Why You Should Add DaVita (DVA) Stock to Your Portfolio

DaVita Inc. DVA has been gaining from its DaVita Kidney Care. The optimism led by a solid third-quarter 2023 performance and its business model are expected to contribute further. However, concerns regarding its dependence on commercial payers and integration risks persist.

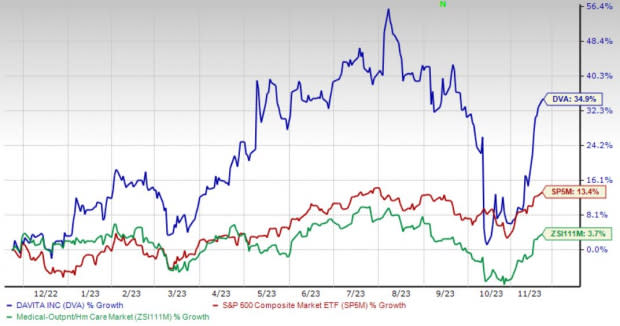

Over the past year, this Zacks Rank #1 (Strong Buy) stock has gained 34.9% compared with a 3.8% rise of the industry and 13.4% growth of the S&P 500.

The renowned global comprehensive kidney care provider has a market capitalization of $8.91 billion. The company projects 18.3% growth for the next five years and expects to maintain its strong performance. DaVita’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 36.6%.

Image Source: Zacks Investment Research

Let’s delve deeper.

DaVita Kidney Care: We are optimistic about DaVita Kidney Care, the major revenue-generating segment of DVA. It specializes in a broad array of dialysis services, significantly contributing to the company's top line. With respect to DaVita’s Integrated Kidney Care, as of Sep 30, 2023, the company had approximately 59,000 patients in risk-based integrated care arrangements, representing approximately $4.8 billion in annualized medical spend. DaVita also had an additional 16,000 patients in other integrated care arrangements.

Business Model: DaVita’s patient-centric care model leverages its platform of kidney care services to maximize patient choice in both models and modalities of care, buoying our optimism. Value-based arrangements are proliferating in the kidney health space. These arrangements are allowing for a much larger degree of collaboration between nephrologists, providers and transplant programs, resulting in a more complete understanding of each patient’s clinical needs. Per management, this is expected to lead to better care coordination and earlier intervention.

Strong Q3 Results: DaVita’s solid third-quarter 2023 results buoy optimism. The company registered an uptick in its overall top line and dialysis patient service and Other revenues during the period. The sequential improvement of DaVita’s bottom line was also recorded. The opening of several dialysis centers within the United States and overseas was promising. The expansion of both margins bodes well for the stock.

Downsides

Dependence on Commercial Payers: A significant portion of DaVita’s dialysis and related lab services revenues are generated from patients who have commercial payers as the primary payers. The payments received from commercial payers are the primary generators of profit. However, there remains a risk of people shifting from commercial insurance schemes to government schemes due to the wide disparity in payment rates in case of a rise in unemployment. In fact, the mix of treatments reimbursed by non-government payers, as a percentage of total treatments, has been falling consistently over the years.

Integration Risks: DaVita’s business strategy includes growth through acquisitions of dialysis centers and other businesses, as well as entry into joint ventures. The company may engage in acquisitions, mergers, joint ventures or dispositions or expand into new business models, which may affect its operations.

Estimate Trend

DaVita is witnessing a positive estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 6.9% north to $7.88.

The Zacks Consensus Estimate for the company’s fourth-quarter 2023 revenues is pegged at $3 billion, suggesting a 2.9% uptick from the year-ago quarter’s reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space are Cardinal Health, Inc. CAH, Integer Holdings Corporation ITGR and Cencora, Inc. COR.

Cardinal Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 15.2%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 15.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardinal Health has gained 34.5% compared with the industry’s 9.4% rise over the past year.

Integer Holdings, sporting a Zacks Rank #1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, with an average of 11.9%.

Integer Holdings has gained 25.1% against the industry’s 7.4% decline over the past year.

Cencora, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 8.9%. COR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.9%.

Cencora has gained 20.1% against the industry’s 13.4% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report