Why Baytex Energy Corp's Stock Skyrocketed 43% in a Quarter: A Deep Dive

Baytex Energy Corp (NYSE:BTE), a prominent player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. As of September 27, 2023, the company's stock price stands at $4.32, marking a 42.62% increase over the past quarter. This impressive performance is reflected in the company's market cap, which currently stands at $3.74 billion. Over the past week, the stock price has also seen a gain of 4.13%. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently at $3.92, indicating that the stock is fairly valued. This is a notable change from three months ago when the stock was modestly undervalued with a GF Value of $4.24.

Unpacking Baytex Energy Corp

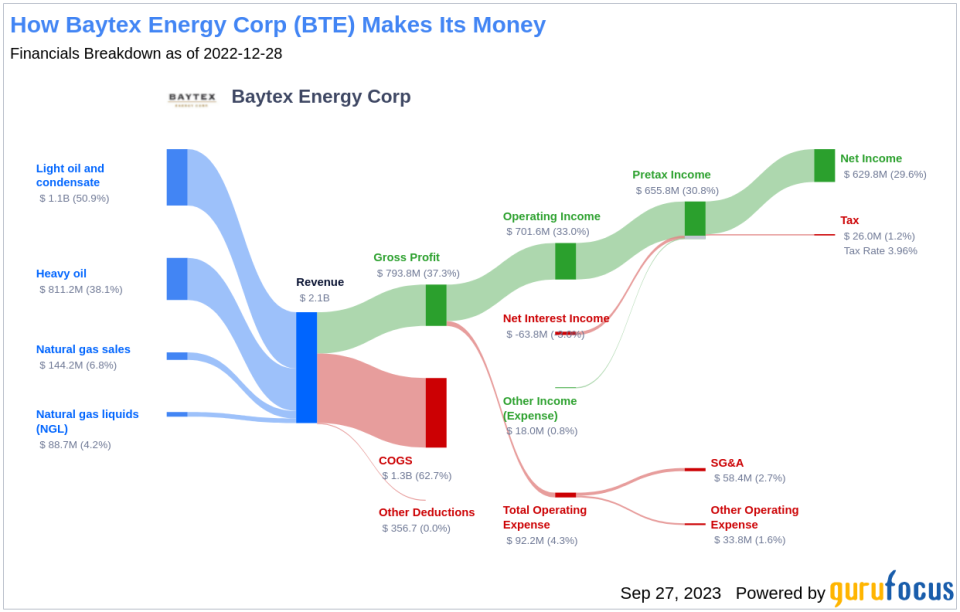

Baytex Energy Corp is a Canada-based oil and gas company with operations extending to the United States. The company primarily focuses on the exploration, development, and production of crude oil and natural gas in Western Canada, which contributes a majority of its revenue. The company's strategic positioning in the energy sector and its robust operational framework have played a significant role in its recent stock performance.

Profitability Analysis

Baytex Energy Corp's profitability is commendable, with a Profitability Rank of 4/10 as of June 30, 2023. The company's Operating Margin stands at 21.83%, outperforming 69.51% of 984 companies in the industry. The company's ROE and ROA are 27.83% and 15.42% respectively, better than 81.47% and 85.65% of companies in the industry. The ROIC of 11.26% is also impressive, outperforming 71.1% of 1090 companies. Over the past decade, the company has had 4 years of profitability, better than 41.25% of 960 companies.

