Why Investors Shouldn't Be Surprised By Arcturus Therapeutics Holdings Inc.'s (NASDAQ:ARCT) 79% Share Price Surge

Arcturus Therapeutics Holdings Inc. (NASDAQ:ARCT) shares have had a really impressive month, gaining 79% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 9.2% isn't as impressive.

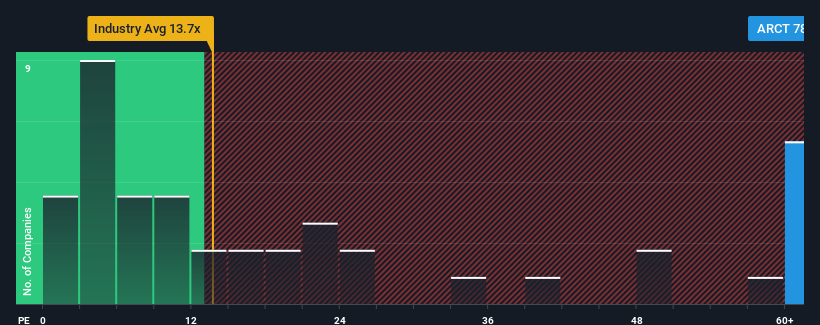

Following the firm bounce in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 15x, you may consider Arcturus Therapeutics Holdings as a stock to avoid entirely with its 78.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Arcturus Therapeutics Holdings could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Arcturus Therapeutics Holdings

Keen to find out how analysts think Arcturus Therapeutics Holdings' future stacks up against the industry? In that case, our free report is a great place to start.

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Arcturus Therapeutics Holdings' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Looking ahead now, EPS is anticipated to climb by 162% per annum during the coming three years according to the eight analysts following the company. With the market only predicted to deliver 9.8% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Arcturus Therapeutics Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Arcturus Therapeutics Holdings' P/E

The strong share price surge has got Arcturus Therapeutics Holdings' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Arcturus Therapeutics Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Arcturus Therapeutics Holdings that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here