Why AZZ Inc's Stock Skyrocketed 16% in a Quarter

AZZ Inc (NYSE:AZZ), a prominent player in the Business Services industry, has seen a significant surge in its stock price over the past quarter. The company's stock price has risen by 15.86% over the past three months, and by 12.76% in the past week alone, reaching a current price of $49.8. With a market cap of $1.36 billion, AZZ Inc's recent performance has caught the attention of investors and market analysts alike.

The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, stands at $89.77, indicating that the stock is significantly undervalued. This is a notable shift from the GF Valuation three months ago, which suggested a possible value trap. This change in valuation, coupled with the recent price surge, presents an interesting scenario for potential investors.

Company Overview: AZZ Inc

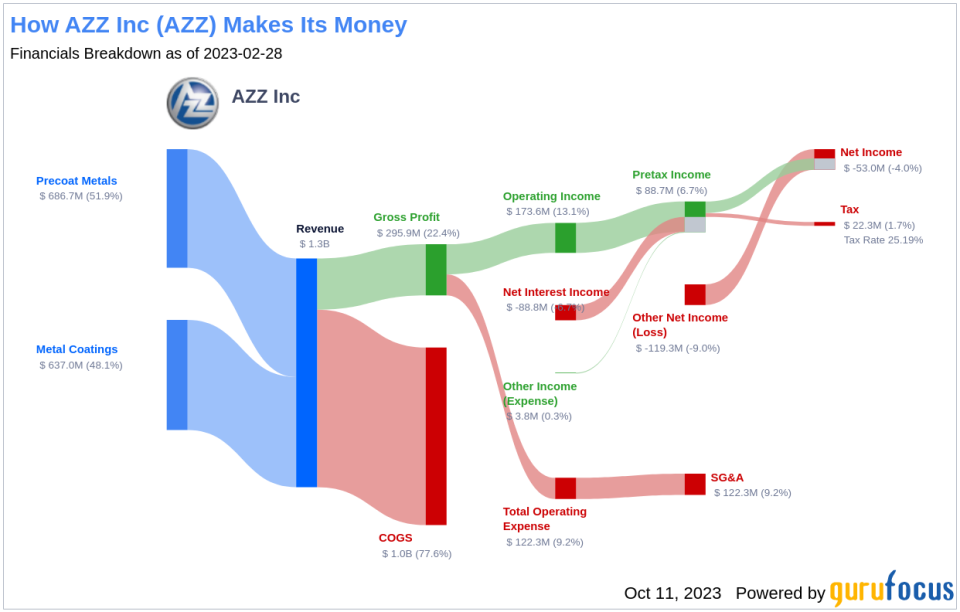

AZZ Inc is a leading provider of galvanizing and metal coating solutions to a broad range of end markets in North America. The company's Metal Coatings segment offers services such as hot dip galvanizing, spin galvanizing, powder coating, anodizing, and plating. The Precoat Metals Segment provides aesthetic and corrosion-resistant coatings for steel and aluminum coils.

