Why Baytex Energy Corp's Stock Skyrocketed 27% in a Quarter: A Deep Dive

Baytex Energy Corp (NYSE:BTE), a leading player in the oil and gas industry, has recently seen a significant surge in its stock price. The company's stock price has risen by 2.80% over the past week and a remarkable 27.00% over the past three months, as of October 9, 2023. Currently, the stock is trading at $4.23, with a market capitalization of $3.64 billion. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The GF Value of Baytex Energy Corp stands at $3.9, compared to its past GF Value of $18.86 three months ago. The stock's current GF Valuation is 'Fairly Valued', a significant improvement from its past GF Valuation of 'Possible Value Trap, Think Twice'.

Company Introduction

Baytex Energy Corp is a prominent oil and gas company, primarily operating in Canada. The company's business model revolves around the exploration, development, and production of crude oil and natural gas in Western Canada. The majority of the company's revenue is derived from its operations in Canada.

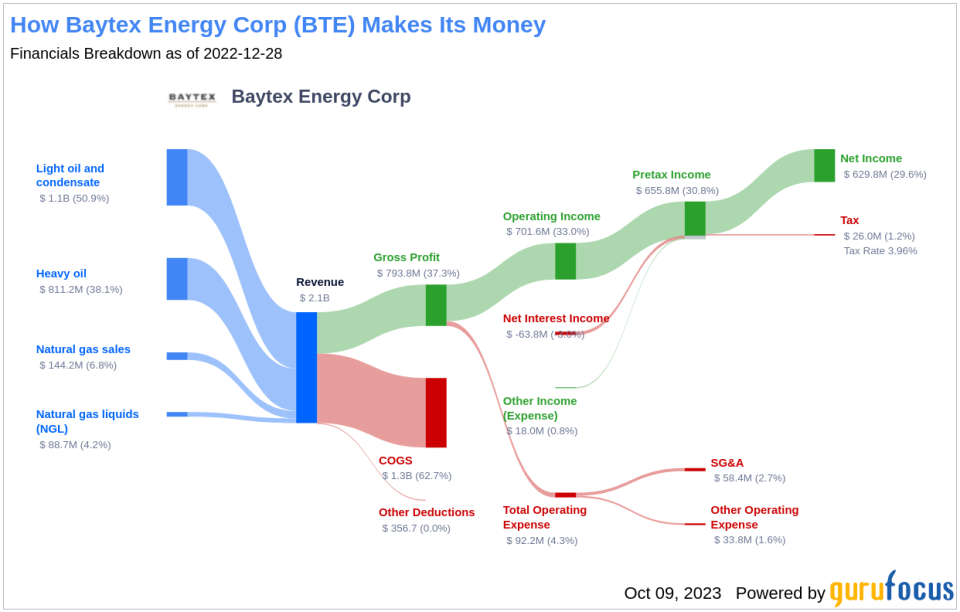

Profitability Analysis

As of June 30, 2023, Baytex Energy Corp's Profitability Rank stands at 4/10. The company's operating margin of 21.83% is better than 69.76% of the 982 companies in the same industry. The company's ROE of 27.83% and ROA of 15.42% are better than 81.62% and 85.74% of the 1023 and 1094 companies respectively. The ROIC of 11.26% is better than 71.47% of the 1083 companies. Over the past 10 years, the company has had 4 profitable years, which is better than 41.13% of the 953 companies.

