Why Is Discovery Communications (DISCA) Down 8.7% Since the Last Earnings Report?

It has been about a month since the last earnings report for Discovery Communications, Inc. DISCA. Shares have lost about 8.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Discovery Lags Q2 Earnings, To Buy Scripps Networks

Discovery Communications performed disappointingly in the second quarter of 2017 reporting lower-than-expected earnings and revenues. The company’s earnings (on an adjusted basis) of 68 cents per share missed the Zacks Consensus Estimate of 71 cents. Also, the bottom line contracted 4.23% on a year-over-year basis.

Discovery’s second-quarter revenues of $1,745 million improved 2.17% on a year-over-year basis, despite the adverse impact of foreign currency movement. However, revenues missed the Zacks Consensus Estimate of $1,764.4 million.

The increase in revenues witnessed in the U.S. Networks and International Networks units was somewhat mitigated by the dismal show of the Education and Other division. However, quarterly adjusted operating income before depreciation and amortization (OIBDA) increased 2% year over year.

Quarterly Performance

Revenues in the US Networks division rose 2% to $890 million. Segmental growth was driven by a 13% rise in Other revenues to $18 million. While Distribution revenues increased 4% to $400 million, revenues from Advertising sources were flat at $472 million. Also, adjusted OIBDA was up 4% year over year for the segment. Plus, adjusted OIBDA margin was 64% in the reported quarter compared with 62% a year ago.

In addition, International Networks revenues rose 3% to $811 million. While Distribution revenues in the segment improved 7% to $457 million, Advertising revenues declined 3% to $333 million. Revenues from Other sources were flat on a year-over-year basis at $21 million. Also, adjusted OIBDA decreased 4% on a year-over-year basis. Adjusted OIBDA margin slid to 29% compared with 31% a year ago.

However, revenues from the Education and Other division fell 4% to $44 million. This decline was primarily due to the impact of sale of the Raw and Betty production studios of the company.

Liquidity

The company exited the second quarter of 2017 with cash and cash equivalents of $206 million and $8,158 million of debt (non-current portion) compared with $300 million and $7, 841 million, respectively, at the end of 2016.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions higher for the current quarter compared to three lower.

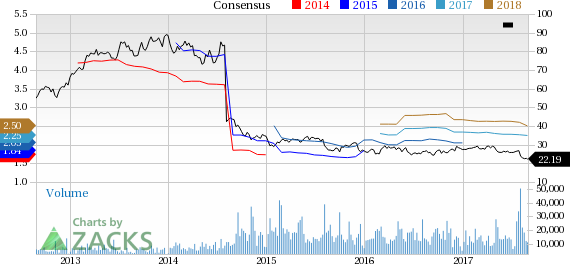

Discovery Communications, Inc. Price and Consensus

Discovery Communications, Inc. Price and Consensus | Discovery Communications, Inc. Quote

VGM Scores

At this time, the stock has a subpar Growth Score of D, though it is lagging a bit on the momentum front with an F. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value based on our styles scores.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are looking for an inline return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discovery Communications, Inc. (DISCA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research