Why MakeMyTrip Ltd's Stock Skyrocketed 55% in a Quarter

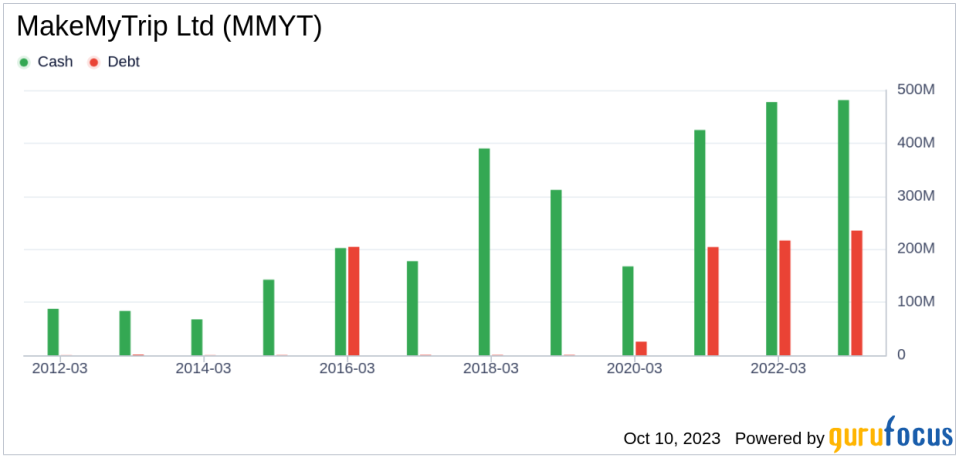

MakeMyTrip Ltd (NASDAQ:MMYT) has seen a significant surge in its stock price over the past three months. The company's market cap stands at $4.46 billion, with its stock price currently at $42.05. Over the past week, the stock price has seen a gain of 6.32%, and over the past three months, it has skyrocketed by 55.22%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of MMYT is $55.8, compared to $51.3 three months ago. This indicates that the stock is modestly undervalued, a significant improvement from being a possible value trap three months ago.

Company Overview: MakeMyTrip Ltd (NASDAQ:MMYT)

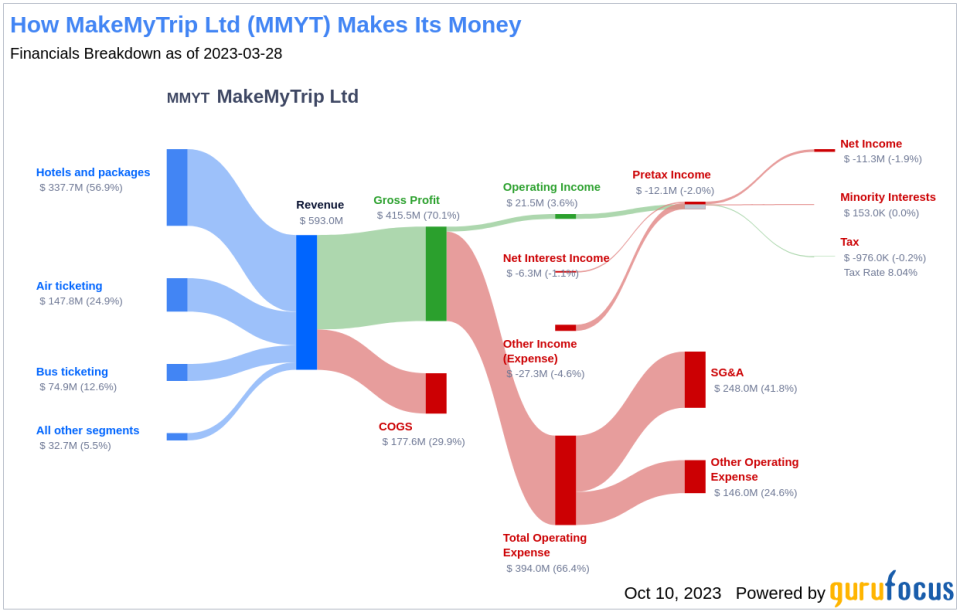

MakeMyTrip Ltd is an online travel company operating in the Travel & Leisure industry. The company provides online booking solutions for day-to-day travel needs. Its operating segments include Air ticketing, Hotels and packages, Bus ticketing, and Others. The majority of its revenue is generated from the Hotels and packages segment, which includes internet-based platforms, call-centers, and branch offices that provide holiday packages and hotel reservations. The Air ticketing segment, which includes internet-based platforms, provides the facility to book domestic and international air tickets. The company primarily operates in India but also has a presence in the United States, South East Asia, Europe, and other countries.

