Why Helmerich & Payne Inc's Stock Skyrocketed 30% in a Quarter: A Deep Dive

Helmerich & Payne Inc (NYSE:HP), a prominent player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. As of September 27, 2023, the company's stock price stands at $44.05, with a market cap of $4.38 billion. Despite a minor dip of 0.80% over the past week, the stock has witnessed a substantial gain of 29.79% over the past three months. According to the GF Value, which currently stands at $67.84, the stock is significantly undervalued. This is consistent with the GF Value three months ago, which was $63.2, indicating that the stock was significantly undervalued then as well. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates.

Company Overview

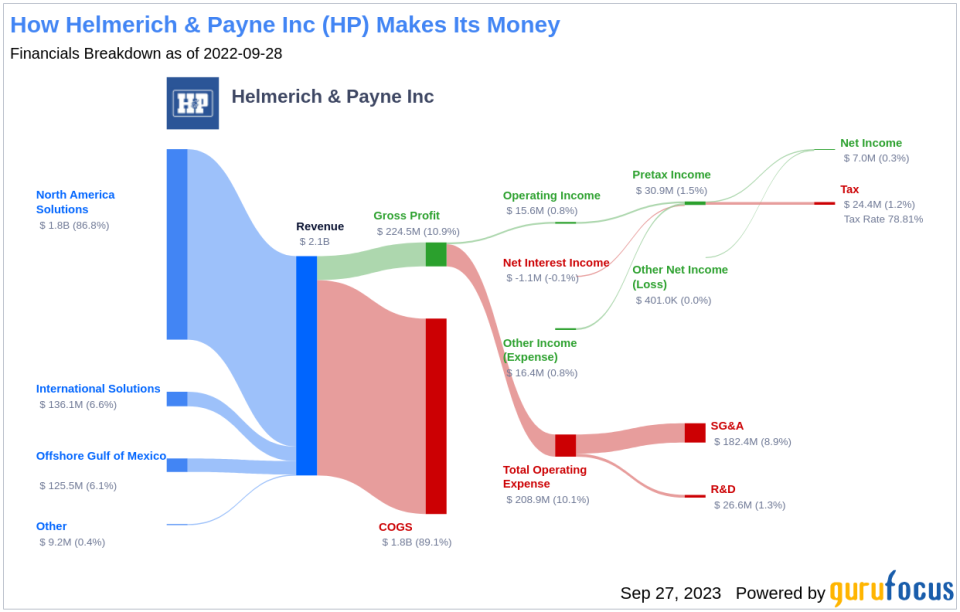

Helmerich & Payne Inc operates in the Oil & Gas industry, boasting the largest fleet of U.S. land drilling rigs. The company's FlexRig line is the leading choice for drilling horizontal wells for the production of U.S. tight oil and gas. With a presence in nearly every major U.S. shale play, H&P has a growing international footprint as well.

