Why Should You Add Quaker Chemical (KWR) to Your Portfolio

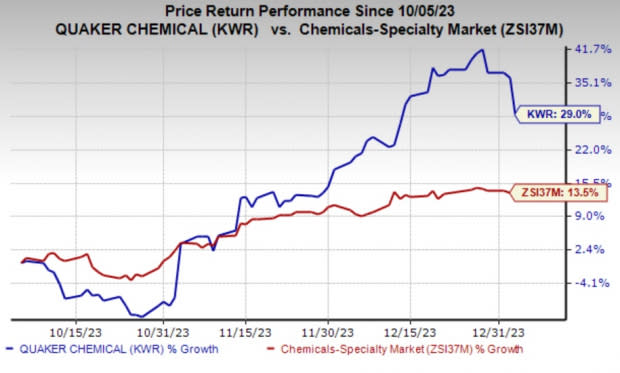

Quaker Chemical Corporation KWR has experienced a 29% increase in its stock value in the last three months against a 13.5% rise of the industry, driven by strong third-quarter performance.

Image Source: Zacks Investment Research

The stock offers an attractive investment opportunity with strong growth prospects, as reflected in its Zacks Rank #2 (Buy).

Positive Earnings Surprise History

Quaker has outperformed the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter average earnings surprise of around 16.7%.

Healthy Growth Potential

The 2023 Zacks Consensus Estimate is pegged at $7.53, indicating a 28.3% increase compared with the previous year’s levels. Further, earnings are expected to experience a 17.9% growth in 2024.

Estimates Northbound

The Zacks Consensus Estimate for Quaker for 2023 has increased by around 1% in the past two months. The consensus estimate for 2024 has also been revised 1.8% upward over the same time frame.

What’s Going in Quaker’s Favor?

Quaker reported a strong third-quarter performance with adjusted earnings per share of $2.05, beating the Zacks Consensus Estimate of $1.89. Despite a 0.3% decline in net sales to $490.6 million, itsurpassed the Zacks Consensus Estimate of $483.6 million. The company showcased resilience through higher selling prices, favorable currency impact, and improved product mix.

The EMEA unit saw a 4% year-over-year increase in sales to $139.6 million, surpassing the consensus estimate of $129 million, driven by higher selling prices and a favorable currency impact, partially offset by lower sales volumes. The Asia/Pacific unit achieved sales of $105.1 million, up 2% from the previous year and exceeding the consensus estimate of $96 million, attributed to increased sales volumes. While the Americas segment experienced a 3% decline in sales to $245.9 million.

KWR remains committed to execute its enterprise strategy as it collaborates with customers to provide value-added services and solutions. It is progressing to position the company to build upon its market leading position by further differentiating its customer intimacy model and accelerating new business wins.

Zacks Rank & Other Key Picks

Some other top-ranked stocks in the Basic Materials space are Centrus Energy Corp. LEU, sporting a Zacks Rank #1 (Strong Buy), and Axalta Coating Systems Ltd. AXTA and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LEU’s current-year earnings has been revised upward by 30.5% in the past 60 days. LEU beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 47.7%. The company’s shares have increased 56.7% in the past year.

The consensus estimate for AXTA’s current-year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have increased 29.1% in the past year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents, indicating a year-over-year surge of 89.3%. AGI beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 19.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quaker Houghton (KWR) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Centrus Energy Corp. (LEU) : Free Stock Analysis Report