Why Investors Shouldn't Be Surprised By Alphatec Holdings, Inc.'s (NASDAQ:ATEC) P/S

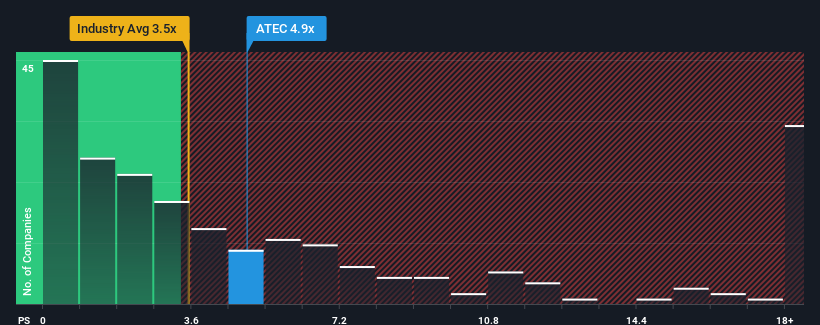

You may think that with a price-to-sales (or "P/S") ratio of 4.9x Alphatec Holdings, Inc. (NASDAQ:ATEC) is a stock to potentially avoid, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios under 3.5x and even P/S lower than 1.5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Alphatec Holdings

How Alphatec Holdings Has Been Performing

Recent times have been advantageous for Alphatec Holdings as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alphatec Holdings.

How Is Alphatec Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Alphatec Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 44% last year. Pleasingly, revenue has also lifted 209% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 22% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 8.9% per year, which is noticeably less attractive.

In light of this, it's understandable that Alphatec Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Alphatec Holdings' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Alphatec Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 5 warning signs for Alphatec Holdings (1 makes us a bit uncomfortable!) that you need to take into consideration.

If you're unsure about the strength of Alphatec Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here