Why Acadia (ACHC) is a Smart Addition to Your Portfolio Now

Acadia Healthcare Company, Inc. ACHC is strategically poised for growth, driven by increasing admissions and expansion in Medicare, Medicaid and commercial businesses. The growing demand for its acute inpatient psychiatric facilities, specialty treatment facilities and comprehensive treatment centers serves as a significant revenue driver for the company.

Acadia Healthcare, with a market capitalization of $7.3 billion, operates as a prominent behavioral healthcare services provider in the United States and Puerto Rico. Due to solid prospects, this currently Zacks Rank #2 (Buy) stock is worth investing in at the moment. In this analysis, we'll explore the growth drivers and estimates and highlight the key factors investors should monitor.

Let’s delve deeper.

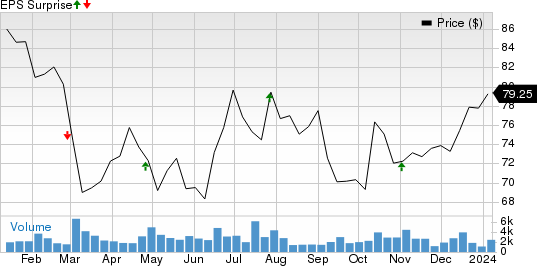

The Zacks Consensus Estimate for ACHC’s 2023 earnings is pegged at $3.41 per share, indicating 13.3% year-over-year growth. The company witnessed two upward estimate revisions over the past 60 days against no movement in the opposite direction. Further, the consensus estimate for 2024 earnings indicates 11.2% year-over-year growth. Acadia Healthcare beat on earnings in three of the last four quarters and missed once, with an average surprise of 3.6%. This is depicted in the figure below.

Acadia Healthcare Company, Inc. Price and EPS Surprise

Acadia Healthcare Company, Inc. price-eps-surprise | Acadia Healthcare Company, Inc. Quote

The consensus mark for 2023 revenues stands at $2.9 billion, suggesting 11.7% growth from a year ago. For 2024, the consensus mark is pegged at $3.2 billion. Headquartered in Franklin, TN, Acadia Healthcare’s top line is poised to capitalize on increasing admissions and patient days. Our model predicts 7.2% year-over-year growth in U.S. same-facility patient days in 2023, along with a 9% year-over-year increase in admissions.

Although the company’s average length of stay is facing some headwinds, especially in the Acquired & Other category, the growth in revenues per patient day is a major tailwind. We expect the U.S. Same Facility revenue per patient day to witness 7% year-over-year growth in 2023 and nearly 2% in 2024.

The company is well-poised to capitalize on the rising demand for hospital services, supported by the growth in the senior population. Its focus on bed additions will enable it to address that increase in demand. It is expected to have expanded its facilities by adding 300 beds in 2023, along with opening at least six Comprehensive Treatment Centers. It is to be seen how much the company further invests in expanding its beds in 2024.

Last month, it inaugurated an acute care hospital in the Indio city of California. Named Coachella Valley Behavioral Health, the facility is equipped with 80 beds. Similar projects are expected to surface in the coming days. Demand for behavioral health and substance use treatment is expected to lead to improving utilization of ACHC’s treatment options.

The hospital company anticipates operating cash flows to be in the range of $450-$500 million for 2023, compared to the previous year's figure of $380.6 million, indicating growing cash-generating ability. Also, ACHC actively pursues joint ventures with renowned healthcare systems, which helps the company to expand its capabilities.

Key Concern

However, there are a few factors that investors should keep an eye on. One for example, is rising expenses, which jumped 7% in 2021, and 9.7% rise in 2022. Our model predicts a more than 30% rise in the metric in 2023. Nevertheless, we believe that a systematic and strategic plan of action will drive growth in the long term.

Other Key Medical Picks

Enhancing the array of healthcare options, other promising stocks in the Medical sector include Brookdale Senior Living Inc. BKD, Enovis Corporation ENOV and Motus GI Holdings, Inc. MOTS, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Brookdale Senior’s full-year 2023 earnings indicates a 49.6% year-over-year improvement. BKD beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 23.5%.

The Zacks Consensus Estimate for Enovis’ 2023 full-year earnings implies a 4.4% increase from the year-ago reported figure. The consensus mark for its current-year revenues is pegged at $1.7 billion. ENOV beat earnings estimates in all the last four quarters, with an average surprise of 11%.

The Zacks Consensus Estimate for Motus GI’s 2023 bottom line suggests a 67.2% year-over-year improvement. MOTS has witnessed one upward estimate revision over the past 30 days against no movement in the opposite direction. It beat earnings estimates in all the last four quarters, with an average surprise of 40.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC) : Free Stock Analysis Report

Motus GI Holdings, Inc. (MOTS) : Free Stock Analysis Report

Enovis Corporation (ENOV) : Free Stock Analysis Report