend yield of 2.32% and a 12-month forward dividend yield of 2.62%. This indicates an anticipated increase in dividend payments over the next 12 months. However, it's worth noting that the company's annual dividend growth rate over the past three years was -11.70%.

Whitbread PLC's 5-year yield on cost is approximately 2.32%, based on its current dividend yield and five-year growth rate.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The sustainability of Whitbread PLC's dividend can be evaluated by examining its payout ratio. The dividend payout ratio reveals the proportion of earnings that the company distributes as dividends. A lower ratio indicates that a substantial portion of earnings is retained, providing funds for future growth and unforeseen downturns. As of 2023-08-31, Whitbread PLC's dividend payout ratio is 0.44.

Whitbread PLC's profitability rank of 7 out of 10 suggests good profitability prospects. The company has reported net profit in 9 out of the past 10 years.

Whitbread PLC's Growth Metrics

Robust growth metrics are crucial for dividend sustainability. Whitbread PLC's growth rank of 7 out of 10 indicates a positive growth trajectory relative to its competitors. The company's revenue per share and 3-year revenue growth rate suggest a strong revenue model, with revenue increasing by approximately 3.00% per year on average. This rate outperforms approximately 60.57% of global competitors.

Whitbread PLC's 3-year EPS growth rate showcases its ability to grow earnings, a critical factor for sustaining dividends in the long term. Over the past three years, the company's earnings have increased by approximately 3.30% per year on average, outperforming approximately 41.75% of global competitors.

Conclusion

Based on Whitbread PLC's consistent dividend payments, reasonable payout ratio, and positive growth metrics, the company appears well-positioned to sustain its dividend in the foreseeable future. However, the negative dividend growth rate over the past three years warrants monitoring. As always, investors should consider these factors in the context of their individual investment objectives and risk tolerance.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.