Why Investors Should Retain SITE Centers (SITC) Stock for Now

SITE Centers’ SITC well-located portfolio in suburban and high household income regions, focus on tenants with necessity-based businesses and an aggressive capital-recycling program are expected to aid its growth. However, rising e-commerce adoption and a high interest rate environment remain concerns.

With the concentration of properties in affluent markets, SITE Centers enjoys solid trade area demographics. It has a solid tenant roster, with 88% of tenants being national by annualized base rent. Most of its tenants hold a relatively strong financial position and have performed well over time.

This is likely to help SITE Centers enjoy stable rental revenues over the long term. While we expect rental income to exhibit marginal year-over-year growth in 2023, the same is expected to increase 2.2% in 2024 and 3.5% in 2025.

Having a necessity-business component has been the saving grace of retail REITs amid pandemic-related headwinds. The majority of the company’s tenants at its shopping centers cater to day-to-day consumer needs, with a focus on value and convenience retailers. Significant essential retail businesses at the company’s centers add resiliency to its business and enable it to generate stable revenues during an adverse economic environment.

SITE Centers has been following an aggressive capital-recycling strategy. Through this, it has divested its slow-growth assets and redeployed proceeds to acquire premium U.S. shopping centers, thereby enhancing its overall portfolio quality.

In the first quarter of 2023, SITE Centers sold off three joint-venture assets for $40 million ($8 million at the company’s share). Moreover, it acquired three convenience properties worth $42 million in the first quarter of 2023 and April 2023. Such initiatives indicate the company’s prudent capital-management practices and will relieve pressure from its balance sheet.

Further, SITE Centers has ample liquidity and focuses on further strengthening its balance-sheet position. As of Mar 31, 2023, the company had $900 million of liquidity. It also enjoys a large pool of unencumbered assets and investment-grade credit ratings that provides easy access to the secured and unsecured debt markets and helps maintain availability on the line.

However, given the convenience of online shopping, it is likely to remain a popular choice among customers. Consequently, this might adversely impact the market share for brick-and-mortar stores, affecting the demand for SITE Centers’ properties.

Additionally, persistent macroeconomic uncertainties and a high interest rate environment are likely to suppress customer sentiments in the near term, affecting demand for retail space. Amid elevated interest rates, we expect the company’s interest expense to increase 9.2% year over year in 2023. Moreover, the dividend payout is likely to become less attractive than the yields on fixed-income and money market accounts.

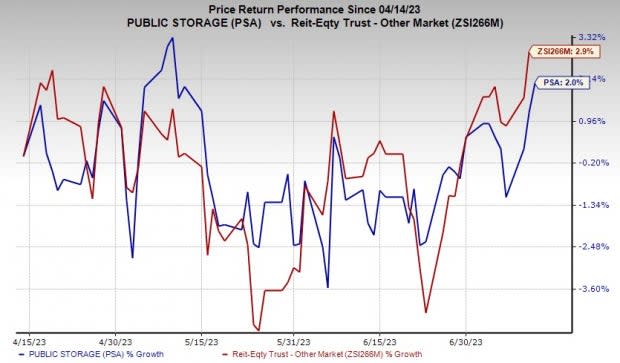

Over the past three months, shares of this Zacks Rank #3 (Hold) company have rallied 2% compared with the industry’s growth of 2.9%.

Image Source: Zacks Investment Research

Stocks to Consider

A couple of better-ranked stocks worth considering are Regency Centers REG and Saul Centers BFS, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Regency Centers’ current-year funds from operations (FFO) per share has been revised marginally upward over the last 30 days to 4.12. In the past three months, REG shares have rallied 5.8%.

The Zacks Consensus Estimate for Saul Centers’ current-year FFO per share has been revised marginally upward over the last 60 days to 3.05. In the past three months, BFS shares have rallied 4.6%.

Note: Anything related to earnings presented in this write-up represent FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regency Centers Corporation (REG) : Free Stock Analysis Report

Saul Centers, Inc. (BFS) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report