Why AeroVironment Inc's Stock Skyrocketed 22% in a Quarter

AeroVironment Inc (NASDAQ:AVAV), a leading player in the Aerospace & Defense industry, has seen a significant surge in its stock price over the past three months. With a current market cap of $3.2 billion and a price of $121.7, the company's stock has gained 1.85% over the past week and a remarkable 21.70% over the past three months. According to the GF Value, defined by GuruFocus.com, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is fairly valued both currently and three months ago, with a GF Value of $120.13 and a past GF Value of $111.7 respectively.

Unveiling AeroVironment Inc (NASDAQ:AVAV)

AeroVironment Inc operates under a single business segment, supplying unmanned aircraft systems, tactical missile systems, high-altitude pseudo-satellites, and other related services to government agencies within the United States Department of Defense as well as the United States allied international governments. The systems can help with security, surveillance, or sensing, and provide "eyes in the sky" without needing an actual person, or driver, in the sky.

Profitability Analysis of AeroVironment Inc (NASDAQ:AVAV)

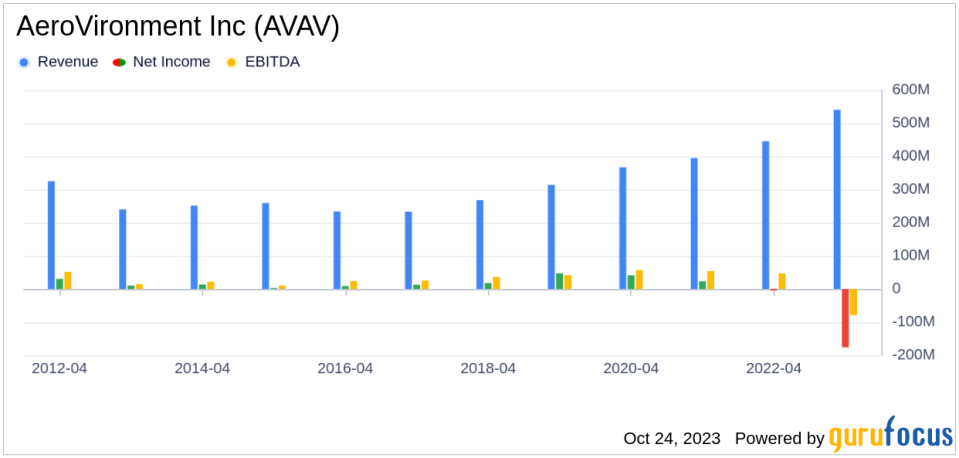

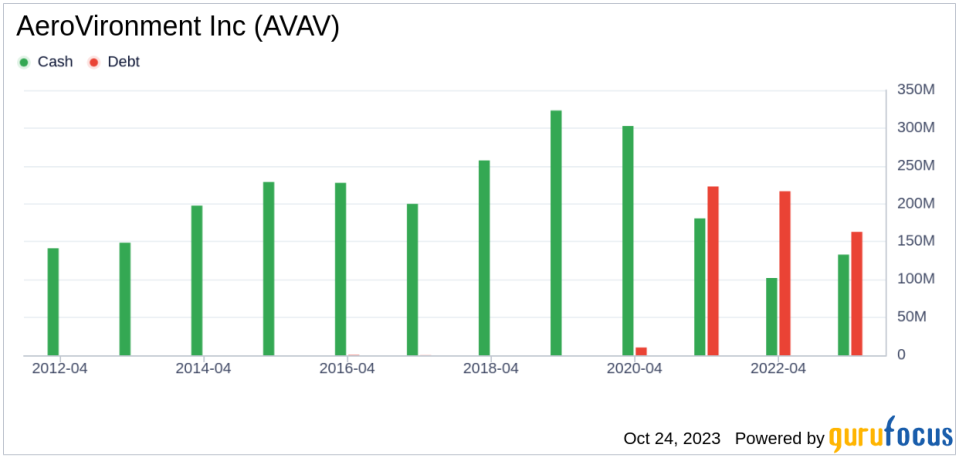

With a Profitability Rank of 7/10, AeroVironment Inc demonstrates a relatively high level of profitability. The company's Operating Margin stands at 1.20%, better than 36.49% of companies in the industry. However, its ROE and ROA are -24.70% and -16.73% respectively, which are lower than the industry averages. The company's ROIC is 0.88%, better than 38.49% of companies in the industry. Over the past 10 years, AeroVironment Inc has been profitable for 8 years, which is better than 64.64% of companies in the industry.

Growth Prospects of AeroVironment Inc (NASDAQ:AVAV)

AeroVironment Inc has a Growth Rank of 6/10, indicating a moderate level of growth. The company's 3-year revenue growth rate per share is 12.30%, better than 76.6% of companies in the industry. Its 5-year revenue growth rate per share is 13.00%, better than 82.98% of companies in the industry. The company's total revenue growth rate (future 3Y to 5Y estimate) is 16.73%, better than 85.25% of companies in the industry.

Top Holders of AeroVironment Inc (NASDAQ:AVAV) Stock

The top three holders of AeroVironment Inc's stock are Baillie Gifford (Trades, Portfolio), Catherine Wood (Trades, Portfolio), and Ken Fisher (Trades, Portfolio), holding 3.02%, 2.29%, and 0.61% of shares respectively.

Competitors in the Aerospace & Defense Industry

AeroVironment Inc faces competition from Moog Inc (NYSE:MOG.A) with a market cap of $3.63 billion, Eve Holding Inc (NYSE:EVEX) with a market cap of $2 billion, and Mercury Systems Inc (NASDAQ:MRCY) with a market cap of $2.18 billion.

Conclusion

In conclusion, AeroVironment Inc has demonstrated a strong performance in the stock market, with a significant gain over the past three months. The company's profitability and growth prospects are relatively high, and it has a strong presence in the Aerospace & Defense industry. However, it faces competition from other industry players. Despite this, the company's current position and future prospects in the industry remain promising.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.