Why Continental Gold Inc (TSE:CNL) Could Be A Buy

Continental Gold Inc (TSX:CNL), a metals and mining company based in Canada, received a lot of attention from a substantial price movement on the TSX in the over the last few months, increasing to CA$3.97 at one point, and dropping to the lows of CA$3.32. This high level of volatility gives investors the opportunity to enter into the stock, and potentially buy at an artificially low price. A question to answer is whether Continental Gold’s current trading price of CA$3.54 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Continental Gold’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change. See our latest analysis for Continental Gold

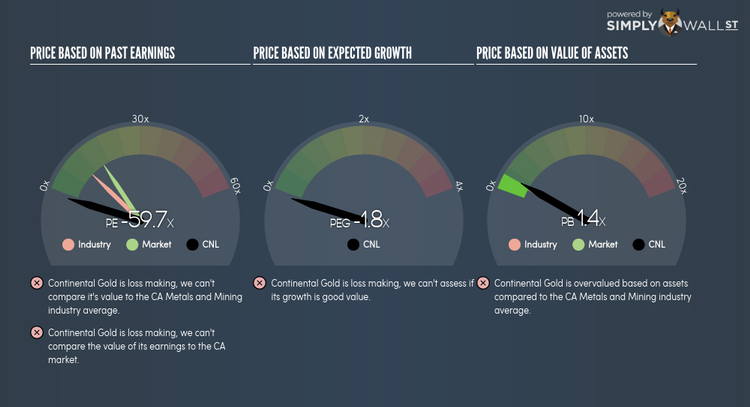

Is Continental Gold still cheap?

According to my relative valuation model, the stock seems to be currently fairly priced. In this instance, I’ve used the price-to-book (PB) ratio given that there is not enough information to reliably forecast the stock’s cash flows, and its earnings doesn’t seem to reflect its true value. I find that Continental Gold’s ratio of 1.39x is trading slightly above its industry peers’ ratio of 1.12x, which means if you buy Continental Gold today, you’d be paying a relatively reasonable price for it. And if you believe that Continental Gold should be trading at this level in the long run, there’s only an insignificant downside when the price falls to its real value. So, is there another chance to buy low in the future? Given that Continental Gold’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us an opportunity to buy later on. This is based on its high beta, which is a good indicator for share price volatility.

Can we expect decent returns from Continental Gold?

Valuation is only one aspect of forming your investment views on Continental Gold. Another thing to consider is whether it is actually a high-quality company. The best type of investment is always in a great company, producing robust returns at a cheap price. We can determine the quality of a stock many ways; one way is to look at how much return it generates relative to the money we’ve invested in the stock. Given that Continental Gold is expected to be loss-making over the next couple of years, you can expect a negative return on your investment over this period of time. Not a very compelling case to buy right now given the uncertainty around profitability.

What this means for you:

Are you a shareholder? CNL appears to be trading at fair value, but the negative outlook does bring on some doubt around the future of the stock, which equates to higher risk. Now may not be the best time to boost your holding in CNL. Consider whether you want to increase your portfolio exposure to CNL, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on CNL for a while, but hesitant on making the leap, I recommend you dig deeper into the stock. Research more to see if the negative return is justified, for example, is the company going through a reinvestment period? And keep in mind the risks that come with negative earnings in the future.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Continental Gold. You can find everything you need to know about Continental Gold in the latest infographic research report. If you are no longer interested in Continental Gold, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.