Why You Should Add PPG Industries (PPG) Stock to Your Portfolio

PPG Industries, Inc. PPG is gaining from favorable market conditions, pricing actions, enhanced manufacturing efficiencies, cost discipline and acquisitions.

This Zacks Rank #2 (Buy) stock is an attractive investment opportunity with strong growth prospects.

Estimates Northbound

The Zacks Consensus Estimate for PPG's third-quarter earnings has increased approximately 4.9% over the past three months. The consensus estimate for 2023 has been revised around 3.6% upward during the same period.

Positive Earnings Surprise History

PPG outperformed the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter average earnings surprise of 7.3%.

Healthy Growth Potential

The Zacks Consensus Estimate for 2023 earnings is currently pegged at $7.51, implying year-over-year growth of 24.1%. Moreover, earnings are expected to register 10.4% growth in 2024.

An Outperformer

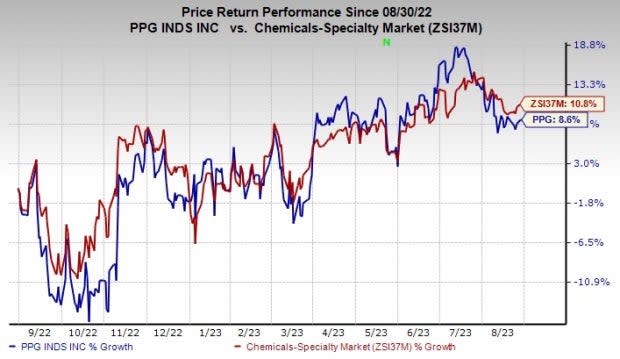

PPG’s shares are up 10.8% over the past year, outperforming the industry’s rise of 8.6%.

Image Source: Zacks Investment Research

Cost & Pricing Actions, Acquisitions Drive PPG

The company is implementing a cost-cutting and restructuring strategy, as well as optimizing its working capital needs. The cost savings realized by these restructuring activities will boost company's profitability. PPG Industries has undertaken considerable cost-cutting efforts, focused especially on regions and end-use industries experiencing severe business conditions. Substantial restructuring efforts are being undertaken by the company in order to lower its global cost structure. The company achieved $15 million in incremental cost reductions through restructuring programs and acquisition synergies in the second quarter of 2023.

Moreover, PPG Industries is pursuing inorganic efforts to grow its business. Tikkurila, Worwag and Cetelon are expected to add to the company's top line in 2023, growing its market presence and broadening its product offerings.

PPG Industries has successfully implemented price hikes throughout its businesses to reduce the impact of raw material and other cost inflation and drive profitability. Significant progress has been made in increasing consolidated segment margins, which were more than 16% in the second quarter, up 330 basis points from the year-ago quarter. The Performance Coatings division delivered outstanding margin performance, with the highest margins since 2016.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Other Key Picks

Other top-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Denison Mine Corp. DNN and Veritiv Corporation VRTV.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). The stock has rallied roughly 64.3% in the past year. CRS beat the Zacks Consensus Estimate in three of the last four quarters while meeting in one. It delivered a trailing four-quarter earnings surprise of 9.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Denison Mines currently carries a Zacks Rank #1. The stock has gained roughly 4.5% in the past year. DNN beat the Zacks Consensus Estimate in three of the last four quarters while meeting once. It delivered a trailing four-quarter earnings surprise of 75%, on average.

Veritiv currently carries a Zacks Rank #2. The stock has rallied roughly 29.3% in the past year. VRTV beat the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Veritiv Corporation (VRTV) : Free Stock Analysis Report