Why You Should Add Radian Group (RDN) Stock to Your Portfolio

Radian Group Inc. RDN has been gaining from a high persistency rate despite continued headwinds, high investment income, declining expenses and prudent capital deployment.

Earnings Surprise History

Radian Group has a decent earnings surprise history. It surpassed estimates in each of the last four quarters, the average being 30.9%.

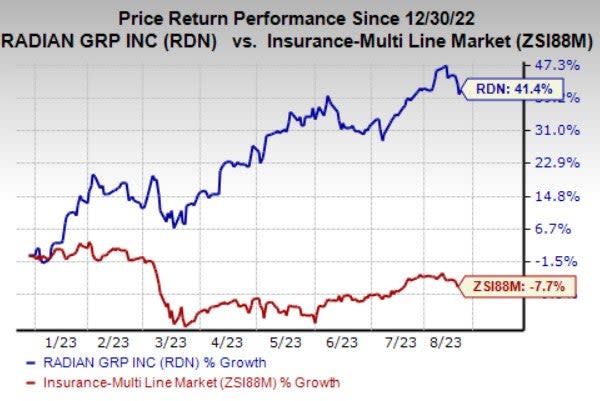

Zacks Rank & Price Performance

Radian Group currently carries a Zacks Rank #2 (Buy). The stock has gained 41.4% against the industry’s decline of 7.7% in the year-to-date period.

Image Source: Zacks Investment Research

Return on Equity

RDN’s return on equity for the trailing 12 months is 17.3%, better than the industry’s average of 12.4%. This reflects efficiency in utilizing shareholders’ funds.

Business Tailwinds

Radian Group remains focused on improving its mortgage insurance portfolio, the main catalyst for long-term earnings growth and managing capital resources, the strategic value creation areas. The growth in the purchase market is positive for the mortgage insurance industry. Persistency should improve, given higher mortgage interest rates.

Continued high levels of the new mortgage insurance business, as well as an increase in persistency, are likely to drive the primary insurance in force, the main driver of future earnings for Radian Group. Despite the challenging environment of high-interest rates, the company strives to reduce its costs to maintain stable earnings. Moreover, it is expected to generate a higher level of net investment income due to the current high-interest rate environment.

The company expects purchase loans to drive volumes which is a positive sign for a strong and stable purchase mortgage origination market. Growing demand and low inventory should mitigate downside risk for home values, protecting the company’s insured portfolio.

The insurer took a few initiatives that will consolidate its capital structure by extending debt maturities while enhancing financial flexibility. Currently, RDN has a solid cash balance of $1.3 billion. The holding company liquidity includes the benefit from a $200 million ordinary dividend paid by Radian Guaranty. Also, the company has been effectively trying to lower its debt level over the last few years.

Radian Group maintains a solid balance sheet with sufficient liquidity and strong cash flows. A strong capital position helps the insurer deploy capital via share repurchases and dividend hikes that enhance shareholders’ value. Its current dividend yield of 3.4% is better than the industry average of 2.6%. The board had approved a new two-year $300 million share buyback program in January 2023. Radian bought back 0.2 million shares worth $5 million, including commissions, in the second quarter. The remaining repurchase capacity was $280 million as of Jun 30, 2023.

Other Stocks to Consider

Some other top-ranked stocks from the multi-line insurance space are Assurant, Inc. AIZ, Old Republic International ORI and Corebridge Financial, Inc. CRBG. Assurant and Old Republic International presently sport a Zacks Rank #1 (Strong Buy), while Corebridge currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Assurant outpaced estimates in each of the trailing four quarters, the average surprise being 24.4%.

The Zacks Consensus Estimate for AIZ’s 2023 earnings suggests an improvement of 8.5%, while the same for revenues indicates growth of 4.1% from the corresponding year-ago reported figures. The consensus mark for AIZ’s 2023 earnings has moved 8.7% north in the past 30 days.

Old Republic International’s bottom line outpaced estimates in each of the trailing four quarters. The average of earnings surprises is 29.9%. The consensus mark for ORI’s 2023 earnings has moved 8.3% north in the past 30 days.

The bottom line of Corebridge outpaced estimates in each of the trailing four quarters, the average surprise being 14.3%.

The Zacks Consensus Estimate for CRBG’s 2023 earnings suggests an improvement of 45.6%, while the same for revenues indicates growth of 23% from the corresponding year-ago reported figures. The consensus mark for CRBG’s 2023 earnings has moved 3% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Corebridge Financial, Inc. (CRBG) : Free Stock Analysis Report