Why Investors Shouldn't Be Surprised By Caspian Sunrise plc's (LON:CASP) 26% Share Price Plunge

Unfortunately for some shareholders, the Caspian Sunrise plc (LON:CASP) share price has dived 26% in the last thirty days, prolonging recent pain. Longer-term shareholders would now have taken a real hit with the stock declining 6.2% in the last year.

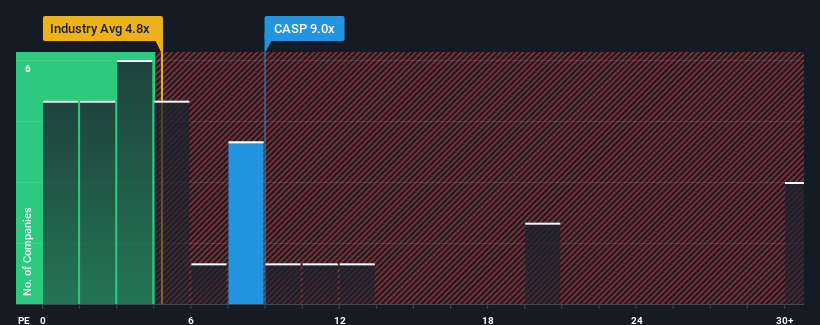

Although its price has dipped substantially, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Caspian Sunrise as an attractive investment with its 9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, Caspian Sunrise's earnings have been unimpressive. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Caspian Sunrise

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Caspian Sunrise will help you shine a light on its historical performance.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Caspian Sunrise's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Comparing that to the market, which is predicted to deliver 9.2% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Caspian Sunrise's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

The softening of Caspian Sunrise's shares means its P/E is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Caspian Sunrise revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Caspian Sunrise (of which 1 can't be ignored!) you should know about.

Of course, you might also be able to find a better stock than Caspian Sunrise. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.