Growth Prospects

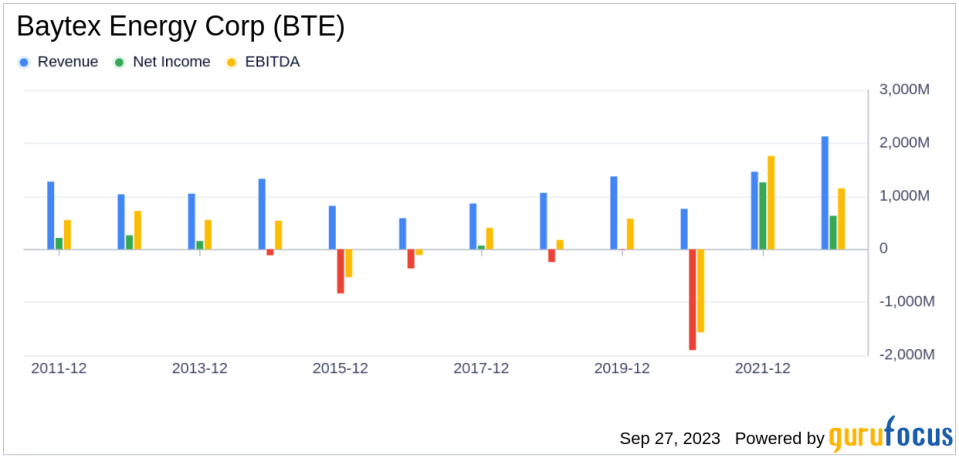

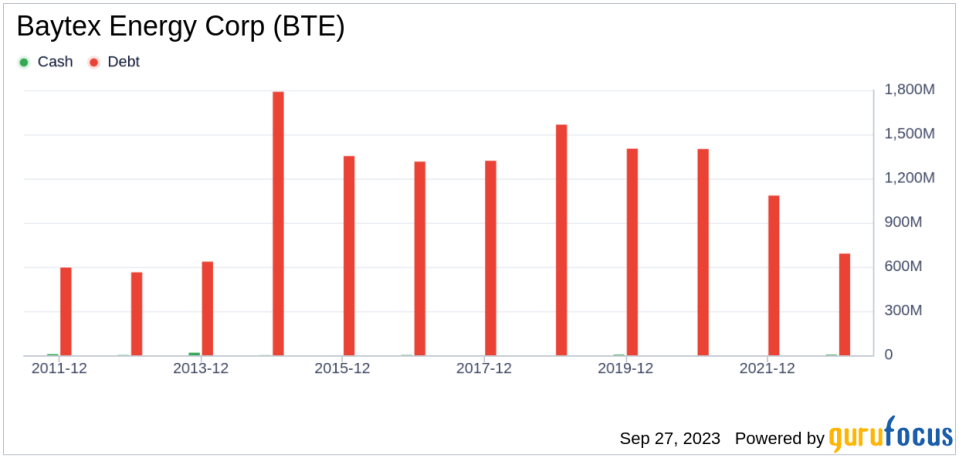

Despite a Growth Rank of 2/10, Baytex Energy Corp has shown promising signs of growth. The company's 3-Year Revenue Growth Rate per Share is 16.50%, outperforming 62.53% of 862 companies. However, the 5-Year Revenue Growth Rate per Share is -2.20%, better than only 30.67% of 789 companies. The company's future total revenue growth rate estimate over a 3-year to 5-year period is -0.01%, better than 32.95% of 261 companies.

Major Stock Holders

The top three holders of Baytex Energy Corp's stock are HOTCHKIS & WILEY, Chuck Royce (Trades, Portfolio), and Steven Cohen (Trades, Portfolio), holding 0.66%, 0.17%, and 0.14% of the company's shares respectively. HOTCHKIS & WILEY holds the most shares, with a total of 5,683,710 shares.

Competitive Landscape

Baytex Energy Corp operates in a competitive industry, with key competitors including Enerplus Corp(TSX:ERF) with a market cap of $3.63 billion, Paramount Resources Ltd(TSX:POU) with a market cap of $3.4 billion, and Crescent Point Energy Corp(TSX:CPG) with a market cap of $4.35 billion. Despite the competition, Baytex Energy Corp's market cap of $3.74 billion indicates a strong position in the industry.

Conclusion

In conclusion, Baytex Energy Corp's impressive stock performance, robust profitability, and promising growth prospects make it a noteworthy player in the Oil & Gas industry. Despite the competitive landscape, the company's strategic operations and strong market position suggest a promising future. Investors should keep a close eye on this stock as it continues to navigate the dynamic energy sector.

This article first appeared on GuruFocus.