Why You Should Hold on to Envestnet (ENV) Stock for Now

Envestnet, Inc. ENV is currently banking on its strong revenue generation capacity, prudent investments and technology development.

ENV has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. The company’s earnings are expected to register 14.5% growth in 2023 and 30.6% in 2024.

Factors That Augur Well

Envestnet remains focused on increasing its share of the addressable market consisting of enterprise clients in wealth management, financial advisors, financial technology providers and financial institutions through its technology platforms. It has made prudent investments toward enhancing and expanding its technology platforms.

The company continues to focus on technology development to improve operational efficiency, increase market competitiveness, address regulatory demands and cater to client-driven requests for new capabilities. Its technology design facilitates significant scalability.

Envestnet’s business model ensures solid asset-based and subscription-based recurring revenue generation capacity. The company’s recurring revenues increased 10.2% in 2020, 20.2% in 2021 and 4.5% year over year in 2022.

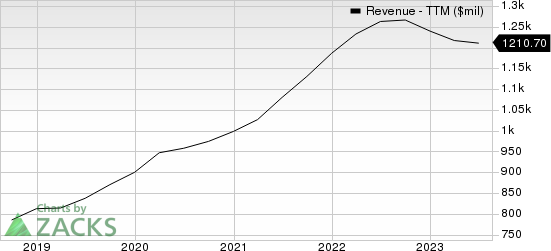

Envestnet, Inc Revenue (TTM)

Envestnet, Inc revenue-ttm | Envestnet, Inc Quote

A Risk

Envestnet's current ratio at the end of second-quarter 2023 was 0.73, lower than the previous quarter's 0.75 and the prior-year quarter's 0.77. Decreasing current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

Envestnet currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services sector can consider stocks like Verisk Analytics VRSK and ICF International ICFI.

Verisk currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The company has a trailing four-quarter earnings surprise of 9.9% on average. VRSK shares have gained 4% in the past three months.

ICF International also carries a Zacks Rank #2 and has a VGM Score of A. The company has a trailing four-quarter earnings surprise of 7% on average. ICFI shares have gained 9.5% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Envestnet, Inc (ENV) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report