Why Asana's CEO Keeps Loading Up on Shares

Insider buying is often seen as a key bullish signal for a stock. Compared to the general public, insiders such as the CEO and chief financial officer have access to much more extensive and up-to-date information on the operations of their company and its prospects for the future.

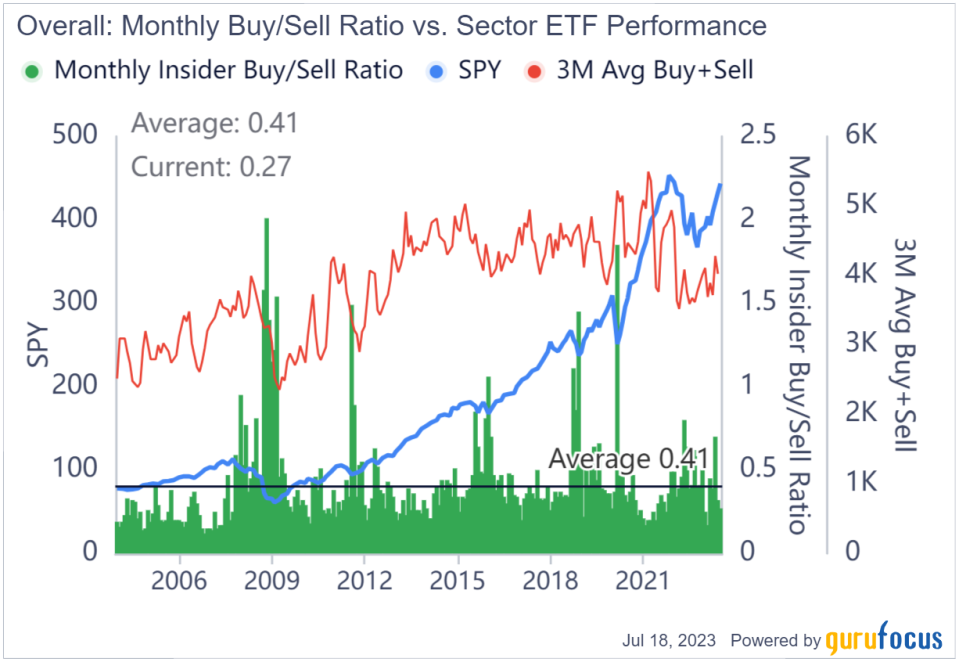

On a broader market scale, GuruFocus data even shows that spikes in insider buying of S&P 500 stocks have historically correlated with great times to buy stocks.

Thus, at first glance, it may seem like Asana Inc.s (NYSE:ASAN) CEO continuously loading up on shares is a sign of brighter times ahead. Since Asana is a cloud-based software company that has added artificial intelligence to its offerings, investors may be even more inclined towards bullish sentiment.

However, believing the stock price will appreciate is not the only reason why an insider would buy shares of their company, even if it is the most talked-about reason. When we take a closer look at Asanas CEO buying on its GuruFocus insider trades page, we see that there are footnotes, indicating we need to look closer at the SEC filing data to get the full picture.

A closer look at Asanas CEO buying

So far in 2023, there have been a lot of insider buys for Asana eight, to be precise. Every single one of them was from the CEO, Dustin Moskovitz. Various other insiders, including the chief financial officer, the chief operating officer and several directors, have been selling Asana shares.

Looking at the footnotes for Moskovitzs Form 4 filings with the SEC in 2023, we see the following explanation is in each and every one of them so far this year as of this writing: The purchases reported on this Form 4 were effected pursuant to a Rule 10b5-1 trading plan, adopted March 9, 2023.

Under Rule 10b5-1, major insiders can set up a plan to buy or sell shares at a predetermined time. Some reasons why insiders might choose to set up a 10b5-1 plan include an under-the-radar method of stock buybacks and being able to trade at times when they would not have been able to otherwise due to possession of material non-public information.

In order to be valid, a 10b5-1 plan must include the following: 1) The price, amount and dates of planned sales or purchases, 2) a formula or metrics for determining the amount, price and date and 3) giving the broker the exclusive right to make the sales or purchases as long as they do not have access to material non-public information when making the trades.

What does this mean for investors?

Despite the different process of 10b5-1 insider buys compared to open-market insider buys, there is nothing in SEC regulations that stipulates companies must disclose the use of this rule to the public. This likely results in some insider buys being made under the rule and yet still being reported to the public in a way that is indistinguishable from open-market insider trades. Nevertheless, companies still often disclose it regardless as it can help avoid public relations problems that can occur from suspiciously timed insider trades.

All things considered, it is still possible that insider buys made under this rule could be a bullish signal, but there is also a higher-than-normal chance they are the result of some sort of financial engineering. Asana has a three-year share buyback ratio of -12.3%, meaning it is seriously diluting shareholders and might have need of a 10b5-1 plan to keep operations running smoothly.

Asanas fundamentals still show an uncertain future

Asanas core business is task management software that assists customers with managing projects, workspaces, tasks, teams and clients. The addition of Asanas AI offering aims to help by analyzing data and providing recommendations to remove workflow bottlenecks, reallocate resources more efficiently, etc.

