Why Fusion Pharmaceuticals (FUSN) Stock Was Up 14% on Wednesday

Shares of radiopharmaceuticals maker Fusion Pharmaceuticals FUSN rose 13.9% on Dec 27, after analysts at Raymond James recently upgraded the stock’s recommendation from Outperform to Strong Buy, citing it as a potential takeover target.

Raymond James also raised the target price set on FUSN’s shares to $15 per share, up from the previously issued $12 price per share.

This decision to revise the recommendation on Fusion Pharmaceuticals’ stock by Raymond James analysts follows a series of recent high-profile acquisitions unfolding in the radiopharma space by pharma giants Eli Lilly LLY and Bristol Myers BMY. During the quarter, Eli Lilly and Bristol Myers made buyout offers for POINT Biopharma and RayzeBio, respectively, both of which are rivals to Fusion Pharmaceuticals in the radiopharma space. While Lilly recently closed the buyout deal, the Bristol Myers deal is expected to close in first-half 2024.

The analysts pointed out that FUSN is one of the ‘most mature biotech companies’ focused on developing radiopharmaceutical therapies. Apart from having a diversified pipeline of targeted alpha therapy (TAT) programs, FUSN also has ‘an established, redundant radiopharma manufacturing supply chain.’

Per Raymond James, these factors could easily help FUSN cross the $1-billion mark threshold in market value. The analysts also project a sizable premium on the company’s valuation in case it is eyed as an acquisition target by big pharma.

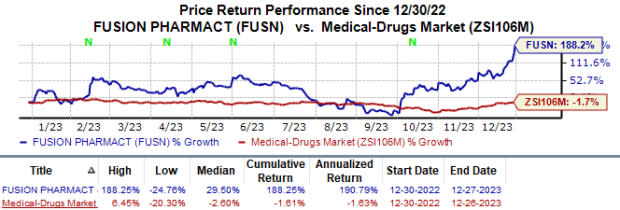

Year to date, shares of Fusion Pharmaceuticals have skyrocketed 188.3% against the industry’s 1.6% fall.

Image Source: Zacks Investment Research

Fusion’s key pipeline candidates include FPI-2265, a small molecule-based TAT targeting prostate-specific membrane antigen for the treatment of metastatic castration-resistant prostate cancer, and FPI-1434 in phase I for patients with solid tumors expressing IGF-1R. Preliminary data from approximately 20 to 30 patients from the phase II study on FPI-2265 are expected to be released in the first quarter of 2024.

In April, Fusion Pharmaceuticals received IND clearance to begin clinical development of FPI-2068, its novel TAT candidate, which targets solid tumors expressing EGFR-cMET. Fusion Pharmaceuticals is jointly developing FPI-2068 with AstraZeneca AZN under the companies' multi-asset collaboration agreement. Pre-clinical data on the candidate has demonstrated strong anti-tumor activity and confirmatory evidence of FPI-2068's mechanism of action.

FUSN signed a collaboration deal with AstraZeneca in 2020 to develop and market novel radiopharma therapies targeting cancer indications. Per the terms of the agreement, Fusion will be responsible for preclinical development through first-in-human studies, while AstraZeneca will assume responsibility for subsequent clinical development. The companies will share costs equally through clinical development.

Fusion also entered into a collaboration with Merck to evaluate FPI-1434 in combination with Merck's blockbuster PD-L1 inhibitor, Keytruda, in patients with solid tumors expressing IGF-1R.

Fusion Pharmaceuticals Inc. Price

Fusion Pharmaceuticals Inc. price | Fusion Pharmaceuticals Inc. Quote

Zacks Rank

FUSN currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Fusion Pharmaceuticals Inc. (FUSN) : Free Stock Analysis Report