Why iQIYI Inc's Stock Skyrocketed 31% in a Quarter: A Deep Dive

China's online entertainment service provider, iQIYI Inc (NASDAQ:IQ), has seen a significant surge in its stock price over the past quarter. With a current market cap of $5.2 billion and a stock price of $5.44, the company's shares have gained 18.25% over the past week and a whopping 30.98% over the past three months. This article aims to delve into the factors contributing to this impressive performance and provide an in-depth analysis of the company's financial health and future prospects.

Stock Performance and Valuation

One of the key indicators of a stock's value is the GF Value. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, iQIYI's GF Value stands at $6.12, indicating that the stock is 'Modestly Undervalued'. This is a significant improvement from three months ago when the GF Value was $6.92, and the stock was considered a 'Possible Value Trap, Think Twice'.

Company Overview

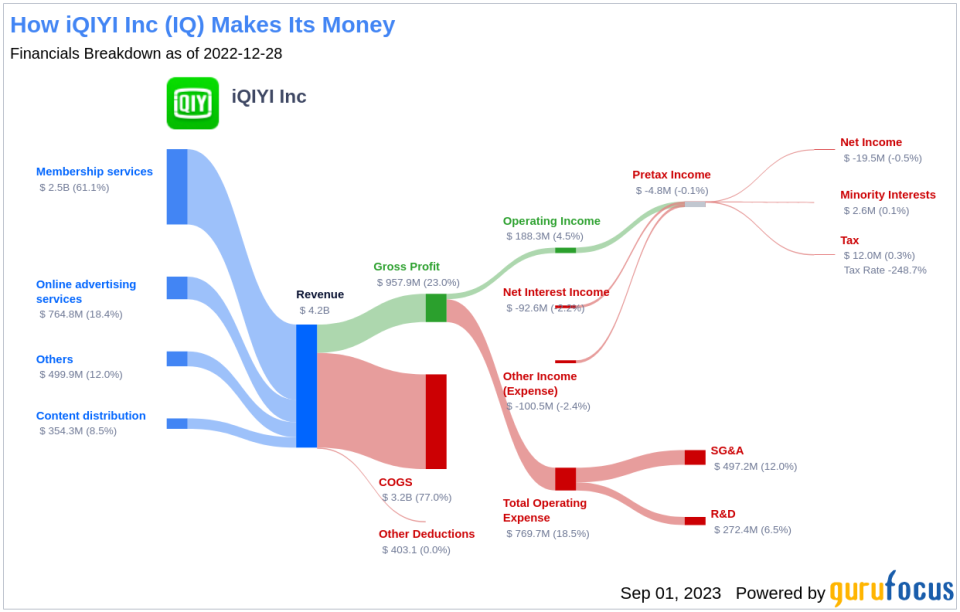

iQIYI Inc is a diversified media company based in China. It offers a variety of services including internet video, live broadcasting, online games, online literature, animations, e-commerce, and social media platform. The company generates most of its revenue from membership services and online advertising services, primarily within China.

Profitability Analysis

According to the Profitability Rank of 3/10, iQIYI's profitability is relatively low within its industry. However, the company's operating margin of 8.22% is better than 66.08% of the companies in the industry. Similarly, the company's ROE of 11.39%, ROA of 1.96%, and ROIC of 5.05% are better than 75.52%, 56.58%, and 62.77% of the companies in the industry, respectively.

Growth Prospects

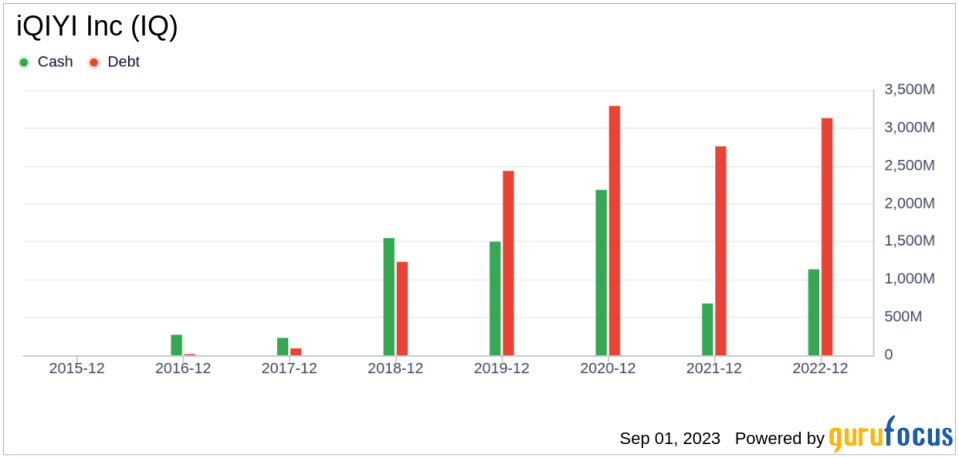

iQIYI's Growth Rank of 6/10 indicates a relatively high growth within its industry. The company's 3-year and 5-year revenue growth rates per share are -5.00% and 3.40% respectively, which are better than 36.22% and 65.09% of the companies in the industry. The company's future total revenue growth rate estimate is 1.70%, which is better than 26.06% of the companies in the industry. Furthermore, the company's 3-year and 5-year EPS without NRI growth rates are 78.50% and 46.20% respectively, which are better than 93.55% and 89.27% of the companies in the industry. The future EPS without NRI growth rate estimate is 32.00%, which is better than 85.29% of the companies in the industry.

Major Shareholders

The top three holders of iQIYI's stock are Jim Simons (Trades, Portfolio) with a 1.22% share, Sarah Ketterer (Trades, Portfolio) with a 0.26% share, and Chris Davis (Trades, Portfolio) with a 0.15% share.

Competitive Landscape

iQIYI operates in a highly competitive industry with major players like CarGurus Inc (NASDAQ:CARG) with a market cap of $2.09 billion, JOYY Inc (NASDAQ:YY) with a market cap of $2.16 billion, and Angi Inc (NASDAQ:ANGI) with a market cap of $1.27 billion.

Conclusion

In conclusion, iQIYI Inc's impressive stock performance can be attributed to its robust growth prospects, improved profitability, and undervalued status. However, the company operates in a highly competitive industry and must continue to innovate and expand its services to maintain its growth trajectory. Investors should keep a close eye on this stock and consider its potential for future growth.

This article first appeared on GuruFocus.