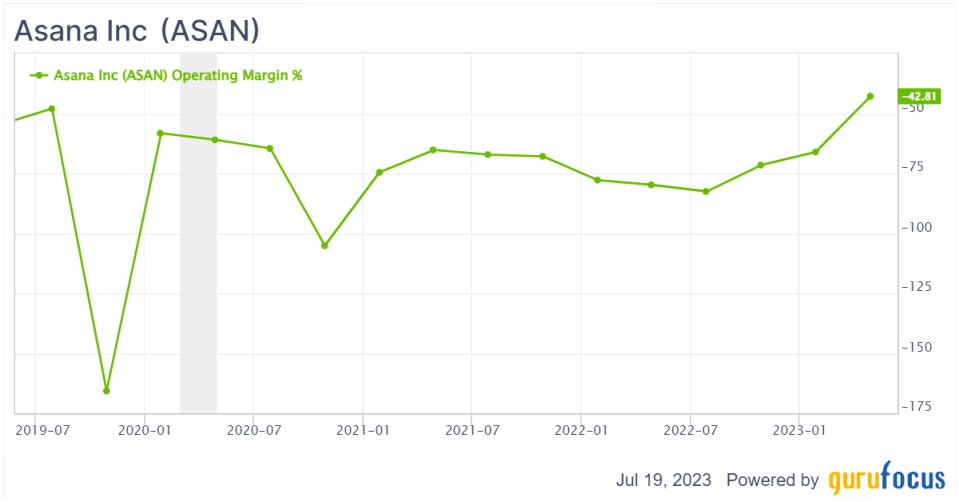

This is a valuable service for businesses, especially larger enterprises, but it has yet to result in profitability. The operating margin is deep in the red at -42.81% as of the latest earnings report, but on the positive side, that is better than what the company has achieved in the past.

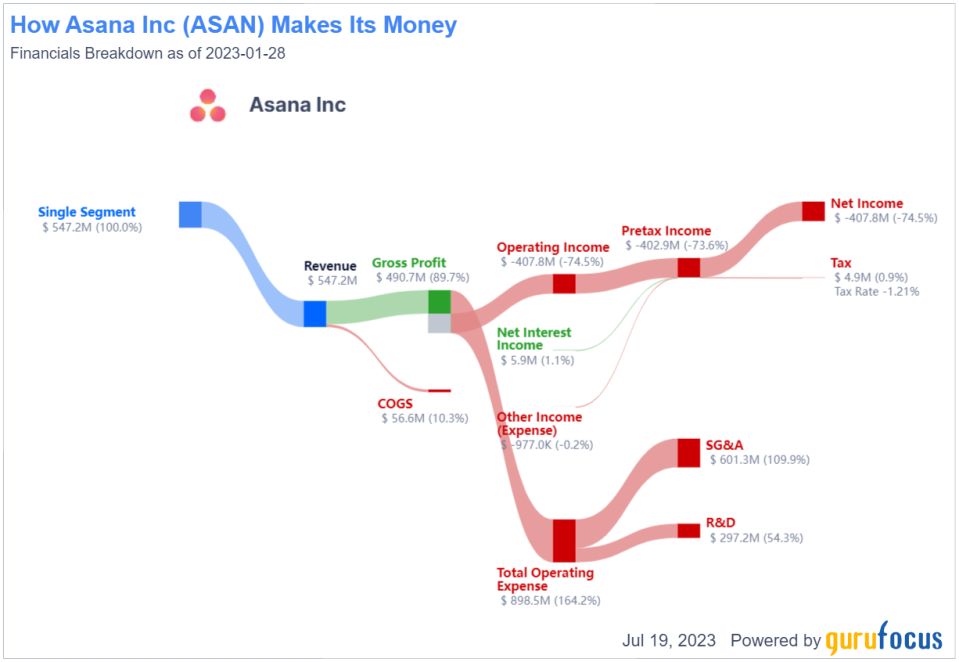

The three-year revenue per share growth rate is 42% while the three-year earnings per share growth rate is -35%. Selling, general and administrative expenses alone are coming in higher than net income, but research and development costs are also high, as shown in the income statement breakdown below. Even if it did not occur any additional expenditures in its annual run rate from now on, Asana would still need to more than double its revenue to achieve profitability.

Asana has dozens of paid and free competitors with varying levels of features to suit different business needs, so its chances of maintaining any sort of competitive advantage without heavy expenditures are looking slim.

Thus, despite Asanas high levels of insider buying from the CEO, to me it seems more likely that these buys are targeted toward benefitting the company in some way more than an expectation that the share price will rise.

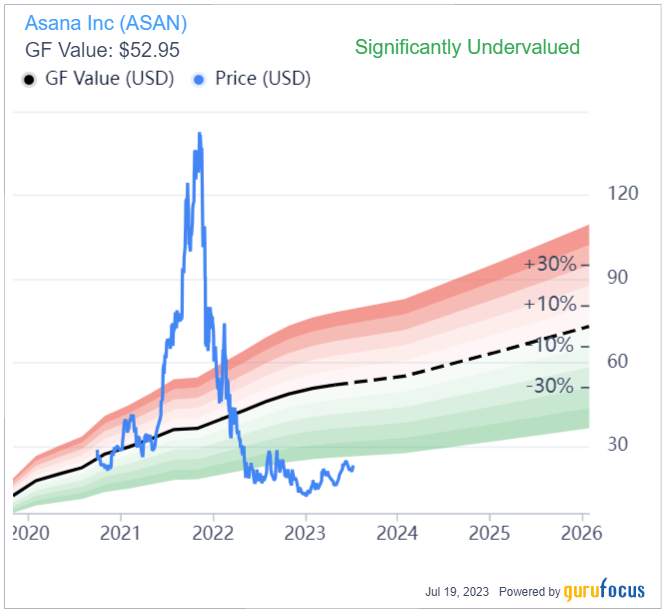

However, Asana has achieved much higher valuation levels in the past, which has even skewed the GF Value calculation to the point where it considers the stock significantly undervalued now. If the company can develop unique offerings to help achieve and stabilize profitability in the long run (perhaps related to its AI efforts), a turnaround could be in the cards.

This article first appeared on GuruFocus.