Why MakeMyTrip Ltd's Stock Skyrocketed 50% in a Quarter: A Deep Dive

MakeMyTrip Ltd (NASDAQ:MMYT) has seen a significant surge in its stock price over the past three months. The company's market cap stands at $4.18 billion, with a current stock price of $39.37. Over the past week, the stock price has seen a gain of 2.68%, and over the past three months, it has seen a remarkable gain of 49.71%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of MMYT is $55.58, indicating that the stock is modestly undervalued. This is a significant improvement from three months ago when the GF Value was $43.5, and the stock was considered a possible value trap.

Company Overview

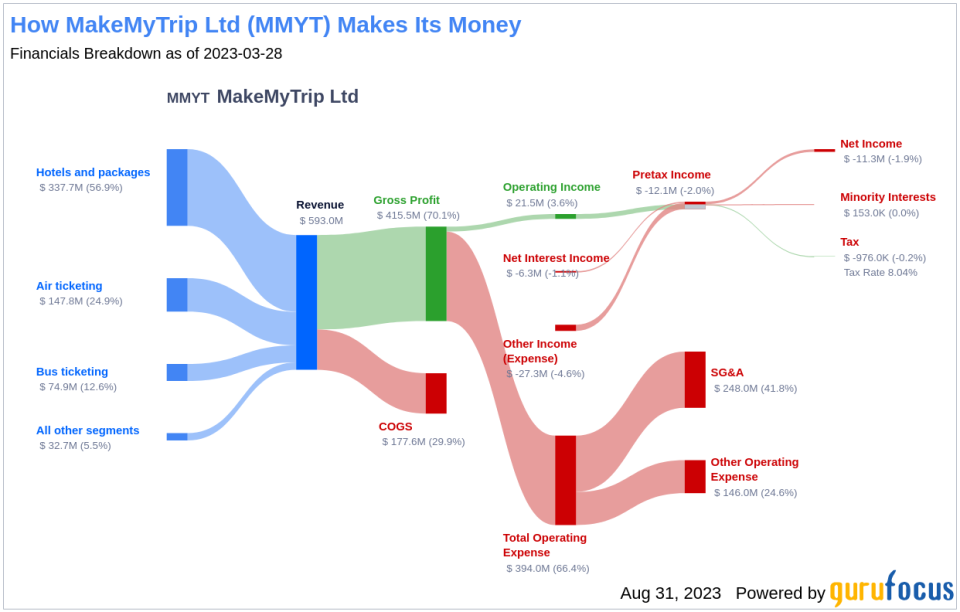

MakeMyTrip Ltd operates in the Travel & Leisure industry. It is an online travel company that provides online booking solutions for day-to-day travel needs. The company's operating segments include Air ticketing, Hotels and packages, Bus ticketing, and Others. The majority of its revenue comes from the Hotels and packages segment, which includes internet-based platforms, call-centers, and branch offices that provide holiday packages and hotel reservations. The company primarily operates in India but also has a presence in the United States, South East Asia, Europe, and other countries.

