Why Herbalife Ltd's Stock Skyrocketed 16% in a Quarter

Herbalife Ltd (NYSE:HLF), a leading player in the Consumer Packaged Goods industry, has seen a significant surge in its stock price over the past quarter. With a current market cap of $1.5 billion and a price of $15.18, the stock has witnessed an impressive 8.75% gain over the past week and a 15.99% increase over the past three months. According to the GF Value, which stands at $37.97, the stock is significantly undervalued. This is consistent with the past GF Value of $45.62, indicating that the stock has been undervalued for some time.

Company Overview: Herbalife Ltd

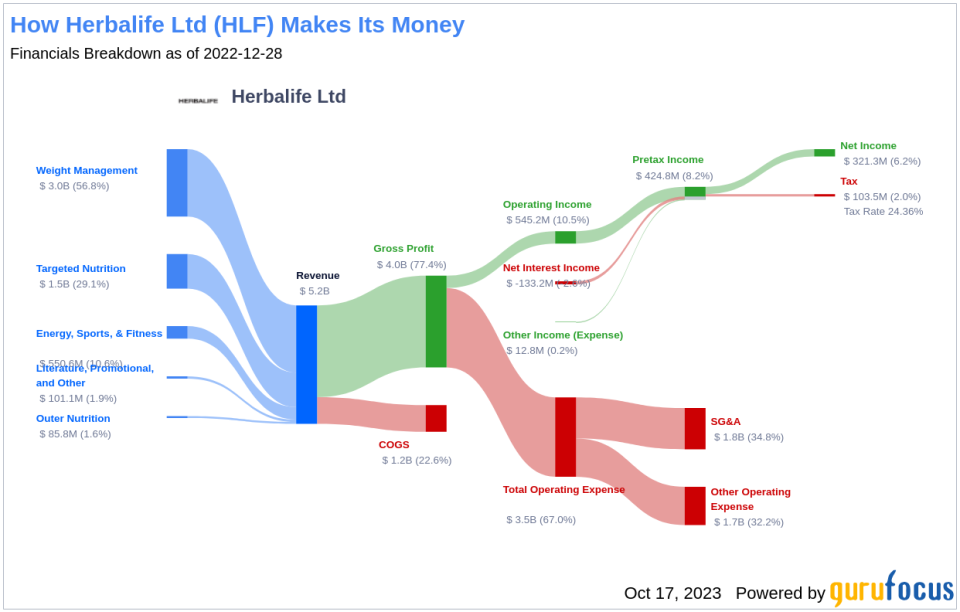

Herbalife Ltd is a global nutrition company that provides health and wellness products to consumers in 95 markets through a direct-selling business model. The company's product portfolio includes weight management products, targeted nutrition, energy, sports, and fitness products, and outer nutrition and literature. The weight management segment, which includes meal replacement, protein shakes, drink mixes, weight loss enhancers, and healthy snacks, generates the majority of the company's revenue. Geographically, the main segments are North America, Mexico, South and Central America, EMEA, Asia-Pacific, and China.

Profitability Analysis

Herbalife Ltd boasts a high Profitability Rank of 9/10, indicating a high level of profitability. The company's Operating Margin stands at 8.53%, better than 67.18% of companies in the industry. The ROE is at an impressive 10000.00%, outperforming 99.94% of companies, while the ROA and ROIC stand at 8.23% and 16.08% respectively. The company has also demonstrated consistent profitability over the past 10 years, better than 99.94% of companies.

Growth Prospects

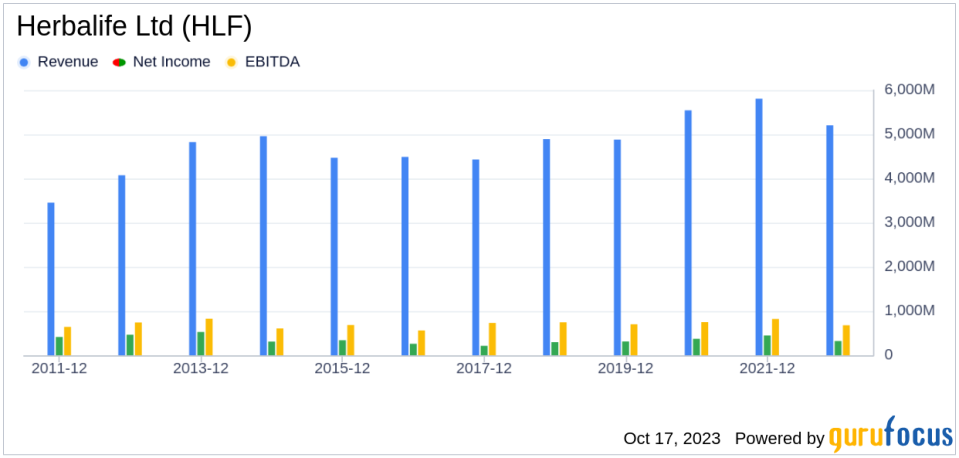

Herbalife Ltd has a strong Growth Rank of 7/10, indicating robust growth. The company's 3-year and 5-year revenue growth rates per share stand at 14.90% and 15.40% respectively, outperforming a significant portion of the industry. The 3-year and 5-year EPS without NRI growth rates are also impressive at 13.70% and 22.20% respectively.

Major Stock Holders

The top three holders of Herbalife Ltd's stock are Jim Simons (Trades, Portfolio), holding 6,392,864 shares (6.46%), Seth Klarman (Trades, Portfolio), holding 1,954,200 shares (1.97%), and First Pacific Advisors (Trades, Portfolio), holding 1,839,085 shares (1.86%).

Competitive Landscape

Herbalife Ltd operates in a competitive industry, with major competitors including Usana Health Sciences Inc (NYSE:USNA) with a market cap of $1.1 billion, John B Sanfilippo & Son Inc (NASDAQ:JBSS) with a market cap of $1.18 billion, and Utz Brands Inc (NYSE:UTZ) with a market cap of $963.960 million.

Conclusion

In conclusion, Herbalife Ltd's stock has shown impressive performance, with the company demonstrating high profitability and strong growth. Despite operating in a competitive industry, the company's consistent profitability over the past 10 years and its robust growth prospects make it a compelling investment. Given its current undervalued status according to the GF Value, the stock holds potential for future growth and profitability.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.