Why Kratos Defense & Security Solutions Inc's Stock Skyrocketed 11% in a Quarter: A Deep Dive

Over the past week, Kratos Defense & Security Solutions Inc (NASDAQ:KTOS) has seen a modest gain of 0.60% in its stock price, bringing it to $15.91. This gain is part of a larger trend, with the stock price having risen by 11.02% over the past three months. The company's market cap currently stands at $2.05 billion. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The GF Value of KTOS is $22.4, indicating that the stock is modestly undervalued. This is a significant improvement from three months ago when the GF Value was $21.95, and the stock was considered a possible value trap.

Company Overview: Kratos Defense & Security Solutions Inc

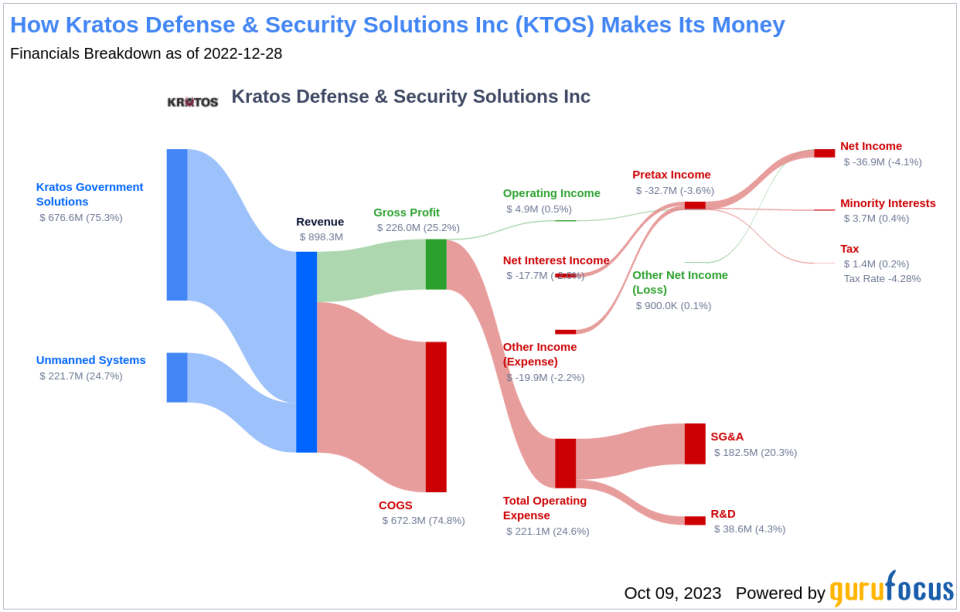

Kratos Defense & Security Solutions Inc operates in the Aerospace & Defense industry. The company develops and fields transformative, affordable technology, platforms, and systems. It operates through two segments: The Kratos Government Solutions (KGS) and The Unmanned Systems. The KGS segment includes microwave electronic products, space, training, and cybersecurity, C5ISR/modular systems, turbine technologies, and defense and rocket support services. The Unmanned Systems segment consists of unmanned aerial, unmanned ground, unmanned seaborne, and related command, control, and communications system businesses. The majority of the company's revenue comes from the Kratos Government Solutions segment.

