This Is Why Altium Limited's (ASX:ALU) CEO Can Expect A Bump Up In Their Pay Packet

Key Insights

Altium will host its Annual General Meeting on 16th of November

Salary of US$500.0k is part of CEO Aram Mirkazemi's total remuneration

The overall pay is 77% below the industry average

Altium's total shareholder return over the past three years was 18% while its EPS grew by 49% over the past three years

The decent performance at Altium Limited (ASX:ALU) recently will please most shareholders as they go into the AGM coming up on 16th of November. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

View our latest analysis for Altium

How Does Total Compensation For Aram Mirkazemi Compare With Other Companies In The Industry?

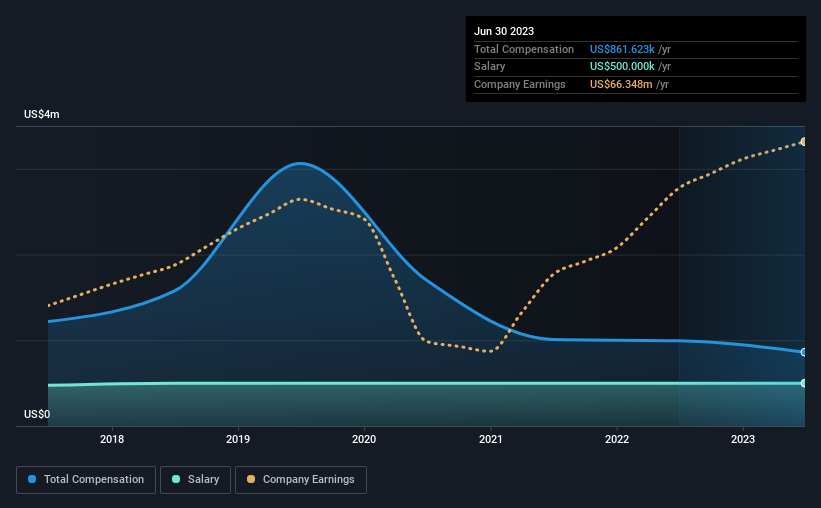

Our data indicates that Altium Limited has a market capitalization of AU$5.6b, and total annual CEO compensation was reported as US$862k for the year to June 2023. Notably, that's a decrease of 13% over the year before. We note that the salary of US$500.0k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar companies from the Australian Software industry with market caps ranging from AU$3.1b to AU$9.9b, we found that the median CEO total compensation was US$3.8m. Accordingly, Altium pays its CEO under the industry median. What's more, Aram Mirkazemi holds AU$402m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$500k | US$500k | 58% |

Other | US$362k | US$494k | 42% |

Total Compensation | US$862k | US$994k | 100% |

Speaking on an industry level, nearly 59% of total compensation represents salary, while the remainder of 41% is other remuneration. There isn't a significant difference between Altium and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Altium Limited's Growth Numbers

Over the past three years, Altium Limited has seen its earnings per share (EPS) grow by 49% per year. In the last year, its revenue is up 19%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Altium Limited Been A Good Investment?

With a total shareholder return of 18% over three years, Altium Limited shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

Whatever your view on compensation, you might want to check if insiders are buying or selling Altium shares (free trial).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.