Why Investors Should Retain Restaurant Brands (QSR) Stock Now

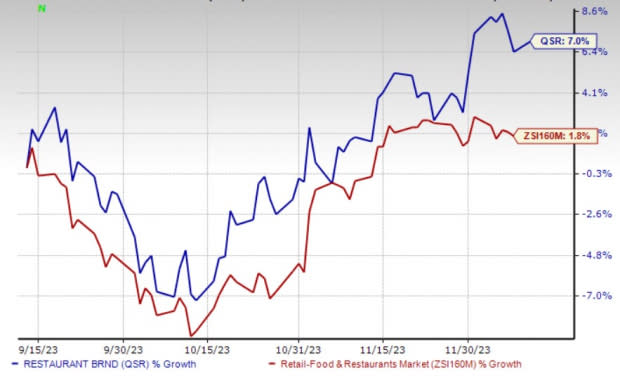

Restaurant Brands International Inc. QSR is benefiting from strong comparable sales, ongoing expansion initiatives, menu innovations and robust digital sales. As a result, the company's stock has seen a 7% increase in the last three months, outperforming the industry's 1.8% growth. Despite these positive trends, the company remains cautious due to elevated costs.

This Zacks Rank #3 (Hold) company’s earnings and revenues in 2023 are likely to witness growth of 2.9% and 7.7%, year over year, respectively. In the past 30 days, earnings estimates for 2023 have witnessed upward revisions of 0.3%.

Growth Catalysts

The company impressed investors with solid comps. In third-quarter 2023, its consolidated comparable sales came in at 7% compared with 8.6% reported in the prior-year quarter. Comps in Tim Hortons, Burger King and Popeyes came in at 6.8%, 7.2% and 7% compared with 9.8%, 9.6% and 3.1%, respectively, reported in the prior-year quarter. The upside was primarily driven by higher traffic, strengthening of core offerings, enhanced restaurant operations and pricing initiatives.

The company is also focusing on expansion efforts to drive growth. Restaurant Brands believes that there is a huge opportunity to grow all its brands around the world by expanding its presence in existing markets and entering new markets. Currently, it has approximately 30,375 restaurants worldwide.

Restaurant Brands also continues to evaluate opportunities to speed up the international development of all three brands by establishing master franchisees with exclusive development rights and joint ventures with new and existing franchisees. During the third quarter of 2023, QSR opened 250 net new restaurants, contributing to 4.2% year-over-year growth in the overall restaurant count.

Restaurant Brands continues to focus on improving its level of service through comprehensive training, improved restaurant operations, reimaging efforts and attractive menu options to enhance overall guest satisfaction and thereby drive comps. The company has an unwavering focus on its goal to drive traffic and revenues at its restaurants through core product platforms, a continual focus on a balanced menu design, expansion of delivery business, promotional offerings, efforts to grow breakfast daypart and product launches.

On the other hand, the company continues to focus on expanding digital sales. During third-quarter 2023, digital sales increased more than 40% year over year, courtesy of strong contributions from kiosks and delivery. It showcased strong digitalization efforts and continued to drive growth for its Tim Hortons brand, with 5 million average monthly users and a consistent digital sales mix of approximately 30% in the quarter. It remains optimistic about the growth of digital sales in international markets, backed by various service modes.

Image Source: Zacks Investment Research

Concerns

The rise in labor and commodity costs continues to hurt the company. It has been witnessing labor challenges in a handful of markets. In third-quarter 2023, total costs of sales came in at $630 million, up 2.4% from $615 million reported in the prior-year quarter. The upside was mainly driven by an increase in commodity, labor and energy costs. The company remains cautious in this regard as further increases in inflation could result in foreign exchange volatility and rising interest rates, thereby adversely affecting the business and result of operations.

Key Picks

Some better-ranked stocks from the Zacks Retail-Wholesale sector are:

Brinker International, Inc. EAT currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 223.6%, on average. The stock has gained 15.8% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for EAT’s 2024 sales and earnings per share (EPS) suggests a rise of 5.1% and 26.2%, respectively, from the year-ago period’s levels.

Abercrombie & Fitch Co. ANF flaunts a Zacks Rank #1 at present. It has a trailing four-quarter earnings surprise of 713%, on average. Shares of ANF have surged 253.1% in the past year.

The Zacks Consensus Estimate for ANF’s 2023 sales and EPS suggests increases of 12.8% and 2,088%, respectively, from the year-ago period’s levels.

Beacon Roofing Supply, Inc. BECN carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 11.1%, on average. Shares of BECN have gained 37.2% in the past year.

The Zacks Consensus Estimate for BECN’s 2023 sales and EPS indicates 7.2% and 8.2% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report