Why Momo Stock Jumped 29.9% in June

What happened

Shares of Momo (NASDAQ: MOMO) gained 29.9% last month, according to data from S&P Global Market Intelligence. There wasn't much in the way of fresh news for the Chinese online dating and social media company in June, but its stock got a delayed boost following better-than-expected earnings results in the prior month.

Momo posted first-quarter earnings results at the end of May, and its stock saw market- and industry-beating momentum in June as Chinese technology stocks rallied. Shares of the Invesco China Technology ETF (which is a good proxy for the country's tech sector) climbed roughly 13% in the month, and Momo got belated credit for its encouraging earnings results as investors warmed to Chinese tech and social media stocks.

Image source: Getty Images.

So what

Sales for Momo's March quarter rose roughly 35% year over year, continuing a trend of decelerating revenue growth but still representing encouraging performance. The company's net income for the period did drop substantially -- falling roughly 65% on a local-currency basis and converting to a profit of $43.1 million, but much of that stemmed from performance-related, stock-based compensation (totaling $69.6 million) paid to the owners of TanTan -- a Chinese dating social media site that Momo acquired in 2018. Total paying users for the Momo app rose roughly 11% year over year in the quarter, to hit 9 million users. Including contribution from TanTan (and not counting users who are on both services), the company's total unique user base climbed to 14 million members.

Momo stock did gain ground following its earnings release on May 28, but gave up much of it in the next couple days of trading. With investors moving back into Chinese tech stocks, it looks like Momo benefited from a more bullish reappraisal of its first-quarter performance.

Now what

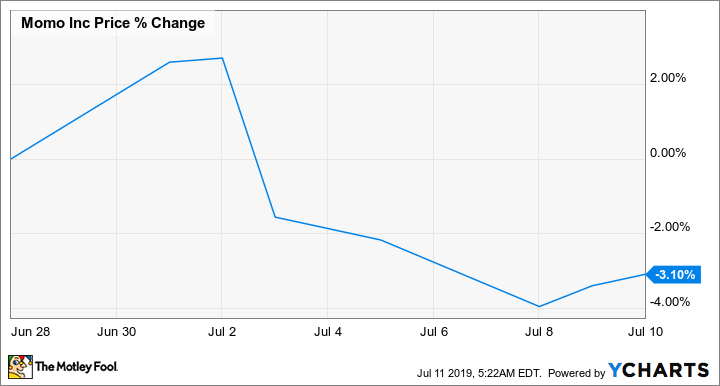

After big gains in June, Momo stock has slipped a bit this month. Shares are down roughly 3% in July's trading so far.

Momo has a leading position in China's online dating market, and strong engagement for its video-based service suggest that the company could still have a long runway for growth if it can successfully navigate regulatory challenges in the Chinese market.

Momo stock trades at roughly 12.5 times this year's expected earnings.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool recommends Momo. The Motley Fool has a disclosure policy.