Why Lincoln National Remains One of My Higher Convictions

In my work, both professionally and as a freelancer, I make a career out of covering a number of sectors - but the insurance service sector is a key one. With profitable trades in companies like Unum (NYSE:UNM), Allianz and Munich Re in the past, I mean Lincoln National Corp. (NYSE:LNC) to be the most recent with a triple-digit or near-triple-digit rate of return.

Lincoln National is an insurance business with a nearly $5 billion market cap even at today's valuation, that's gone through a substantial revaluation due to non-trivial changes in its universal life insurance lapse assumptions. This, in turn, led to the company declining similar to, but worse than other insurance companies going through similar things - and since then, the company has traded at trough levels between $20 and $25 per share.

However, the company, at normalization, has the potential to outperform at triple digits over time.

Operations and financials

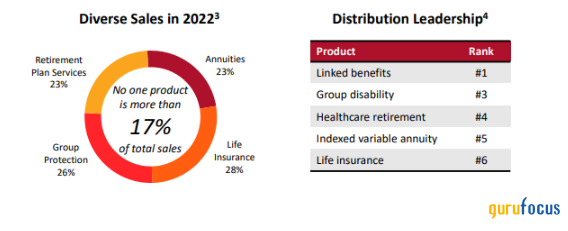

Lincoln National is a national insurance player with a distribution franchise in four business segments, encompassing Group Protection, Life Insurance, Annuities and Retirement plan services.

The company has a nationwide leadership in linked benefits and is among the market leaders in several key fields - with a very attractive overall sales mix.

Even following the latest two years of trouble, the company remains BBB+ rated and its dividend of $1.8 remains well-covered by the normalized earnings per share, coming to a current yield of 6.31% at the time of writing.

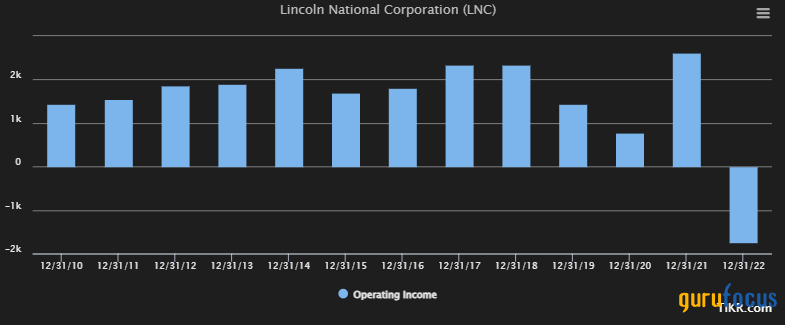

Lincoln National is a life and health insurer that, over time, trades in a volatile manner. By that, I mean it is not unusual for the company to see one to two years of low multiples, followed by the company trading at close to 10 times normalized price-earnings for a few years - or even above that. While the valuation trends have been volatile, I find it important to point out the actual underlying earnings trends have, for the most part, not been reflective of what's going on with the share price.

With the exception of the period going into Covid-19 and beyond, you will note the company has always provided a certain level of operating income, though the share price development over the same time would have you believe operations were far more volatile.

As an analyst covering the insurance space, I was not surprised by the fact the company turned south after reporting this re-evaluation. I also maintain a stance I formed fairly when the company dipped below $40 per share, and that stance is that the market is overreacting.

The result of the company's assumption update was the 22-point impact for what in industry vernacular is known as the RBC, or risk-based capital ratio, over time. Typically, you're looking at a 400% ratio target or above here in this industry - with a sub-200% RBC ratio typically necessitating regulatory intervention. Once the ratio dips below 70% (which differs somewhat from locale to locale), regulators are obliged to take over the company entirely.

So when I tell you that Lincoln, from a 2018 RBC ratio of 452% declined to a 377% RBC ratio in 2022, that is not a small thing - but neither is it something that spells doom for the company, provided that the company turns this around again.

And turning this around is exactly what it spent much of 2023 doing. Early work included the raising of over $1 billion of preferred stock, capital efficiency plans, a new variable annuity hedge strategy, tactical hedges on VUL in-force (those are variable universal life insurance policies), working to enhance the profitability of group protection, but also monetizing assets wherever possible and profitable to get back to somewhere positive.

I want to mention at this point that based on the company's current structure, there are no liquidity or cash issues based on the holding company's excessive liquidity available here - that's also why the company, while getting its A-rating cut, still is above a BBB and why I do not see it going lower than the BBB+.

Because all recent signs point to this turning around.

What signs?

Well, the company managed to sign a $28 billion reinsurance deal back in May of 2023, which included it ceding $28 billion of, among other things, fixed annuity statutory reserves to Fortitude Re, and having the result of substantially improving its RBC as well as being accretive to company free cash flow - around 15% for the RBC side and $100 million for the free cash flow annually. In December, the company also sold its wealth management unit to Osaic - a small transaction, but an important one, expected to generate upwards of $700 million worth of capital with Linconln retaining all current aspects of Lincoln Financial Distributors.