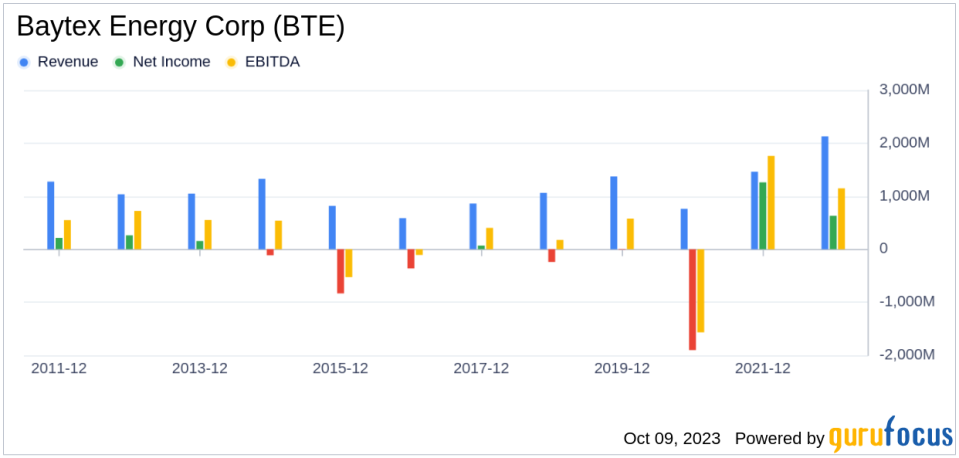

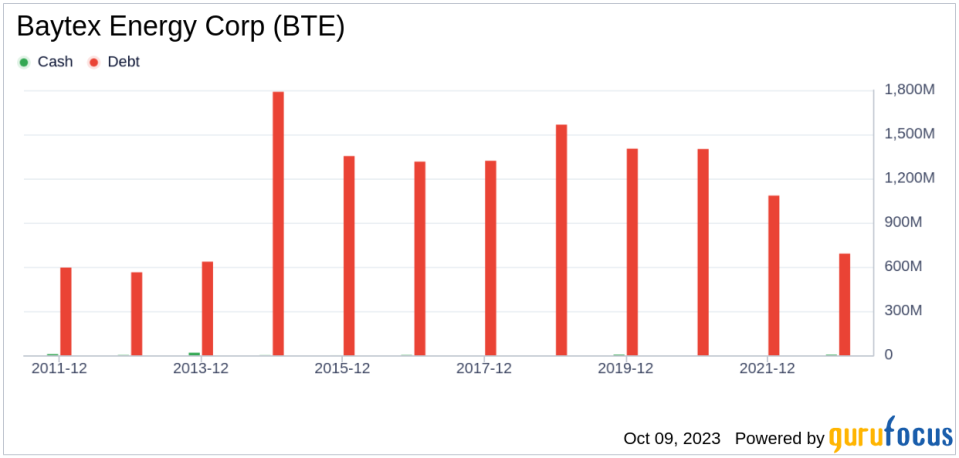

Growth Prospects

As of today, Baytex Energy Corp's Growth Rank is 4/10. The company's 3-year revenue growth rate per share of 16.50% is better than 61.89% of the 858 companies. However, the 5-year revenue growth rate per share of -2.20% is only better than 30.37% of the 787 companies. The company's future total revenue growth rate estimate over a 3-year to 5-year period is -0.01%, which is better than 31.66% of the 259 companies.

Major Stock Holders

The top three holders of Baytex Energy Corp's stock are HOTCHKIS & WILEY, Chuck Royce (Trades, Portfolio), and Steven Cohen (Trades, Portfolio). HOTCHKIS & WILEY holds 5,683,710 shares, accounting for 0.66% of the total shares. Chuck Royce (Trades, Portfolio) holds 1,478,838 shares, accounting for 0.17% of the total shares. Steven Cohen (Trades, Portfolio) holds 1,195,794 shares, accounting for 0.14% of the total shares.

Competitive Landscape

Baytex Energy Corp faces stiff competition from Enerplus Corp(TSX:ERF), Paramount Resources Ltd(TSX:POU), and Crescent Point Energy Corp(TSX:CPG). Enerplus Corp has a market capitalization of $3.47 billion, Paramount Resources Ltd has a market capitalization of $3.15 billion, and Crescent Point Energy Corp has a market capitalization of $4.11 billion.

Conclusion

In conclusion, Baytex Energy Corp has shown a remarkable surge in its stock price over the past three months. The company's profitability and growth prospects are promising, and it has a strong presence in the oil and gas industry. However, the company faces stiff competition from its peers. Investors should keep a close eye on the company's performance and make informed decisions based on comprehensive analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.