Profitability Analysis

MakeMyTrip Ltd's Profitability Rank stands at 2/10 as of June 30, 2023. The company's Operating Margin is 5.61%, better than 45.99% of 811 companies in the same industry. Its ROE is 1.99%, better than 42.08% of 789 companies, and its ROA is 1.28%, better than 47.41% of 831 companies. The company's ROIC is 4.13%, better than 59.56% of 826 companies.

Growth Prospects

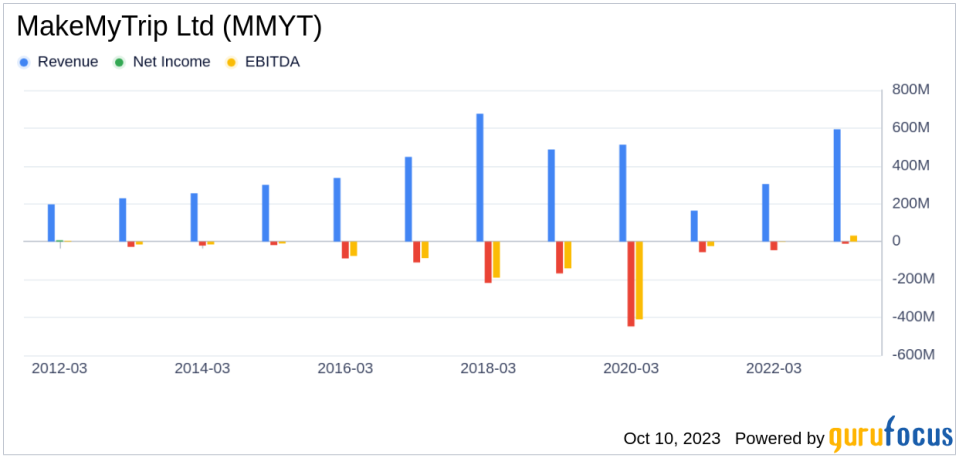

MakeMyTrip Ltd's Growth Rank is 2/10 as of today. The company's 3-Year Revenue Growth Rate per Share is 3.60%, better than 62.4% of 758 companies. However, its 5-Year Revenue Growth Rate per Share is -10.20%, better than only 37.45% of 713 companies. The company's 3-Year EPS without NRI Growth Rate is 71.40%, better than 91.91% of 507 companies, and its 5-Year EPS without NRI Growth Rate is 46.00%, better than 90.5% of 221 companies.

Top Holders of MakeMyTrip Ltd (NASDAQ:MMYT) Stock

The top three holders of MakeMyTrip Ltd (NASDAQ:MMYT) stock are Baillie Gifford (Trades, Portfolio), Sarah Ketterer (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio). Baillie Gifford (Trades, Portfolio) holds 2,265,374 shares, representing 2.13% of the total shares. Sarah Ketterer (Trades, Portfolio) holds 218,869 shares, representing 0.21% of the total shares. Paul Tudor Jones (Trades, Portfolio) holds 97,766 shares, representing 0.09% of the total shares.

Competitors Analysis

The top three competitors of MakeMyTrip Ltd (NASDAQ:MMYT) are TripAdvisor Inc(NASDAQ:TRIP) with a stock market cap of $2.18 billion, Sabre Corp(NASDAQ:SABR) with a stock market cap of $1.31 billion, and Travel+Leisure Co(NYSE:TNL) with a stock market cap of $2.59 billion.

Conclusion

In conclusion, MakeMyTrip Ltd (NASDAQ:MMYT) has shown a significant surge in its stock price over the past three months. The company's profitability and growth ranks are low, but it has shown improvement in its operating margin, ROE, ROA, and ROIC. The company's top holders and competitors also provide a comprehensive view of its position in the market. Despite the challenges, the company's stock is currently modestly undervalued, indicating potential for further growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.