So the company is pulling what levers it can, and it is working, albeit slowly.

If there is one quality I find that many investors today lack, it is the patience to see the materialization of solid long-term upside. The company's earnings troughed during 2022, seeing Lincoln National manage a negative GAAP earnings of below $10 per share - but current estimates are for that to turn around, and in a very big way. Here are the current S&P global estimates for where company's GAAP earnings per share is forecasted to go for the next three years.

Note that each of those income levels by far covers the current dividend of $1.80, and quickly would result in once again enabling a raising of this, should the company choose to do so.

However, most importantly, is what the materialization of such a massive GAAP earnings per share reversal would do to the current valuations - because valuation is the primary thing, beyond quality, that I look at.

Valuation upside and risks

Lincoln National currently trades at a normalized price-earning ratio of around 5.30 based on earnings per share of around $5.30. If you want to use GAAP assumptions, it can be said to trade at around a price-earnings ratio of 8.1 for the 2023 estimated period.

I view this as being cheap for two reasons. First, I expect the company to substantially improve this because it is capable of being far higher. Between $5 and $8 is far more likely. At the current share price, it might trade fairly if we look at a 20-year average to the GAAP, but unless you believe the estimated 2023 GAAP level is not subject to change in 2024, then this is a BBB+-rated company you should pay attention to.

Expecting the company to normalize to around an 8 to 9 times range for earnings per share in the next two to three years would entail an upward move to a share price of between $60 and $70, given that current forecasts are for the company to manage $7 per-share earnings (adjusted) in 2024 and $7 to $8 per share price-earnings ratio in 2025-26.

Such a development from this share price would come at the potential for a rate of return of 100%-plus in the shorter term and over 33% annualized on a two to three-year basis. We can also look at the GuruFocus targets for the company where they come in. Currently, a projected free cash flow gives us a price target of over $56 oer share, with a median price-share value touching on the $70 level.

While the company is showing declining revenue, this is natural given it is divesting operations and reorganizing. Lincoln National is also assessed as a high-risk potential, but I would argue the fundamental risk to the company's operations or safety is overstated by the market here.

All insurance companies come at a certain degree of operational risk. However, the degree of punishment the company has taken by the market here is disproportionate to where it sees the long-term earnings potential of its continuing operations. The market is ignoring growth in sales in two retail business lines going into 2024 and also ignoring that the company is still, after almost five months, expecting the same sort of advantages from the reinsurance deal, which will see the company's RBC modestly going back up toward the 400% level. The RBC is going to, I expect, stay close to or around that 400% level for the foreseeable future. I do not see it moving back up to the 2018 level anytime soon.

Also, Lincoln National still, as of the latest quarter, has no sort of liquidity or leverage issues - and continues to pay the dividend of $1.80, which puts this, in my view, as one of the better BBB+-rated, 6%-plus yields in this field.

My targets and expectations

The company's operations in annuities, life insurance, group protection and retirement services are all attractive, providing solid earnings despite underlying equity markets. Take the retirement plan services segment, for instance, providing eight consecutive years of positive net flows with continued good trends into 2023 as well. These positive business line trends coupled with Lincoln National's operational track record of lowering costs as well as its fundamentals and forecasts is what gives me a high conviction in my investing here.

I give the company an impacted target of at least $45 per share, which corresponds at the very least to a 2024 estimated price-earnings ratio of 6.30 based on an earnings per share expectation of around $7 on an adjusted basis. This would mark an upside of 60% for the year period and, in the longer term in 2026, an estimated annualized rate of return of over 20%.

My personal investment target is that each investment I make should bring about a conservatively adjusted upside of over 15% inclusive of dividends, meaning the company should manage this even if it does worse than the markets, the forecasts or the historical valuation levels suggest.

That is why I forecast Lincoln National at $45 per share, instead of going to $55 to $60 per share. I fully expect the company to be able or capable of managing higher, but I'm more comfortable expecting less - though still market-beating.

I view Lincoln National as a deeply misunderstood and misvalued equity at this time, much as with happened with Unum Group back in 2020. I bought a significant stake in Unum at that time at less than $12 per share and was able to rotate this at over $43 per share less than two years later. I do not expect Lincoln National to manage the same sort of movement - the issues here are deeper, and Unum never saw the sort of earnings or RBC impact that Lincoln is seeing - but the underlying trends are quite the same, as I see them.

It is for that reason that Lincoln National is my current first-tier pick in the NA insurance space, specifically in the life and health space, and why I maintain a considerable portfolio position in the common stock.

This article first appeared on GuruFocus.