Profitability Analysis

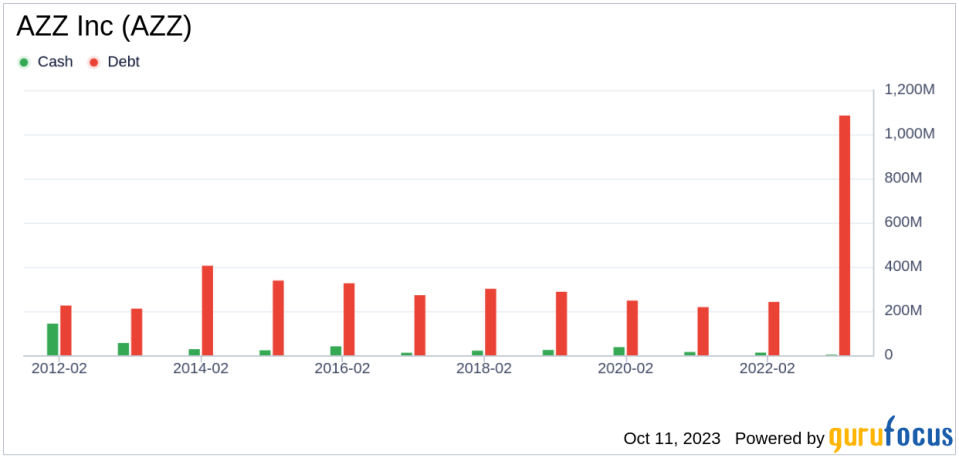

AZZ Inc's Profitability Rank stands at 7 out of 10, indicating a relatively high level of profitability. The company's operating margin is 14.01%, better than 76.57% of the companies in the industry. However, the company's ROE and ROA stand at -5.88% and -2.02% respectively, which are lower than the industry average. Despite this, the company's ROIC is 7.31%, better than 56.47% of the companies in the industry. Furthermore, the company has maintained profitability for 9 out of the past 10 years, which is better than 72.99% of the companies in the industry.

Growth Prospects

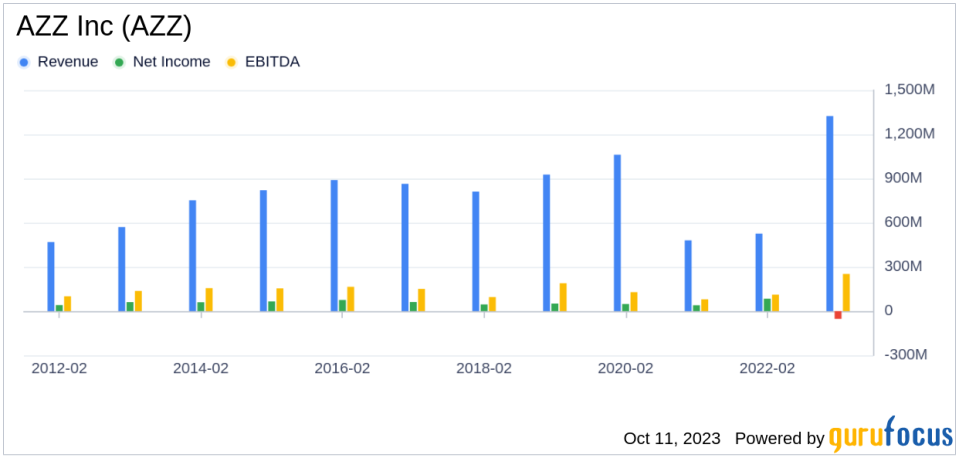

The company's Growth Rank is 5 out of 10, indicating moderate growth. The 3-year and 5-year revenue growth rates per share are 9.50% and 0.90% respectively. The company's 3-year and 5-year EPS without NRI growth rates stand at 8.20% and 2.80% respectively. These figures suggest that the company has been able to maintain steady growth over the past few years.

Major Stock Holders

The top three holders of AZZ Inc's stock are Mario Gabelli (Trades, Portfolio), holding 2.82% of the shares, HOTCHKIS & WILEY, holding 1.06% of the shares, and Paul Tudor Jones (Trades, Portfolio), holding 0.08% of the shares. Their significant holdings indicate a strong belief in the company's potential and future performance.

Competitive Landscape

AZZ Inc operates in a competitive market, with major competitors including Target Hospitality Corp with a market cap of $1.64 billion, Zeuus Inc with a market cap of $754.436 million, and BrightView Holdings Inc with a market cap of $731.045 million. Despite the competition, AZZ Inc's recent performance and growth prospects make it a compelling option for investors.

Conclusion

In conclusion, AZZ Inc's recent stock price surge, coupled with its strong profitability and growth prospects, make it an interesting option for investors. Despite facing stiff competition, the company's significant undervaluation according to its GF Value and the backing of major stockholders suggest a promising future. However, as with any investment, potential investors should conduct thorough research and consider their own risk tolerance before making a decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.