Why You Must Add Strategic Education (STRA) Stock to Portfolio

Strategic Education, Inc. STRA has been benefiting from strong enrollment trends, favorable pricing and innovative programs.

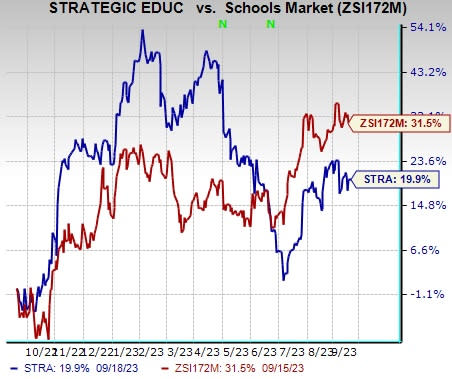

Shares of STRA have gained 19.9% in the past year, compared with the Zacks Schools industry’s 31.5% growth. Although the shares have underperformed its industry, the ongoing enrollment growth trend and strategic pricing will drive the company’s growth in the upcoming period.

Notably, the earnings estimates for 2023 have moved upward over the past 30 days to $3.21 per share from $3.16 per share. This depicts analysts’ optimism about the stock’s potential. Furthermore, this Zacks Rank #1 (Strong Buy) company delivered a trailing four-quarter earnings surprise of 12.1%, on average.

Image Source: Zacks Investment Research

Factors Favoring STRA

Solid Enrollment: Strategic Education is gaining from strong demand environment and consistent year-over-year growth in university inquiries. During the second quarter of 2023, the company witnessed solid enrollment growth in the U.S. Higher Education (“USHE”) and Education Technology Services (“ETS”) segments.

Under the USHE segment, Strayer and Capella Universities reported strong new student enrollment, backing the segment’s enrollment growth by 4.7% from the year-ago quarter’s level to 80,353 students. Under the ETS segment, Sophia Learning subscriptions and employer-affiliated enrollment witnessed notable growth year over year. Sophia Learning’s average total subscribers increased approximately 30% year over year and employer-affiliated enrolment was 27.1% of USHE enrolment compared with 24.6% in the year-ago period.

Higher Pricing: STRA also focuses on its pricing strategies to increase and maintain its growth momentum. During the second quarter of 2023, this strategy contributed to the company’s growth. The increase in revenue per student in the quarter is attributable to the planned pricing increase for 2023. This factor resulted in the quarter’s revenue growth of 8.3% year over year in the Australia/New Zealand segment on a constant-currency basis.

Diverse Programs: The company believes in providing various innovative programs to improve student outcomes. Under the USHE segment, the Capella University indulges in continuous innovation and course updates that expands its product portfolio, which, in turn, boosts enrollments and drives long-term growth. One of these innovations is FlexPath, which continues to be one of the company’s fastest-growing programs as it allows students to focus on leveraging their skills and knowledge gained during professional hours. In second-quarter 2023, FlexPath enrollments represented 21% of all USHE enrollments, up from 19% reported in the prior-year period.

Higher Growth Rates: The Zacks Consensus Estimate of earnings of $3.21 per share for 2023 indicates 27.9% year-over-year growth. The same for 2024 reflects 31.5% year-over-year growth.

Other Key Picks

Some other top-ranked stocks from the Consumer Discretionary sector are Royal Caribbean Cruises Ltd. RCL, Live Nation Entertainment, Inc. LYV and Guess?, Inc. GES.

Royal Caribbean presently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 28.5%, on average. The stock has surged 92% in the past year. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates growth of 55.2% and 182.8%, respectively, from the year-ago period’s levels.

Live Nation presently sports a Zacks Rank of 1. LYV has a trailing four-quarter earnings surprise of 34.6%, on average. The stock has declined 3.6% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests rises of 21% and 57.8%, respectively, from the year-ago period’s levels.

Guess currently sports a Zacks Rank of 1. GES has a trailing four-quarter earnings surprise of 43.4%, on average. Shares of the company have increased 34.6% in the past year.

The Zacks Consensus Estimate for GES’ fiscal 2023 sales and EPS implies improvements of 3.7% and 9.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report