Why G-III Apparel Group Ltd's Stock Skyrocketed 26% in a Quarter

G-III Apparel Group Ltd (NASDAQ:GIII), a leading player in the Manufacturing - Apparel & Accessories industry, has seen a significant surge in its stock price over the past three months. The company's market cap currently stands at $1.16 billion, with its stock price at $25.37. Over the past week, the stock has gained 4.21%, and over the past three months, it has seen a remarkable 26.19% gain. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The GF Value of GIII has risen from $28.55 to $29.73 over the past three months, indicating a positive trend. The stock is currently considered modestly undervalued, a significant improvement from being significantly undervalued three months ago.

Company Overview

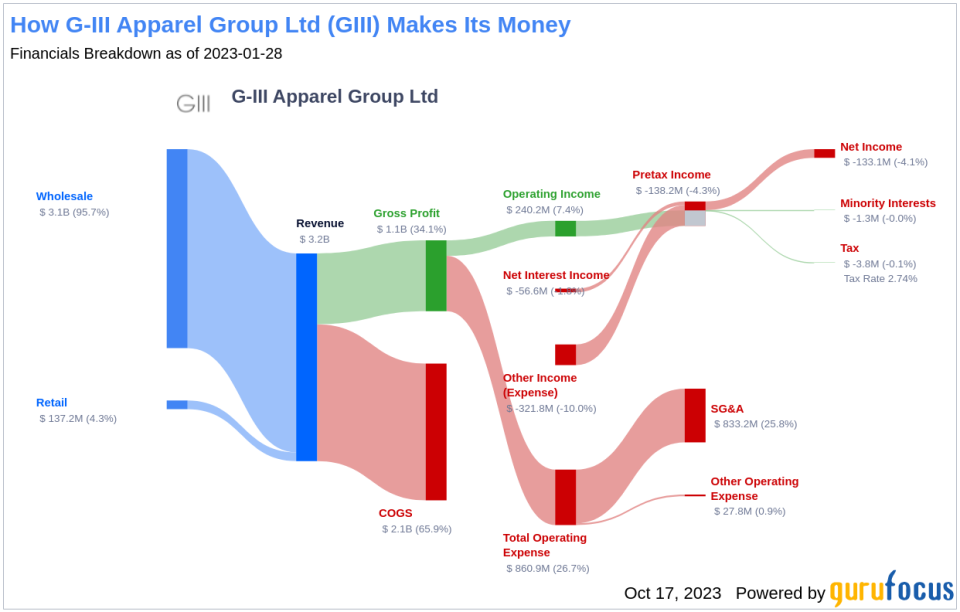

G-III Apparel Group Ltd is a textile company that manufactures a wide range of apparel, footwear, and accessories. The company sells its products under various brands, including its own brands, licensed brands, and private-label brands. G-III's portfolio is anchored by five global power brands: DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld. The company operates in two segments: Wholesale Operations and Retail Operations. The Wholesale operations segment includes sales of products under brands licensed by G-III from third parties, as well as sales of products under its own brands and private-label brands. The retail operations segment primarily consists of Wilsons Leather, G.H. Bass, and DKNY retail stores. The majority of the company's revenues are derived from Wholesale operations.

Profitability Analysis

G-III Apparel Group Ltd has a Profitability Rank of 7/10, indicating a relatively high level of profitability. The company's Operating Margin is 6.29%, which is better than 61.78% of companies in the same industry. The company's ROE is -12.26%, ROA is -6.30%, and ROIC is 8.04%. These figures indicate that the company has been able to generate a decent return on its invested capital. Over the past 10 years, the company has been profitable for 9 years, which is better than 72.43% of companies in the industry.

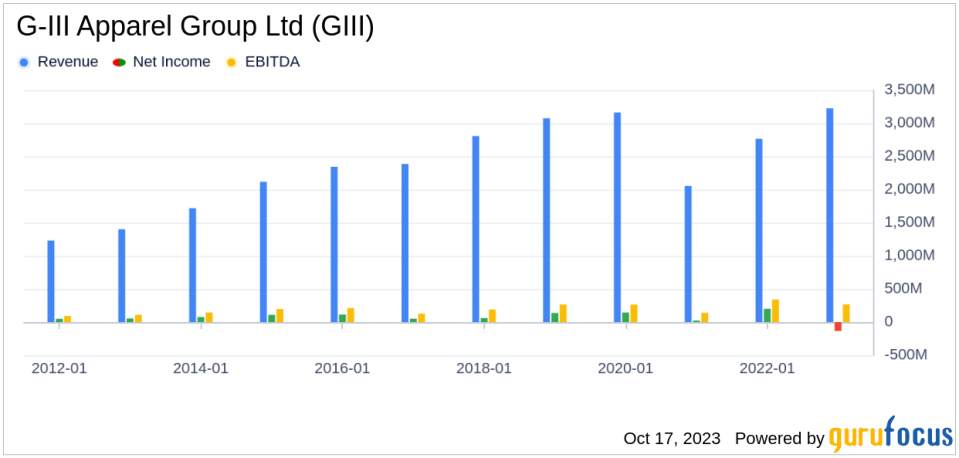

Growth Prospects

The company's Growth Rank is 4/10, indicating moderate growth. The 3-year and 5-year revenue growth rates per share are 1.60% and 0.60% respectively. The company's future total revenue growth rate estimate is 2.04%. These figures suggest that the company has the potential for steady growth in the coming years.

Major Stockholders

The top three holders of G-III Apparel Group Ltd's stock are HOTCHKIS & WILEY, Francisco Garcia Parames (Trades, Portfolio), and Steven Scruggs (Trades, Portfolio). HOTCHKIS & WILEY holds 408,190 shares, representing 0.9% of the total shares. Francisco Garcia Parames (Trades, Portfolio) holds 349,422 shares, accounting for 0.77% of the total shares. Steven Scruggs (Trades, Portfolio) holds 348,636 shares, representing 0.76% of the total shares.

Competitive Landscape

G-III Apparel Group Ltd faces competition from FIGS Inc, Hanesbrands Inc, and Oxford Industries Inc. FIGS Inc has a market cap of $1.11 billion, Hanesbrands Inc has a market cap of $1.53 billion, and Oxford Industries Inc has a market cap of $1.5 billion.

Conclusion

In conclusion, G-III Apparel Group Ltd has shown impressive performance in the stock market over the past three months. The company's operations, profitability, and growth prospects make it a compelling choice for investors. Despite facing competition from other companies in the industry, G-III Apparel Group Ltd has managed to maintain a strong position and is poised for further growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.