Why You Should Add PPG Industries (PPG) Stock to Your Portfolio

PPG Industries, Inc. PPG is gaining from pricing actions, enhanced manufacturing efficiencies, cost discipline and acquisitions.

We are positive on the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks promising and is poised to carry the momentum ahead.

Let's see what makes this Zacks Rank #2 (Buy) stock an attractive investment option at the moment.

Estimates Northbound

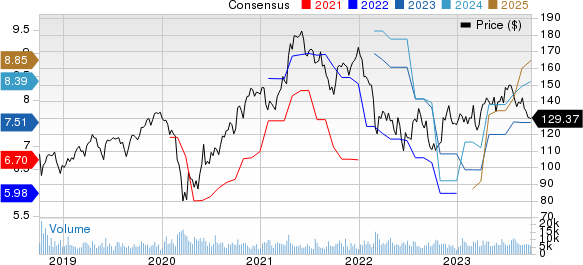

The Zacks Consensus Estimate for PPG's 2023 earnings has increased roughly 3.6% over the past three months. The consensus estimate for 2024 has also been revised around 6.2% upward during the same period. The favorable estimate revisions instill investor confidence in the stock.

Positive Earnings Surprise History

PPG outperformed the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter average earnings surprise of 7.3%.

Healthy Growth Prospects

The Zacks Consensus Estimate for 2023 earnings is currently pegged at $7.51, implying year-over-year growth of 24.1%. Moreover, earnings are expected to register 11.6% growth in 2024.

Cost & Pricing Actions, Acquisitions Drive PPG

PPG Industries is benefiting from higher pricing across its segments, manufacturing efficiencies, cost actions and efforts to grow its business through acquisitions.

The company is implementing a cost-cutting and restructuring strategy, as well as optimizing its working capital requirements. The cost savings generated by these restructuring initiatives will act as a tailwind for the company. PPG Industries has undertaken extensive restructuring efforts to reduce its cost structure, primarily focusing on regions and end markets with weak business conditions. The company achieved $15 million in incremental cost reductions through restructuring programs and acquisition synergies in the second quarter of 2023.

PPG Industries is also raising selling prices across its business segments to offset the impact of raw material and other cost inflation and drive profitability. Significant progress has been made in increasing consolidated segment margins, which were more than 16% in the second quarter, up 330 basis points from the year-ago quarter. Pricing measures are likely to continue to support its margins in the remainder of 2023.

The company is also undertaking measures to grow business inorganically through value-creating acquisitions. Contributions from the acquisitions are expected to get reflected in its performance in 2023. Acquisitions, including Tikkurila, Worwag and Cetelon, are likely to contribute to its top line this year.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Stocks to Consider

Other top-ranked stocks worth a look in the basic materials space include Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and Alamos Gold Inc. AGI.

Hawkins has a projected earnings growth rate of 18.9% for the current year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has a trailing four-quarter earnings surprise of roughly 25.6%, on average. HWKN shares are up around 52% in a year.

The Zacks Consensus Estimate for current fiscal-year earnings for CRS is currently pegged at $3.48, implying year-over-year growth of 205.3%. Carpenter Technology currently carries a Zacks Rank #2.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 10%, on average. The stock has rallied around 86% over the past year.

Alamos Gold currently carries a Zacks Rank #2. The Zacks Consensus Estimate for AGI's current-year earnings has been revised 7.5% upward over the past 60 days.

The Zacks Consensus Estimate for current fiscal-year earnings for Alamos Gold is currently pegged at 43 cents, implying year-over-year growth of 53.6%. AGI shares have rallied around 36% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report