Why Medtronic Is a Long-Term Winner

Shares of medical device company Medtronic PLC (NYSE:MDT) have fallen 8% year to date, but are down 23% over the last year.

Much of the recent decline can be attributed to the companys latest quarterly report, where supply chain constraints and scarcity of semiconductor chips were the primary headwinds.

Looking at the long term, Medtronic has performed quite well and has secured its spot as one of the best names in medical technology. The company also has an extremely long history of rewarding shareholders with dividend increases. The stock is trading at a significant discount to its intrinsic value as well.

Lets look closer at Medtronic to see why the company may represent a good opportunity for those investors looking for value and income.

Company background and results history

Medtronic produces more implantable biomedical devices than any other medical technology company in the world. The companys presence extends to more than 120 countries. Medtronic is composed of four business segments, including Cardiovascular, Medical Surgical, Neuroscience and Diabetes.

The company reported fourth-quarter and fiscal year 2022 earnings results on May 26. For the quarter, revenue fell 1.2% to $8.1 billion while adjusted earnings per share of $1.52 compared to $1.50 in the prior year. Revenue was $340 million below Wall Street analysts estimates, while adjusted earnings per share was 4 cents less than expected.

For the year, revenue grew 5% to $31.7 billion while adjusted earnings per share improved 26% to $5.62. Adjusted earnings per share came in 3 cents below the low end of company guidance given at the conclusion of the third quarter.

Organic revenue grew 1% during the fourth quarter as currency exchange negatively impacted results.

Cardiovascular grew 5% to $2.96 billion. Strength was seen in most areas of the segment, led by its Micra pacemaker and TYRX absorbable antibacterial envelopes. The structural heart and aortic business was the best performer, growing 8% year over year. Products remained in high demand even as supply chain issues impacted the aortic business. Catheters and stents helped coronary and peripheral vascular improve 4%.

Medical Surgical fell 1% to $2.23 billion. Surgical innovations was flat due to supply chain issues, specifically semiconductors, and Covid-19 related lockdowns in China. Respiratory, gastrointestinal and renal was lower by 4%. Excluding lower ventilator revenue, sales were flat. Monitoring systems grew at a high rate.

Neuroscience increased 2% to $2.30 billion. Spinal revenue matched the prior year, but gains in robotics and navigation and powered surgical instruments drove a mid-20% growth in neurosurgery. Specialty therapies was up 6%, primarily on stroke products.

Diabetes revenue declined 5% to $597 million. Lack of new product approvals compared to the prior year led to steep decreases in the U.S. business. This was only partially offset by strength in international markets, where durable insulin pumps, consumables, and continuous glucose monitoring products remain in high demand.

Medtronic provided guidance for the new fiscal year as well, with leadership expecting organic growth of 4% to 5%. Currency exchange is projected to be a significant hurdle in fiscal year 2023, with revenue likely to be impacted by at least $1 billion. Adjusted earnings per share are forecasted in a range of $5.53 to $5.65 for the year, which would be a marginal improvement from the prior year at the midpoint.

Takeaways

Medtronic experienced a somewhat mixed quarter. Revenue was down on a reported basis, but organic growth showed a slight tick higher. Adjusted net income was flat, while adjusted earnings per share benefited from a small decline in the average share count.

The company was facing a difficult comparable period. In the fourth quarter of 2021, revenue grew almost 37% and adjusted earnings per share nearly tripled as Medtronic saw higher demand following the postponement of procedures during the worst of the Covid-19 pandemic. Quarterly revenues are just about back to where they were prior to the pandemic, which should be viewed as a positive.

More worrisome are supply chain constraints. Covid-19 lockdowns in China were the primary cause of declines in several businesses as the government imposed restrictions on populations seeing outbreaks of the virus. This was particularly evident in the surgical innovations business, which was down a mid-teens percentage from the prior year due to a shortage of chips.

Future flareups of Covid-19 would likely result in similar restrictions, which could further impact the companys performance. On the other hand, easing of restrictions and an increase in semiconductors would be a tailwind to the company.

Inflationary pressure remains a challenge. The combination of an increase in transportation, labor and material costs is something that most companies are dealing with.

There are some positives going for Medtronic as the company continues to work to enhance its portfolio through innovation. The company conducted more than 300 clinical trials last fiscal year and received more than 200 approvals from regulatory bodies in the U.S., Europe, China and Japan. The companys pipeline has proven successful over the long term, with many products becoming the industry standard.