Profitability Analysis

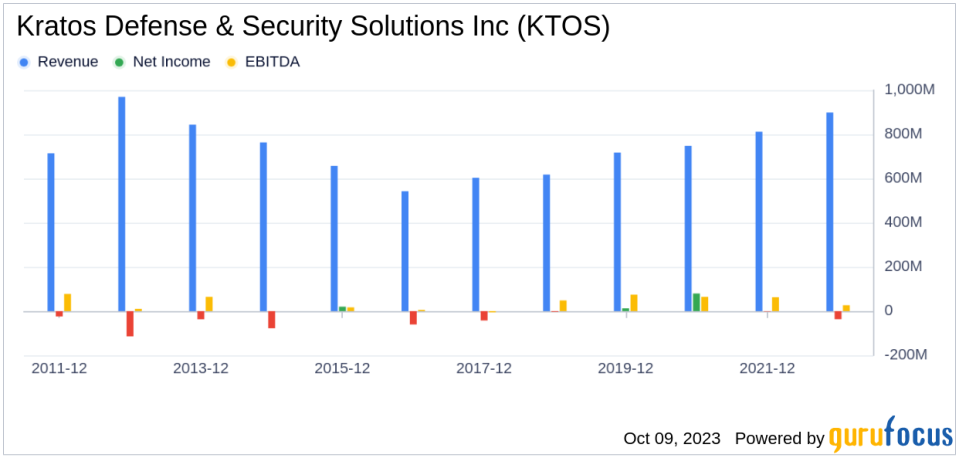

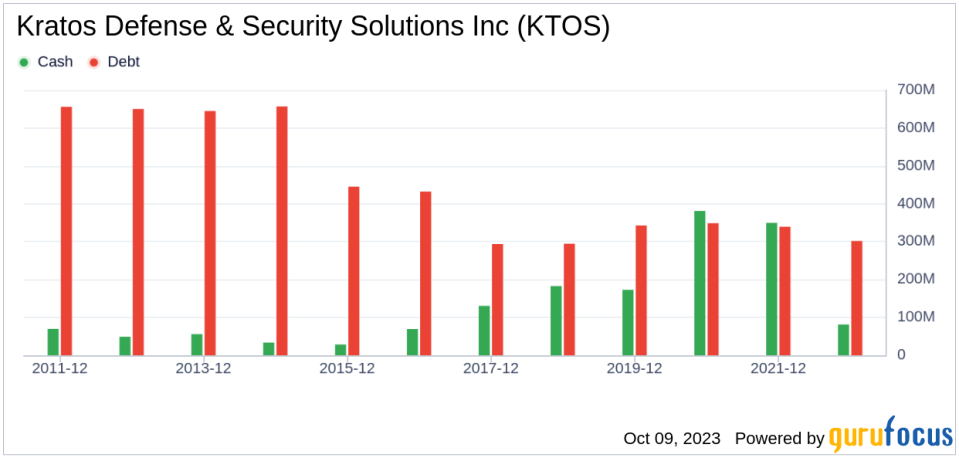

As of June 30, 2023, Kratos Defense & Security Solutions Inc has a Profitability Rank of 4/10. The company's Operating Margin is 0.98%, which is better than 35.03% of the companies in the industry. The company's ROE is -2.77%, better than 28.37% of the companies in the industry. The ROA is -1.66%, better than 29.8% of the companies in the industry. The ROIC is 1.20%, better than 40.07% of the companies in the industry. Over the past decade, the company has had 3 years of profitability, which is better than 14.5% of the companies in the industry.

Growth Prospects

Kratos Defense & Security Solutions Inc has a Growth Rank of 3/10. The company's 3-Year Revenue Growth Rate per Share is 2.60%, which is better than 50% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 1.30%, which is better than 44.87% of the companies in the industry. The company's future total revenue growth rate estimate over the next 3 to 5 years is 8.94%, which is better than 63.33% of the companies in the industry.

Major Holders

The top three holders of Kratos Defense & Security Solutions Inc's stock are Catherine Wood (Trades, Portfolio), who holds 7,278,529 shares (5.7% of the total shares), Ron Baron (Trades, Portfolio), who holds 4,558,203 shares (3.56% of the total shares), and Chuck Royce (Trades, Portfolio), who holds 541,300 shares (0.42% of the total shares).

Competitors

Kratos Defense & Security Solutions Inc faces competition from several companies in the Aerospace & Defense industry. The top three competitors are Spirit AeroSystems Holdings Inc(NYSE:SPR) with a market cap of $1.78 billion, AAR Corp(NYSE:AIR) with a market cap of $2.11 billion, and V2X Inc(NYSE:VVX) with a market cap of $1.66 billion.

Conclusion

In conclusion, Kratos Defense & Security Solutions Inc has shown promising growth and profitability over the past quarter. The company's stock price has risen by 11.02% over the past three months, and its GF Value indicates that the stock is modestly undervalued. The company's profitability and growth ranks, along with its operating margin, ROE, ROA, and ROIC, suggest that it is performing well compared to its industry peers. The company's future growth prospects also look promising, with a high future total revenue growth rate estimate. However, the company faces competition from several other companies in the industry. Despite this, the company's strong performance and promising future prospects make it a potentially attractive investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.