Profitability Analysis

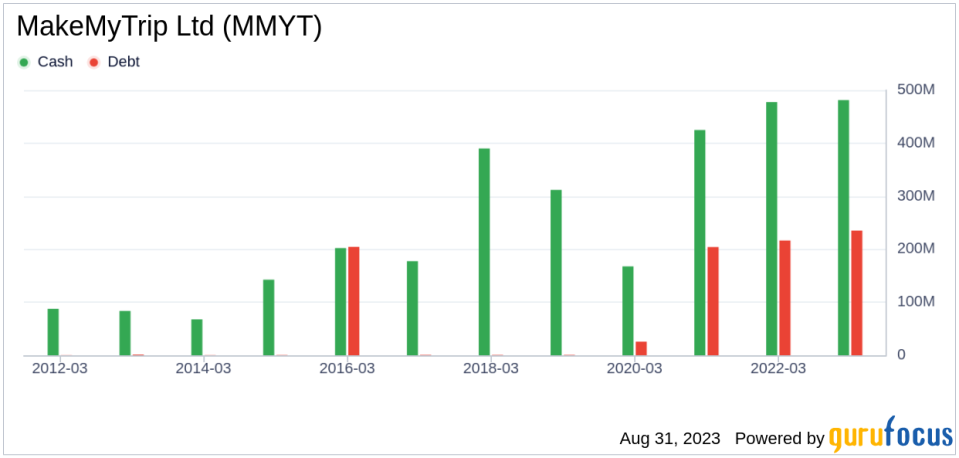

MakeMyTrip Ltd's Profitability Rank is 2/10, indicating that the company's profitability is relatively low compared to its industry peers. The company's Operating Margin is 5.61%, which is better than 47.57% of the companies in the industry. The ROE is 1.99%, better than 44.21% of the companies in the industry, and the ROA is 1.28%, better than 49.7% of the companies in the industry. The ROIC is 4.13%, better than 60.62% of the companies in the industry.

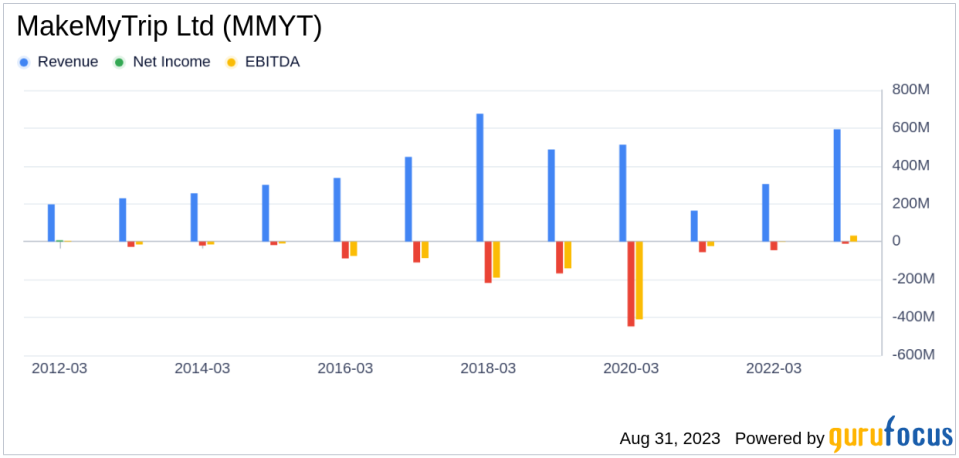

Growth Prospects

The company's Growth Rank is 2/10, indicating that its growth is relatively low compared to its industry peers. The 3-Year Revenue Growth Rate per Share is 3.60%, better than 63.15% of the companies in the industry. However, the 5-Year Revenue Growth Rate per Share is -10.20%, better than only 37.71% of the companies in the industry. The 3-Year EPS without NRI Growth Rate is 71.40%, better than 92.19% of the companies in the industry, and the 5-Year EPS without NRI Growth Rate is 46.00%, better than 91.82% of the companies in the industry.

Top Holders

The top three holders of MakeMyTrip Ltd stock are Baillie Gifford (Trades, Portfolio), Sarah Ketterer (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio). Baillie Gifford (Trades, Portfolio) holds 2,265,374 shares, representing 2.13% of the total shares. Sarah Ketterer (Trades, Portfolio) holds 218,869 shares, representing 0.21% of the total shares. Paul Tudor Jones (Trades, Portfolio) holds 97,766 shares, representing 0.09% of the total shares.

Competitors

The top three competitors of MakeMyTrip Ltd are TripAdvisor Inc(NASDAQ:TRIP) with a stock market cap of $2.09 billion, Sabre Corp(NASDAQ:SABR) with a stock market cap of $1.69 billion, and Travel+Leisure Co(NYSE:TNL) with a stock market cap of $3.02 billion.

Conclusion

In conclusion, MakeMyTrip Ltd has seen a significant surge in its stock price over the past three months. The company's profitability and growth ranks are relatively low compared to its industry peers, but it has shown significant improvement in its GF Value. The company's top holders and competitors also provide a comprehensive view of its position in the market. Based on the analyzed data, MakeMyTrip Ltd presents a potential investment opportunity, but investors should conduct further research and consider the company's profitability and growth prospects before making an investment decision.

This article first appeared on GuruFocus.