Profitability Analysis

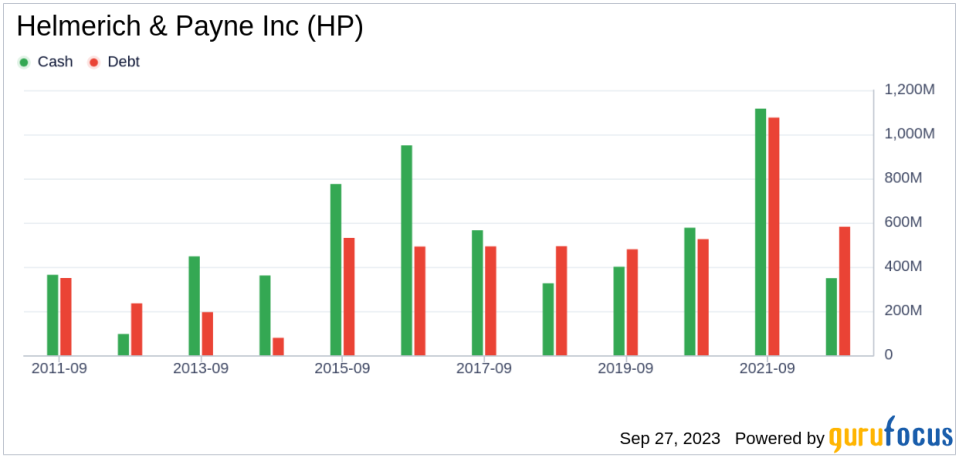

Helmerich & Payne Inc has a Profitability Rank of 5/10, indicating moderate profitability. The company's operating margin stands at 17.87%, better than 65.04% of 984 companies in the same industry. The ROE is 14.66%, outperforming 63.43% of 1031 companies, while the ROA is 9.22%, better than 74.21% of 1101 companies. The ROIC is 10.13%, surpassing 68.62% of 1090 companies. Over the past decade, the company has demonstrated profitability for five years, outperforming 50.94% of 960 companies.

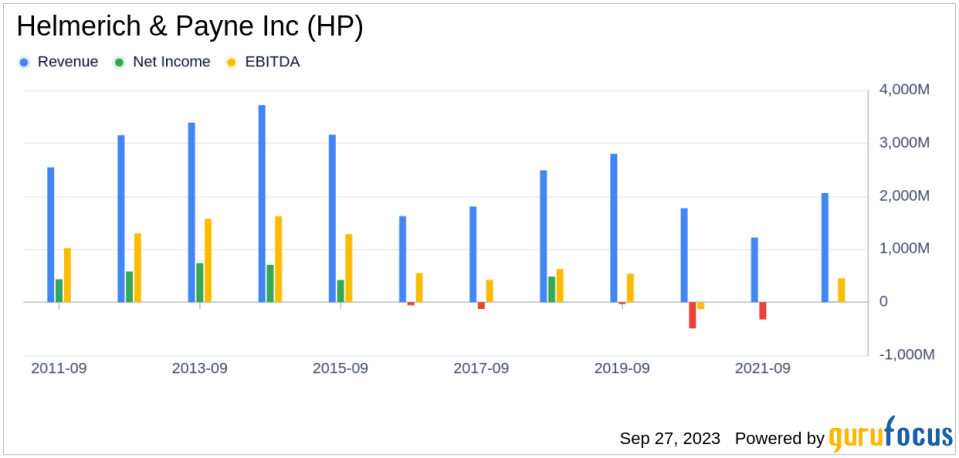

Growth Prospects

The company's Growth Rank is 1/10, indicating low growth. However, the future growth estimates are promising. The 3-year revenue growth rate per share is -9.00%, better than 17.75% of 862 companies. The 5-year revenue growth rate per share is -5.00%, outperforming 24.21% of 789 companies. The future 3 to 5-year total revenue growth rate is estimated at 12.81%, better than 82.76% of 261 companies. The future 3 to 5-year EPS without NRI growth rate is projected at a whopping 165.28%, surpassing 98.46% of 65 companies.

Major Stockholders

Ken Fisher (Trades, Portfolio) is the largest holder of Helmerich & Payne Inc's stock, owning 0.81% of the shares. Prem Watsa (Trades, Portfolio) holds 0.56% of the shares, while First Eagle Investment (Trades, Portfolio) owns 0.06%.

Competitive Landscape

Helmerich & Payne Inc faces competition from several companies in the Oil & Gas industry. Seadrill Ltd (NYSE:SDRL) has a market cap of $3.65 billion, Patterson-UTI Energy Inc (NASDAQ:PTEN) has a market cap of $6.17 billion, and Transocean Ltd (NYSE:RIG) has a market cap of $6.71 billion.

Conclusion

In conclusion, Helmerich & Payne Inc's stock has shown a remarkable performance over the past three months, with a significant gain of 29.79%. The company's profitability and growth metrics, along with its position in the market relative to its competitors, make it a potential candidate for value investors. Despite the low growth rank, the future growth estimates are promising, indicating potential for further stock price appreciation.

This article first appeared on GuruFocus.