Why Should You Invest in Employers Holdings (EIG) Stock Now?

Employers Holdings’ EIG niche focus on low-to-medium hazard risk small businesses, better pricing, investment in technology, solid capital position and favorable growth estimates make it worth adding it to one’s portfolio.

This insurer is well poised to capitalize on the growth opportunities offered by the $50 billion-plus market.

Employers Holdings has a favorable VGM Score of B. This helps to identify stocks with the most attractive value, growth and momentum. Back-tested results show that stocks with a Growth Score of A or B combined with a Zacks Rank #1 (Strong Buy) or #2 (Buy) offer better returns.

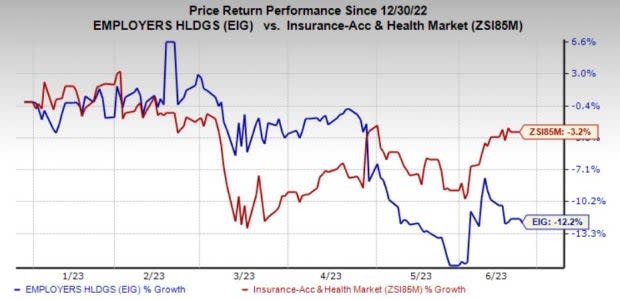

Zacks Rank & Price Performance

Employers Holdings currently carries a Zacks Rank #2. Year to date, the stock has declined 12.2% compared with the industry’s decrease of 3.2%.

Image Source: Zacks Investment Research

Optimistic Growth Projection

The Zacks Consensus Estimate for 2023 earnings is pegged at $3.13, indicating an increase of 6.8% on 19.7% higher revenues of $0.9 billion. The consensus estimate for 2024 earnings is pegged at $3.43, indicating an increase of 9.6% on 9.9% higher revenues of $0.9 billion.

Earnings Surprise History

The insurer has a solid record of delivering an earnings surprise in the last four quarters, with the average beat being 35.63%.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2023 and 2024 has moved 2.6% and 2.4% north in the past 60 days, reflecting analyst optimism.

Business Tailwinds

EIG’s growth strategy encompasses accelerating premium growth by expanding underwriting appetite while managing fixed expenses. The insurer thus is expanding its Employers and Cerity underwriting capacity.

EIG boasts a solid track of favorable reserve development leveraging disciplined underwriting,

The insurance industry has been witnessing accelerated digitalization. EIG stays focused on investing in technology and digitalization to scale up its business.

EIG has a superior quality and highly liquid investment portfolio that supports financial flexibility. Insurers are beneficiaries of an improving rate environment. The Fed raised interest rates seven times in 2022 and thrice in 2023. At its recently concluded FOMC meeting, the committee, for the time being, paused further rate hikes despite high inflation. The Fed hinted at another increase by 2023 end. Companies that have locked in high interest rates are bound to generate higher yields at this point.

Impressive Dividend History

Banking on operational excellence, EIG increased dividends at a 12-year CAGR of 13.7%. Its current dividend yield of 3% is higher than the industry average of 2.5%.

Attractive Valuation

Shares are trading at a price-to-book multiple of 1.04, lower than the industry average of 1.71.

The company has a Value Score of B. This style score helps find the most attractive value stocks.

Before its valuation expands, it is advisable to take a position in the stock.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are Unum Group UNM, RLI Corp. RLI and Kinsale Capital Group KNSL. While Unum Group and RLI Corp. sport a Zacks Rank #1 each, Kinsale Capital carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Unum has a decent track record of beating earnings estimates in three of the last trailing four quarters, the average being 18.61%. In the past year, UNM has gained 71.7%.

The Zacks Consensus Estimate for UNM’s 2023 and 2024 earnings per share is pegged at $7.49 and $7.76, indicating a year-over-year increase of 20.6% and 3.5%, respectively.

RLI beat estimates in each of the last four quarters, the average being 43.50%. In the past year, RLI has gained 20.6%.

The Zacks Consensus Estimate for RLI’s 2023 and 2024 earnings has moved 10.1% and 3.7% north, respectively, in the past 60 days.

Kinsale Capital has a solid track record of beating earnings estimates in each of the last trailing four quarters, the average being 14.77%. In the past year, KNSL has gained 71.7%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings per share is pegged at $10.37 and $12.41, indicating a year-over-year increase of 32.9% and 19.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

Employers Holdings Inc (EIG) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report