Why Elastic NV's Stock Skyrocketed 27% in a Quarter: A Deep Dive

Elastic NV (NYSE:ESTC), a leading software company, has seen a significant surge in its stock price over the past quarter. With a current market cap of $8.03 billion and a stock price of $81.57, the company has experienced a 2.38% gain over the past week and a remarkable 27.09% increase over the past three months. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of Elastic NV stands at $119.27, indicating that the stock is significantly undervalued. This is consistent with the GF Valuation from three months ago, which also classified the stock as significantly undervalued.

Company Overview: Elastic NV

Elastic NV operates in the software industry, with its headquarters in Mountain View, California. The company specializes in search-adjacent products, with its search engine capable of processing both structured and unstructured data to derive valuable insights. Elastic NV's primary focus areas include enterprise search, observability, and security.

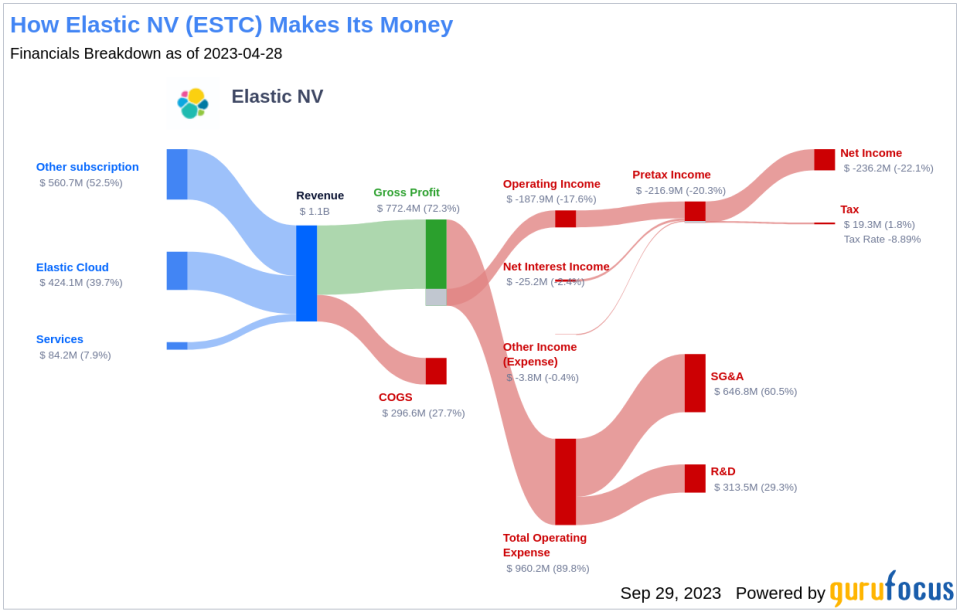

Profitability Analysis

As of July 31, 2023, Elastic NV's Profitability Rank stands at 3 out of 10, indicating a need for improvement. The company's Operating Margin is -14.63%, which is better than 29.26% of the companies in the industry. The ROE is -54.30%, outperforming 14.62% of the companies, while the ROA is -13.06%, better than 26.94% of the companies. The ROIC is -19.57%, which is better than 24.58% of the companies in the industry.

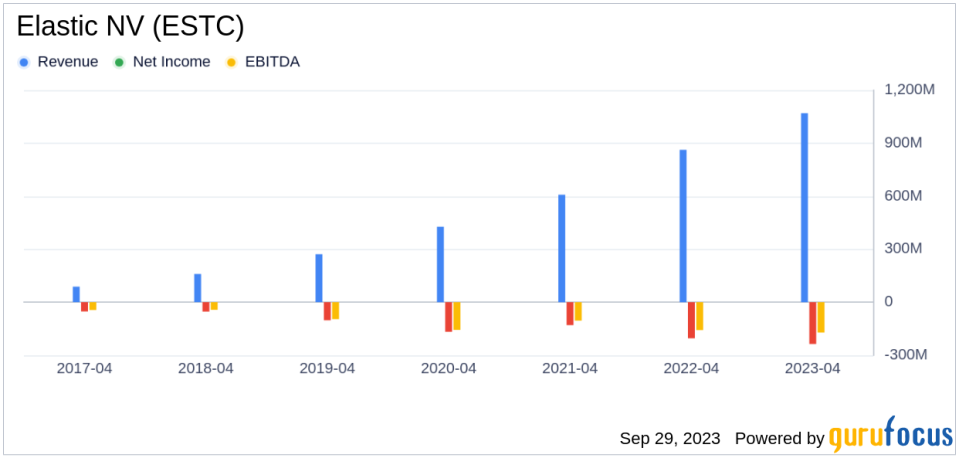

Growth Prospects

Elastic NV's Growth Rank is 8 out of 10, indicating strong growth potential. The company's 3-Year Revenue Growth Rate per Share is 27.20%, outperforming 82.77% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 31.10%, better than 91.46% of the companies. The Total Revenue Growth Rate (Future 3Y To 5Y Est) is 18.34%, outperforming 75.15% of the companies. However, the 3-Year EPS without NRI Growth Rate is -5.20%, better than only 34.27% of the companies, and the 5-Year EPS without NRI Growth Rate is -16.80%, better than just 10.9% of the companies. The EPS Growth Rate (Future 3Y To 5Y Est) is 63.59%, outperforming 97.52% of the companies.

Major Stock Holders

The top three holders of Elastic NV's stock are Baillie Gifford (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). Baillie Gifford (Trades, Portfolio) holds the largest share with 7,582,321 shares, accounting for 7.79% of the total shares. Jim Simons (Trades, Portfolio) holds 200,977 shares, making up 0.21% of the total shares, while Joel Greenblatt (Trades, Portfolio) holds 17,298 shares, accounting for 0.02% of the total shares.

Competitive Landscape

Elastic NV faces stiff competition from Coupa Software Inc (COUP) with a market cap of $6.12 billion, RingCentral Inc (NYSE:RNG) with a market cap of $2.84 billion, and Procore Technologies Inc (NYSE:PCOR) with a market cap of $9.51 billion.

Conclusion

In conclusion, Elastic NV has shown impressive growth over the past quarter, with its stock price increasing by 27.09%. Despite its low profitability rank, the company's strong growth rank and the fact that it is significantly undervalued according to the GF Value indicate potential for future growth. However, investors should also consider the company's competitive landscape and the holdings of major stockholders when making investment decisions.

This article first appeared on GuruFocus.