Why Hold Strategy is Apt for Waste Management (WM) Stock Now

Waste Management, Inc. WM is currently benefiting from growing environmental concerns, along with its efforts to establish price and cost discipline.

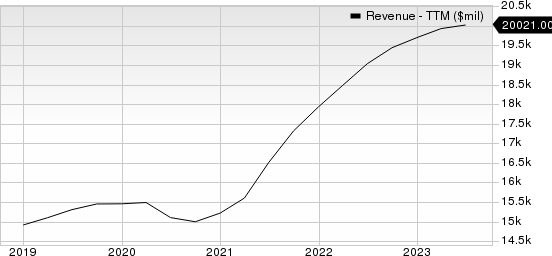

The company’s earnings for 2023 and 2024 are expected to grow 6.6% and 11.7%, respectively. Revenues for 2023 and 2024 are expected to grow 3.9% and 5.4%, respectively.

WM’s Tailwinds

Waste Management continues to benefit from increasing environmental concerns, rapid industrialization, increase in population and active government measures to reduce illegal dumping. Its top line increased 2% year over year in the second quarter of 2023.

Waste Management, Inc. Revenue (TTM)

Waste Management, Inc. revenue-ttm | Waste Management, Inc. Quote

The company’s core operating initiatives target focused differentiation and continuous improvement, and instilling price and cost discipline to achieve better margins. While differentiation through capitalization of extensive assets ensures long-term profitable growth and competitive advantages, cost control, process improvement and enhancements to its digital platform help enhance service quality.

The company has a steady dividend, as well as a share repurchase policy. In 2022, 2021 and 2020, it repurchased shares worth $1.5 billion, $1.4 billion and $402 million, respectively. It paid $1.1 billion, $970 million and $927 million in dividends in 2022, 2021 and 2020, respectively. WM plans to return significant cash to shareholders through healthy dividends and share repurchases in the future as well.

A Risk

WM's current ratio at the end of the second quarter of 2023 was pegged at 0.82, lower than the prior quarter’s 0.87 and the prior-year quarter’s current ratio of 1.07. A decline in the current ratio does not bode well, as it indicates that the company may have problems meeting its short-term obligations.

Zacks Rank and Stocks to Consider

WM currently carries a Zacks Rank #3 (Hold).

The following better-ranked stocks from the Business Services sector are worth consideration:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with an average surprise of 9.9%. The consensus mark for 2023 revenues is pegged at $2.66 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.71 per share, indicating a 14% rise from the year-ago figure. VRSK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 8.4% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once, and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings suggests growth of 9.3% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report