Why You Should Hold Archer Daniels (ADM) Before Q2 Earnings

Archer Daniels Midland Company ADM has been consistent in its top and bottom-line performances for quite a while now. The company reported earnings and sales surprise for the 10th consecutive quarter in first-quarter 2023. This has kept investors positive about its quarterly performances. Additionally, investors expect the company’s ongoing initiatives to drive growth.

Among the initiatives, Archer Daniels has significantly progressed on its three strategic pillars, optimize, drive and growth. Also, it has been on track with the Readiness program. The gains from these positives are well reflected in the company’s shares.

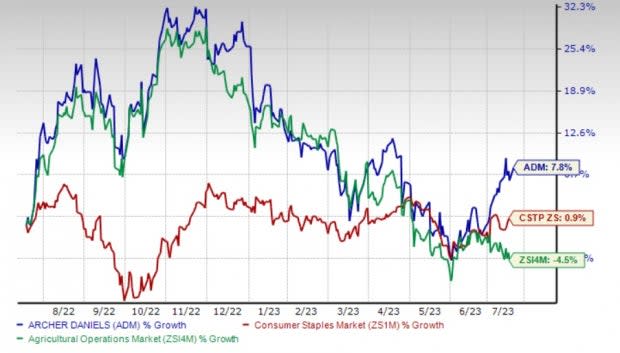

Shares of Archer Daniels have gained 7.8% in the past year against the industry’s decline of 4.5%. Moreover, this Zacks Rank #3 (Hold) stock has also outperformed the Consumer Staples sector’s rise of 0.9% in the same period.

Image Source: Zacks Investment Research

What Puts Archer Daniels in the Sweet Spot?

Archer Daniels looks poised for long-term growth, owing to its progress on the optimize, drive and growth pillars. Under the optimize pillar, the company revealed plans to expand alternative protein capabilities in Decatur, IL, and starch production in Marshall, MN. It concluded its alternative protein expansion in Serbia and is on track to launch the expanded probiotic capacity in Valencia, Spain.

The company also expects to start operating its joint venture crush and refining facility in North Dakota by this year’s harvest. It continues to adapt to consumers’ changing nutritional preferences as part of optimizing growth.

Under its drive pillar, ADM has been adapting its organizational structure to meet operational excellence and set goals. Notably, Archer Daniels inked an agreement with Benson Hill to process and commercialize a portfolio of proprietary ingredients derived from their ultra-high protein soybeans.

In response to growing trends for all things sustainable, the company has been making efforts to expand its solutions portfolio, which forms part of its Carbohydrate Solutions unit. It collaborated with LG Chem to produce lactic and polylactic acids for bioplastics, which is a plant-based product.

ADM launched Biosolutions to expand its portfolio of sustainable higher-margin solutions, particularly for pharmaceuticals and personal care markets. Such endeavors are likely to help attain 10% revenue growth on an annual basis.

In a recent development, Archer Daniels entered a joint venture with Gevo to help meet the demand for low-carbon, sustainable aviation fuel. It also decided to shut down its ethanol facility in Peoria by the end of October. The company is utilizing innovative technologies to develop products and boost operating capabilities.

Additionally, Archer Daniels is likely to gain from the Readiness goals of driving business improvement, standardizing functions and enriching consumers’ experience, which are on track. As part of readiness efforts, it introduced a company-wide simplification initiative. The company’s strategic pillars for growth and the aforementioned initiatives are guided and supported by the Readiness program, focused on accelerating and enhancing competitiveness.

Hurdles to Overcome

Archer Daniels has been witnessing a rising SG&A expense trend for a while now. In first-quarter 2023, ADM’s SG&A expenses rose 6.3% year over year, following an increase of 14.1%, 13.6%, 10.1% and 16.7% in the fourth, third, second and first quarters of 2022, respectively. Additionally, SG&A expense rose 4.9%, 13.2%, 15.8% and 12.8% in the fourth, third, second and first quarters of 2021, respectively. This can be attributed to higher performance-related compensation, project-related costs and shifting of costs from business segments into the centralized centers of excellence in supply chain and operations.

Recently, Archer Daniels has been witnessing soft trends in its Nutrition segment, which are hurting investor sentiments. In first-quarter 2023, the company’s Nutrition segment witnessed a year-over-year revenue decline of 3.7%. The adjusted operating profit fell 23% from the year-ago quarter. The Human Nutrition unit was flat year over year.

The Flavors unit was drab due to sluggish results in North America, while sturdy margins aided the Specialty Ingredients unit. The Health & Wellness business remained weak year over year. Also, the Animal Nutrition unit was weak year over year due to lower margins in amino acids.

However, management has been making efforts to help reduce destocking impacts in beverages, lower margins in amino acids and the broader demand fulfillment challenges. It expects 2023 operating profit growth of more than 10% on a constant-currency basis, led by Human Nutrition. Also, the company is likely to witness growth toward the back half of the year.

Consumer Staples Stocks Worth a Look

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely, Molson Coors TAP, Coca-Cola FEMSA KOF and PepsiCo Inc. PEP.

Molson Coors currently sports a Zacks Rank #1 (Strong Buy). TAP has a trailing four-quarter earnings surprise of 32.1%, on average. Shares of TAP have rallied 16.1% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Molson Coors’ current financial year’s sales and earnings suggests growth of 5.3% and 10.2%, respectively, from the year-ago period’s reported figures. TAP has an expected EPS growth rate of 4.3% for three to five years.

Coca-Cola FEMSA currently carries a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 13.5% for three to five years. Shares of KOF have rallied 49.7% in the past year.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s sales and earnings per share for the current financial year suggests growth of 19.5% and 14.6%, respectively, from the year-ago period’s reported figures. KOF has a trailing four-quarter negative earnings surprise of 33.8%, on average.

PepsiCo has a trailing four-quarter earnings surprise of 6.3%, on average. It currently carries a Zacks Rank #2. Shares of PEP have gained 9.1% in the past year.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 4.6% and 8.4%, respectively, from the year-ago period's reported figures. PEP has an expected EPS growth rate of 7.8% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report