Whitestone REIT (WSR) Reports Solid Occupancy and Revenue Growth in Q4 and Full Year 2023 Results

Occupancy: Achieved record occupancy of 94.2% in Q4 2023.

Revenue Growth: Year-over-year revenue increase exceeded 5%.

Core FFO Guidance: 2024 Core FFO per share guidance initiated at $0.98 - $1.04.

Dividend Increase: Quarterly cash distribution increased by 3.13% for Q2 2024.

Leasing Spreads: GAAP leasing spreads nearly 22% in Q4 2023.

On March 6, 2024, Whitestone REIT (NYSE:WSR) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. Whitestone, a real estate investment trust specializing in high-quality open-air shopping centers in Sunbelt markets, reported a year of robust performance with significant occupancy gains and revenue growth.

Financial and Operational Highlights

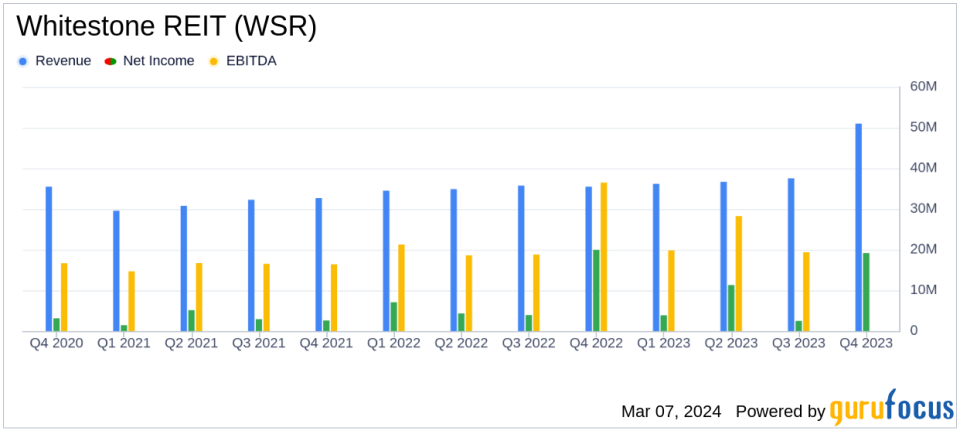

Whitestone's Q4 2023 results showed a record occupancy rate of 94.2%, up from 93.7% in the same quarter of the previous year. The company also reported strong leasing activity with GAAP leasing spreads of 21.8% and a significant number of new leases signed. Rental rate growth for new leases was 37.3%, while renewal leases saw a growth of 15.3%. The company's same-store property net operating income (NOI) increased by 2.4% year-over-year.

For the full year, Whitestone's revenue growth exceeded 5%, and the company initiated a 2024 Core FFO per share guidance range of $0.98 to $1.04. The dividend was also increased by 3% as announced on March 5, 2024, reflecting the company's confidence in its financial stability and growth trajectory.

Balance Sheet Strength and 2024 Outlook

Whitestone's balance sheet remains solid with a net debt to EBITDAre ratio improvement from 7.5X to a projected range of 7.0X to 6.6X for 2024. The company estimates that GAAP net income available to common shareholders will be within the range of $0.32 to $0.38 per diluted share for the full year 2024.

The company's portfolio consists of 55 wholly-owned properties with approximately 5.0 million square feet of gross leasable area. The diversified tenant base is a key strength, with the largest tenant accounting for only 2.1% of annualized base rental revenues.

Investor and Analyst Confidence

Whitestone's strategic focus on high-growth Sunbelt markets and community-centered properties has positioned it well for continued success. The company's strong financial performance and proactive management are likely to instill confidence in investors and analysts alike.

Whitestone will host a conference call on March 7, 2024, to discuss the earnings results in greater detail, providing an opportunity for investors and analysts to gain further insights into the company's performance and strategies.

For value investors and potential GuruFocus.com members, Whitestone REIT's solid performance in occupancy and revenue growth, coupled with its prudent financial management and strategic market focus, make it a noteworthy consideration in the REIT sector.

For further information and a detailed financial breakdown, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Whitestone REIT for further details.

This article first appeared on GuruFocus.