Why Buying Virtu Financial (VIRT) is a Prudent Move Now

Virtu Financial, Inc. VIRT is well poised to grow on the back of its diversified business and capital markets business strength. The high-interest rate environment continues to aid its interest and dividend income.

Headquartered in New York, Virtu Financial is a leading financial services company. It has a market cap of $3.1 billion.

Outperformer & Zacks Rank

Over the past three months, shares of Virtu Financial have gained 4%, outperforming the industry’s 3.1% rise. Courtesy of solid prospects, this Zacks Rank #2 (Buy) stock is worth adding to your portfolio at the moment.

Let’s delve deeper.

VIRT’s proprietary market-making businesses are boosting its results. The company’s engagement with the retail flow is boosting its profits. Our estimate for this unit’s adjusted net trading income for 2023 signals a lower decline level compared to the recent trends. Similar traits are also expected in its execution services business.

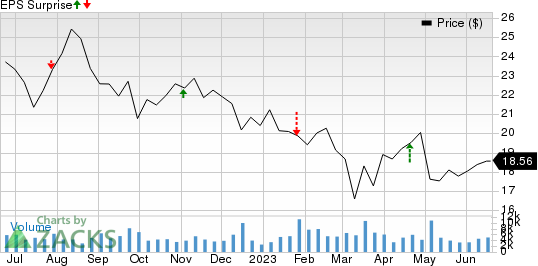

The Zacks Consensus Estimate for VIRT’s current-year earnings is pegged at $2.41 per share, which rose 3.4% in the past 60 days. The stock has witnessed four upward estimate revisions during this period against none in the opposite direction. Virtu Financial beat on earnings in two of the last four quarters and missed twice, the average surprise being 1.2%.

Virtu Financial, Inc. Price and EPS Surprise

Virtu Financial, Inc. price-eps-surprise | Virtu Financial, Inc. Quote

Over the trailing 12-month period, the company’s free cash flow increased 16.2% to $746 million. Its strong cash-generating ability enables it to take shareholder-friendly moves. In the first quarter of 2023, it bought back shares worth $76 million and had $244.8 million remaining under its share buyback authorization at the first-quarter end. Also, this dividend-paying company has a dividend yield of 5.2%, significantly higher than the industry average of 2.3%.

The company is gaining from its ITG buyout, which diversified its revenues, along with leveraging its core technology. Management also doesn’t shy away from divesting non-core assets to boost efficiency and reduce costs. Our estimate for 2023 operating expenses suggests a 2% year-over-year decline.

Key Risks

There are a few factors that investors should keep an eye on.

VIRT’s declining revenues can be concerning. The consensus mark for current-year revenues is pegged at $1.3 billion, signaling a 12.3% year-over-year fall. Also, with the market stabilizing fast, Virtu Financial’s performance is likely to suffer as it gains traction from market volatility. Nevertheless, we believe that a systematic and strategic plan of action will drive its growth in the long term.

Other Top-Ranked Players

Some other top-ranked stocks in the broader finance space are Axos Financial, Inc. AX, Forge Global Holdings, Inc. FRGE and WisdomTree, Inc. WT, each carrying a Zacks Rank #2 at present.You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based in Las Vegas, Axos Financial is a consumer and business banking products provider. The Zacks Consensus Estimate for AX’s 2023 earnings indicates a 16.1% year-over-year increase.

Headquartered in San Francisco, Forge Global offers marketplace infrastructure, data services, as well as technology solutions for participants in the private market. The Zacks Consensus Estimate for FRGE’s 2023 earnings indicates a 27.9% year-over-year improvement.

Based in New York, WisdomTree is a global financial innovator. It provides a wide range of suite of exchange-traded products and other solutions. The Zacks Consensus Estimate for WT’s 2023 earnings signals 34.6% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

Forge Global Holdings, Inc. (FRGE) : Free Stock Analysis Report

WisdomTree, Inc. (WT) : Free Stock Analysis Report