Why Hold Strategy is Apt for Centene (CNC) Stock Right Now

Centene Corporation CNC is expected to remain on its growth track with the help of increasing memberships and a strong focus on business streamlining. Nevertheless, weakness in Commercial business continues to tighten.

Centene, with a market cap of $46.4 billion, is a well-diversified, multi-national healthcare company. Based in Saint Louis, MO, the company offers fully integrated cost-effective services to commercial and government-sponsored programs.

Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth holding on to at the moment.

Let’s delve deeper.

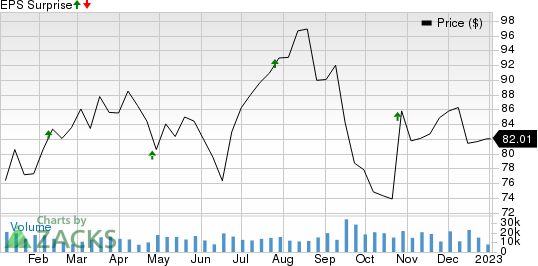

The Zacks Consensus Estimate for Centene’s 2022 earnings is pegged at $5.72 per share, indicating an 11.1% year-over-year increase, while our estimate suggests 10.5% year-over-year growth. The company has witnessed one upward estimate revision in the past month against none in the opposite direction. CNC beat on earnings in all the last four quarters, the average being 5.2%.

Centene Corporation Price and EPS Surprise

Centene Corporation price-eps-surprise | Centene Corporation Quote

The consensus estimate for 2022 revenues is pegged at $144.5 billion, suggesting a 14.7% rise from the prior-year reported figure, while our estimate suggests a 14.4% year-over-year increase. The company’s 2023 outlook for total revenues of $137.4-$139.4 billion is lower than the 2022 guidance figure. The company estimates premium and service revenues of $129.5-$131.5 billion, lower than the $134-$136 billion guided for 2022.

However, 2023 adjusted EPS is estimated to be $6.25-$6.40, signaling a massive increase from 2022 estimates despite a declining top line. This highlights Centene’s improving operating efficiency. The Value Creation Plan launched in 2021 is aiding the company in this regard. Divesting non-core operations like Magellan Rx and PANTHERx is paving the road to improving profitability.

While the company does not shy away from divesting less profitable businesses, it has an active inorganic growth strategy. Strategic acquisitions enable the company to scale up its business and increase membership. Major buyouts include Community Medical Holdings, MHM Services, Fidelis Care and Magellan Health.

CNC expects the health benefits ratio to be 87.2-87.8% in 2023, signaling an improvement from the 2022 estimate of 87.6-88%. Even though the number of people opting for proceduresis high, which were paused earlier due to the pandemic, the company is expected to manage medical costs quite effectively.

Membership growth on the back of contract wins, network expansion, and delving deeper into existing states and new markets will help the company. Our estimate for total membership for 2022 indicates 5% year-over-year growth, thanks to a rise in Medicaid and Medicare businesses. As a result, we expect premiums to grow 12.4% in 2022, while service revenue growth is estimated to be higher than 50%.

The company is undervalued at current levels. CNC is trading at 14.34X forward 12-month earnings value, which compares favorably to the 19.77X of the industry.

Risks

However, there are a few factors, which might impede the stock’s growth.

The company’s commercial business continues to witness declining membership levels despite an improving employment scenario, which usually leads to higher demand. The high level of inflation might keep the commercial business under pressure.

As of Sep 30, 2022, its long-term debt amounted to $18.1 billion. Its total debt reflects 41.8% of its total capital at the third-quarter end, higher than the industry's average of 39.2%. Nevertheless, we believe that a systematic and strategic plan of action will drive its long-term growth.

Key Picks

Some better-ranked stocks in the broader medical space are CareDx, Inc. CDNA, MedAvail Holdings, Inc. MDVL and AMN Healthcare Services, Inc. AMN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CareDx’s 2022 earnings has improved 24.5% in the past 60 days. CDNA has witnessed two upward estimate revisions during this time against none in the opposite direction. It beat earnings estimates by 57.1% in the last reported quarter.

The Zacks Consensus Estimate for MedAvail Holdings’ 2022 bottom line indicates a 37.3% improvement from the prior-year reported number. MDVL has witnessed one upward estimate revision in the past 60 days against none in the opposite direction.

The Zacks Consensus Estimate for AMN Healthcare’s 2022 bottom line indicates a 44% improvement from the prior-year reported number. The consensus estimate for AMN’s top line indicates 30.1% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

CareDx, Inc. (CDNA) : Free Stock Analysis Report

MedAvail Holdings, Inc. (MDVL) : Free Stock Analysis Report