Why China Stocks Are Surging This Week

Amidst all the economic uncertainty this week, stocks of companies that are based in China are doing really well.

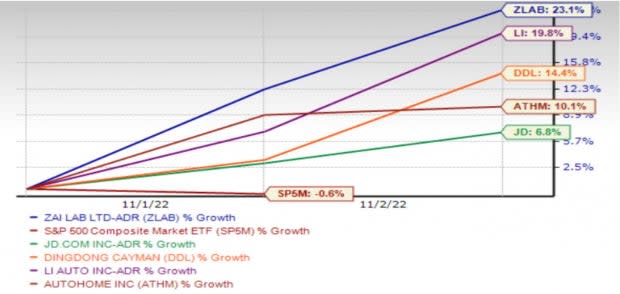

Of all these stocks, I’ve picked five that you can see in the chart below. Zai Lab Ltd. ZLAB is up 23.1%, Li Auto Inc. LI up 19.8%, Dingdong (Cayman) Ltd. DDL up 14.4%, Autohome Inc. ATHM up 10.1% and JD.com, Inc. JD up 6.8%.

Prices So Far This Week

Image Source: Zacks Investment Research

This obviously can’t be related to Xi’s election win because that was last week. Moreover, more than one commentator has said how he is pretty much a dictator, going after any company or its management if they don’t subscribe to his worldview or strictly follow orders. There are also some big negatives, such as the U.S.-China decoupling (which has been going on for a while now), slowing economic growth and COVID-related shutdowns.

Rumors that the government could be easing COVID restrictions may have lifted the shares.

Another possible explanation for the optimism around China stocks (and it is across a wide swathe of industries) could be the high inflation and impending recession that U.S.-based companies are exposed to. U.S. markets are at a heightened state of volatility not only because the fears of a recession are growing larger, but also because of the Fed’s hawkishness that continues to raise borrowing costs.

The Fed’s statement yesterday suggests an incrementally cautious approach to future rate hikes, which makes sense given that we are about 8 months from the first hike and it normally takes 9-12 months to get a sense of the impact on the economy. So we are getting there. Future hikes might depend on a better assessment of the economic situation.

However, Fed chair Powell clearly doesn’t want to enthuse anyone, because that could have the opposite effect. So he cautioned that it is “very premature” to talk about a pivot. The Fed may be considering the cumulative effect of its tightening measures, but that would probably lead to a 50 bp hike next time rather than a 75 bp hike. Therefore, it continues to look like things have to get far more painful before they get better.

Other reasons could be company-specific, affecting each individual stock differently:

Zai Lab develops and commercializes therapies to treat cancer, autoimmune disorders, infectious diseases and psychiatric disorders primarily in Mainland China and Hong Kong. The company, which is slated to report third-quarter results on Nov 9, has grown its revenues around 200% over the last two years. Since it is in the business of developing drugs, losses are not considered exceptional in the initial years, and the company is investing in building fixed assets and inventory.

Although profits are still some years away, the Zacks Consensus Estimates for 2022 and 2023 indicate a 38.9% improvement in the situation this year on revenue growth of 45.4%. The following year, Zai Lab is expected to improve its profitability by 12.9% on revenue growth of 62.3%.

While monthly deliveries coming out of Chinese EV makers were not exciting, they remained substantially higher on a year-over-year basis. Li Auto saw its October deliveries rise 31% from last year while dropping 13% from September. If COVID restrictions are truly relaxed, the company may be able to resume regular production, which would also boost deliveries. Analysts are looking for revenue growth of 67.6% this year and 70.5% in the next. losses are expected to increase 323.1% this year with Li storming to profits in the next.

The reopening is also proving positive for ecommerce platform Dingdong. The company sells fresh produce, meat, seafood, prepared food, and other food products, such as dairy and bakery products, snacks, oil, seasonings and beverages in China. In the last quarter, it reported strong double-digit GMV and revenue growth with better conversions, as more cities started opening up. The attention to quality and range, scale of operations and greater efficiencies are expected to generate breakeven results in December. Its next earnings report is on Nov 21.

Analysts currently forecast 89.3% earnings growth this year on 16.6% revenue growth. Next year, revenue and earnings are expected to grow an additional 17.1% and 93.0%, respectively.

Autohome, which reports today, offers interactive content and tools through ecommerce websites and apps. Users can use these to research the new or used cars they are looking to purchase. It also provides a range of services and generates revenue through advertising. The company has gone through a tough period as supply chain concerns limited the new cars on offer, which also lowered traffic. However, easing supply chains are leading to greater optimism about the availability of cars, which is expected to translate to stronger results at the company.

Analysts are looking for both revenue and earnings to decline a respective 14.5% and 34.3% this year. But they expect around 7% revenue growth and 8.6% earnings growth in 2023.

JD.com provides electronic and general merchandise and supply chain solutions in mainland China. The rise in share prices may simply be attributed to ongoing volatility, as there was a sharp decline in the last week of October, followed immediately by a jump and then another fall, before another rise. There is a good amount of uncertainty for a company like JD because of the way China treated Alibaba and the general crackdown on Chinese tech companies of late.

Analysts are currently modestly optimistic about JD’s prospects. They’re looking for revenue growth of 1.5% and 14.9% in 2022 and 2023, respectively. Earnings growth is expected to be stronger, at a respective 31.4% and 21.6%. The company will report on Nov 17, after which we’ll know more.

ZLAB and LI shares carry a Zacks Rank #3 (Hold), DDL shares a Zacks Rank #1 (Strong Buy), ATHM shares a Zacks Rank of #4 (Sell) and JD #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JD.com, Inc. (JD) : Free Stock Analysis Report

Autohome Inc. (ATHM) : Free Stock Analysis Report

Zai Lab Limited Unsponsored ADR (ZLAB) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

Dingdong Cayman Limited Sponsored ADR (DDL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research