Why You Should Add RenaissanceRe (RNR) Stock to Your Portfolio

RenaissanceRe Holdings Ltd. RNR is currently aided by improving premiums and investment income, sturdy segmental performances, buyouts and a solid financial position. The rise in returns from the fixed maturity portfolio and improving underwriting results add further momentum. The favorable impact of a high interest rate environment remains a key driver.

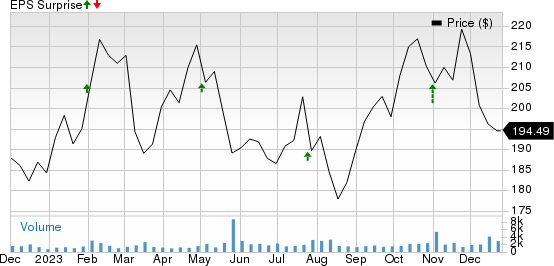

Price Performance & Zacks Rank

Over the past six months, shares of RenaissanceRe have gained 6.1% compared with the industry’s 6.7% rise. Headquartered in Pembroke, Bermuda, RNR offers insurance and reinsurance products in the domestic and international markets. It was founded in 1993 and currently has a market cap of $10.2 billion.

Due to its solid prospects, this Zacks Rank #2 (Buy) stock is an attractive addition to investment portfolios at the moment.

Let’s delve deeper.

The Zacks Consensus Estimate for RenaissanceRe’s current-year earnings is pegged at $34.04 per share, which has witnessed one upward estimate revision in the past 30 days against none in the opposite direction. The estimate indicates a significant year-over-year growth from the 2022 level of $7.30 per share. Management’s expectation of a combined ratio in the mid-90s range for the Casualty and Specialty segment is likely to aid bottom-line growth in the coming quarters. RNR beat on earnings in all the last four quarters, the average surprise being 16.5%.

RenaissanceRe Holdings Ltd. Price and EPS Surprise

RenaissanceRe Holdings Ltd. price-eps-surprise | RenaissanceRe Holdings Ltd. Quote

The consensus estimate for RenaissanceRe’s current-year revenues stands at $8 billion, indicating 15% year-over-year growth. We expect its Casualty and Specialty business to play a significant role in top-line growth. Our model suggests that net premiums earned from the segment will jump around 11.5% year over year in 2023.

Moreover, increasing returns from its fixed maturity and short-term portfolios are expected to benefit its net investment income. We expect the metric to surge 116.8% year over year in 2023, supported by the high-interest rate environment.

RenaissanceRe’s robust trailing 12-month return on equity of 26.7% outpaced the industry's average of 7.2%. This highlights the company's ability to produce significant returns compared to industry benchmarks, showcasing its efficiency in capital investment.

The company’s ability to generate growing free cash flow is remarkable, which will improve its financial flexibility going forward. Over the trailing 12-month period, the metric jumped 33% year over year. It exited the third quarter with cash and cash equivalents of $1.2 billion.

The company's inorganic growth initiatives continue to play an important role in facilitating business expansion. The recent acquisition of Validus Re from AIG stands out as a substantial move in recent years. This strategic initiative is expected to not only augment the scale of its global property and casualty reinsurance business but also contribute significantly to overall profitability.

However, RNR’s rising operational expenses keep denting its margins. The metric rose 30.4% year over year in 2022. We expect it to further increase 16.9% in 2023. Nevertheless, we believe that a systematic and strategic plan of action will drive growth and improve financials in the long term.

Other Key Picks

Some other top-ranked stocks in the broader Finance space are Assurant, Inc. AIZ, Brown & Brown, Inc. BRO and The Hartford Financial Services Group, Inc. HIG. While Assurant currently sports a Zacks Rank #1 (Strong Buy), Brown & Brown and Hartford Financial Services presently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Assurant’s current-year earnings indicates a 31% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 42.4%. Also, the consensus mark for AIZ’s 2023 revenues suggests 5.4% year-over-year growth.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $2.76 per share, which indicates 21.1% year-over-year growth. It has witnessed five upward estimate revisions against none in the opposite direction during the past 60 days. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 12.3%.

The consensus mark for Hartford Financial Services’ current-year earnings indicates a 7.7% year-over-year increase. It beat earnings estimates in three of the past four quarters, meeting once, with an average surprise of 10.8%. Furthermore, the consensus estimate for HIG’s 2023 revenues suggests 8.5% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report