Why You Should Hold on to Envestnet (ENV) Stock for Now

Envestnet, Inc. ENV is currently banking on its strong revenue generation capacity, prudent investments and technology development.

The company’s earnings are expected to register 14% growth in 2023 and 31.2% in 2024.

Tailwinds

Envestnet remains focused on increasing its share of the addressable market, consisting of enterprise clients in wealth management, financial advisors, financial technology providers and financial institutions through its technology platforms. It has made prudent investments toward enhancing and expanding its technology platforms.

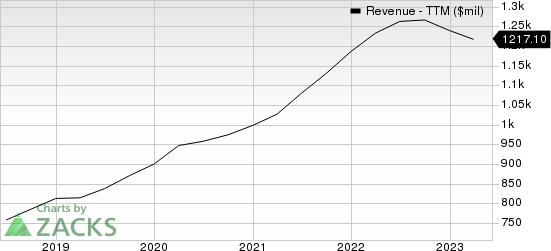

Envestnet, Inc Revenue (TTM)

Envestnet, Inc revenue-ttm | Envestnet, Inc Quote

The company continues to focus on technology development to improve operational efficiency, increase market competitiveness, address regulatory demands and cater to client-driven requests for new capabilities. Its technology design facilitates significant scalability.

Envestnet’s business model ensures solid asset-based and subscription-based recurring revenue generation capacity. The company’s recurring revenues increased 10.2% in 2020, 20.2% in 2021 and 4.5% year over year in 2022.

Some Risks

Envestnet's current ratio at the end of first-quarter 2023 was pegged at 0.75, lower than the previous quarter's 0.93 and the prior-year quarter's 1.83. A decline in the current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

Envestnet currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following better-ranked stocks.

Green Dot GDOT: GDOT currently carries a Zacks Rank #2 (Buy) and has a VGM Score of A. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company has an impressive earning surprise history, beating the consensus mark in all the trailing four quarters. The company has an average surprise of 37.3%.

Maximus MMS: MMS carries a Zacks Rank of 2 and has a VGM Score of A.

The company has an impressive earning surprise history, beating the Zacks Consensus mark in three instances and missing once, the average surprise being 9.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report