For example, Medtronics leadless pacemaker unit continues to see strong uptake rates, led by the companys Micra device. This product can be implanted right into the heart and was one of the best performers for the company, producing revenue growth in the low 20% range during the fourth quarter. Micra was approved for use in Japan and China last quarter, with the company expecting the product to see ongoing strength as it receives future regulatory approvals.

Medtronics Prescence in emerging markets should be a tailwind to future results. This is important as the U.S. counted for 51% of quarterly revenue, but saw a 2% decline. Developed markets outside of the U.S. improved 4%. Emerging markets, representing 17% of total revenue, decreased 10% organically. Excluding China, emerging markets were up 20% from the prior year. An easing of lockdowns in China would go a long way in returning one of Medtronics most important regions back to growth.

The positives that Medtronic has going for it should outweigh short-term issues, paving the way for a business model that continues to reward shareholders.

Dividend and valuation analysis

On May 25, Medtronic announced it is raising its dividend by 8% for the July 15 payment. The companys dividend growth steak now extends to 45 years, which more than earns it the title of Dividend Aristocrat.

According to Value Line, the dividend has compounded at a rate of 10.3% over the past decade, so the most recent raise is within striking distance of the typical increase.

Using the new annualized dividend of $2.72 and the midpoint for guidance for the fiscal year, Medtronic has a projected payout ratio of 49%. This is above the 10-year average payout ratio of 38%, but not to a level where a dividend cut looks remotely imminent.

Shares of Medtronic have an average yield of 2.1% since 2012. Following the decrease in share price, the stock now yields 2.9%. This is one of the highest yields shareholders have seen in the last 15 years.

Following the sell-off in the stock, Medtronic is now trading a much more attractive valuation. Shares traded with an average price-earnings ratio of 18 for the past decade. Using the current share price of $95, Medtronic has a forward price-earnings ratio of 17.

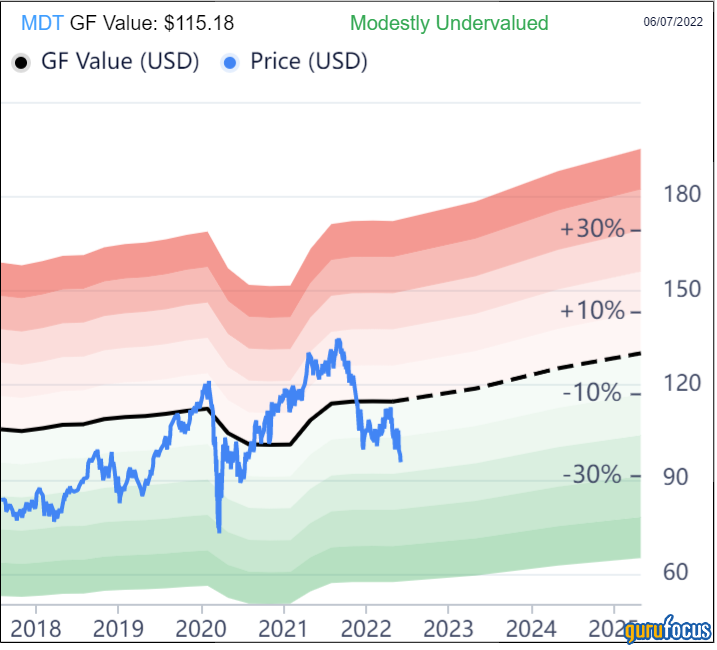

The GF Value chart shows the stock to be trading at a discount to its intrinsic value and rates Medtronic as modestly undervalued.

With a GF Value of $115.18, Medtronic has a price-to-GF Value of 0.82. Reaching the GF Value would result in a gain of 21%.

Final thoughts

Medtronic is not without its challenges, namely supply chain constraints and inflationary pressures. The company does maintain a leadership position in its industry, driven by innovative medical technology that is in high demand.

The company has a lot to offer investors beyond its business model as it operates in a fairly recession-resistant industry, is paying a much higher yield than usual, has a very long dividend growth streak and trades at a sizeable discount to its intrinsic valuation. This suggests Medtronic could be a good opportunity for investors looking beyond issues impacting the company in the near term.

This article first appeared on GuruFocus.