Why is Masco (MAS) Sinking Despite Solid Bottom-Line Prospect?

Masco Corporation MAS has been benefiting from strong pricing actions and operational efficiency to mitigate the impact of raw material inflation. Its market-leading brands, acquisition synergies and strong liquidity give it strength for solid growth potential in the long term.

Strong Bottom-Line Views for 2023 & Long-Term Prospects

Masco has undertaken cost-saving initiatives that target company-wide annual savings through reduction of corporate expenses and simplification of Masco’s organizational structure. It has also acquired various businesses to expand its diverse product portfolio.

Backed by strong execution in the first half of 2023, the company raised its adjusted earnings expectation to $3.50-$3.65 per share from a prior projection of $3.10-$3.40. The adjusted operating margin for the year is now projected to be 16% versus 15% expected earlier. It now anticipates an adjusted operating margin of 17% for both segments, up from 16% projected earlier.

On Jul 21, 2023, MAS entered into an agreement to acquire the entire share capital of Sauna360 Group Oy within its Plumbing Products segment. The product portfolio of Sauna360 includes traditional, infrared and wood-burning saunas, along with steam showers. The acquisition is expected to close in the third quarter of 2023, subject to customary closing adjustments.

The company has been witnessing strong demand for all its market-leading brands. The Behr brand is the number one brand in the do-it-yourself (DIY) market for architectural coatings. The PRO paint business continues to gain a significant share in the market. Impressively, PRO paint has a three-year run rate of approximately 70%.

Recently, Masco launched adjacent paint categories like aerosols, interior stains and caulks and sealants within PRO that added to the results in the first half of 2023 and are expected to continue to add benefits in 2023. The company plans to increase investments in people and capabilities in 2023.

Backed by these capabilities, MAS anticipates approximately 10% average annual EPS growth and 3-5% average annual sales growth organically in the long run. On the back of a strong balance sheet position, it plans to return shareholders 1-2% above EPS growth via dividends and 2-4% through repurchases.

Here’s Why the Stock is Sinking

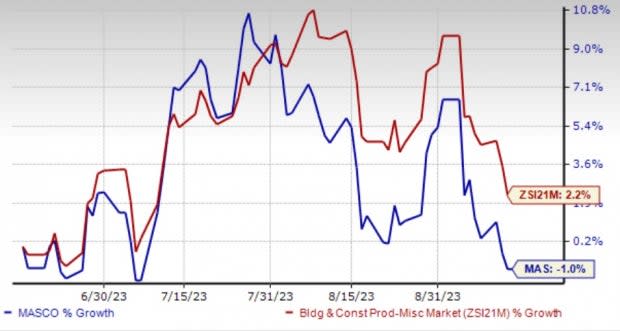

Despite the above-mentioned tailwinds, Masco’s shares plunged 1% in the past three months versus the Zacks Building Products – Miscellaneous industry’s 2.2% growth.

Image Source: Zacks Investment Research

Masco has witnessed a slowdown in demand for many of its products since the second quarter of 2022. This trend is likely to continue in the rest of 2023, thanks to higher interest rates, inflationary pressure and softness in housing.

Given housing delays and foreign currency headwinds, Masco expects sales to decline approximately 10%. The Plumbing segment’s sales are likely to decline year over year in the range of 10-12% compared with the prior expectation of 10-14%, including the impact of foreign currency. The Decorative Architectural segment’s sales are expected to fall year over year within the range of 8-10% compared with the previous expectation of 5-10%. Particularly within paint, DIY sales are likely to decrease in high-single-digits and PRO sales are expected to decline in mid-single-digits.

The overall industry has been witnessing intense inflationary pressure over the last few quarters. The current inflation pressure and shipping delays are concerning Masco. The company expects inflation to be in low single-digit for 2023, affecting its paint raw material basket.

Zacks Rank & Key Picks

MAS currently sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks carrying the same rank as MAS in the same space are:

Installed Building Products, Inc. IBP is a leading installer of insulation and complementary building products. It primarily banks on a robust pipeline of acquisition opportunities across multiple geographies, products and end markets.

Installed Building’s earnings for 2023 are expected to grow by 5%. The same has moved north to $9.40 per share from $8.68 per share over the past 60 days, reflecting analysts’ optimism for its growth potential.

Gibraltar Industries, Inc. ROCK manufactures and distributes products to the industrial and buildings market. The company is benefiting from material cost alignment, field operations efficiency, price management, business mix, 80/20 initiatives and the share repurchase program.

The Zacks Consensus Estimate for ROCK’s 2023 earnings has moved north to $3.97 per share from $3.76 in the past 30 days. ROCK’s expected earnings growth rate for 2023 is 16.8%.

TopBuild Corp. BLD is an installer and distributor of insulation and other building products to the U.S. construction industry. It benefits from strong demand, strategic acquisitions and a favorable mix of installation business.

BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates growth of 3.3% and 6.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report