Why Nabors Industries Ltd's Stock Skyrocketed 35% in a Quarter: A Deep Dive

Nabors Industries Ltd (NYSE:NBR), a prominent player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 34.80%, from $88.70 to its current price of $119.58. This impressive performance has been accompanied by a market cap increase to $1.14 billion. Over the past week alone, the stock has gained 8.82%, indicating a strong upward momentum. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, has also risen from $117.23 to $124.39 over the past three months. Currently, the stock is considered fairly valued, a significant improvement from its modestly undervalued status three months ago.

Unveiling Nabors Industries Ltd

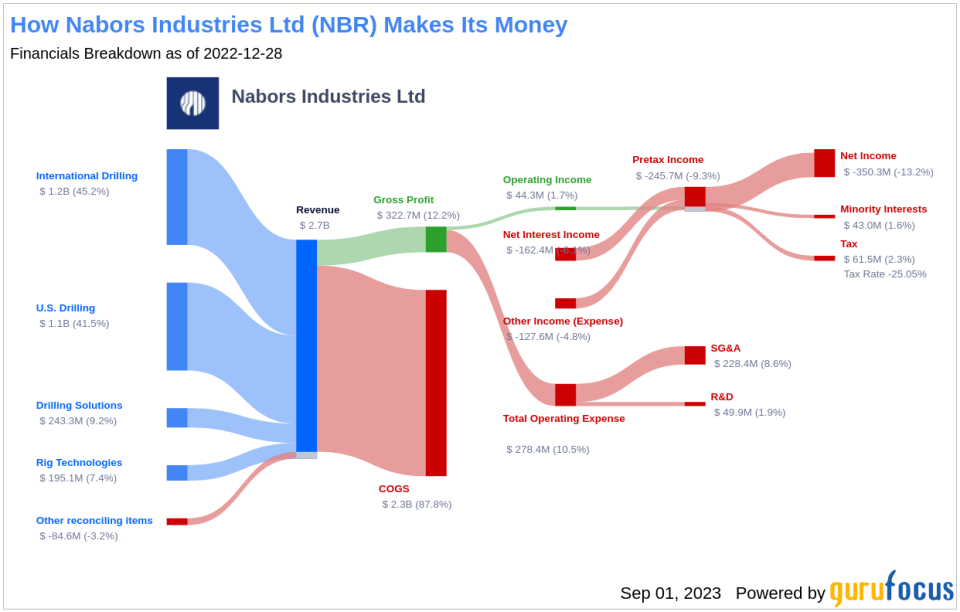

Nabors Industries Ltd is a leading provider of drilling and drilling-related services in the oil and gas industry. The company owns and operates one of the world's largest land-based drilling rig fleets and provides offshore platform rigs in the United States and international markets. Nabors Industries Ltd operates in over 15 countries and has five reportable segments: U.S. Drilling, Canada Drilling, International Drilling, Drilling Solutions, and Rig Technologies. The company's key revenue is generated from International Drilling.

Profitability Analysis

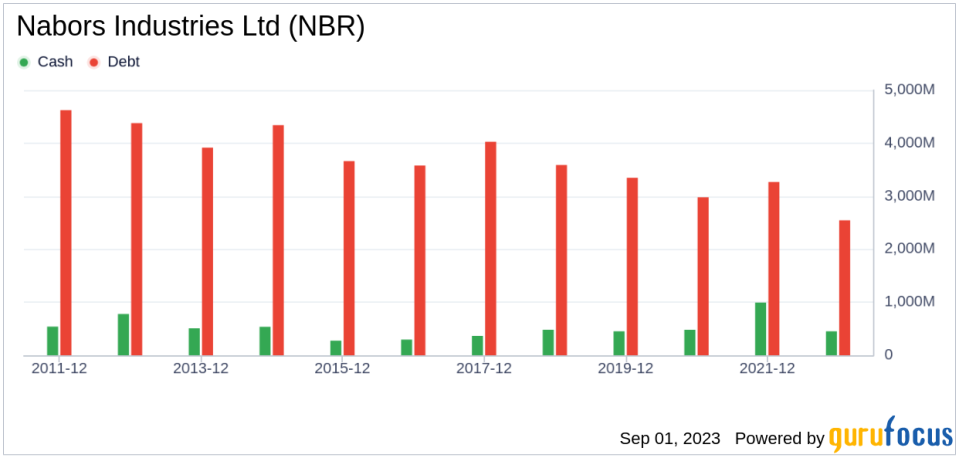

As of June 30, 2023, Nabors Industries Ltd has a profitability rank of 3/10. The company's operating margin of 7.81% is better than 47.98% of 967 companies in the same industry. The company's ROE, ROA, and ROIC, which stand at -7.02%, -0.62%, and 0.87% respectively, also reflect its profitability. Despite having only one year of profitability over the past 10 years, Nabors Industries Ltd's performance is better than 10.65% of 948 companies in the same sector.

Growth Prospects

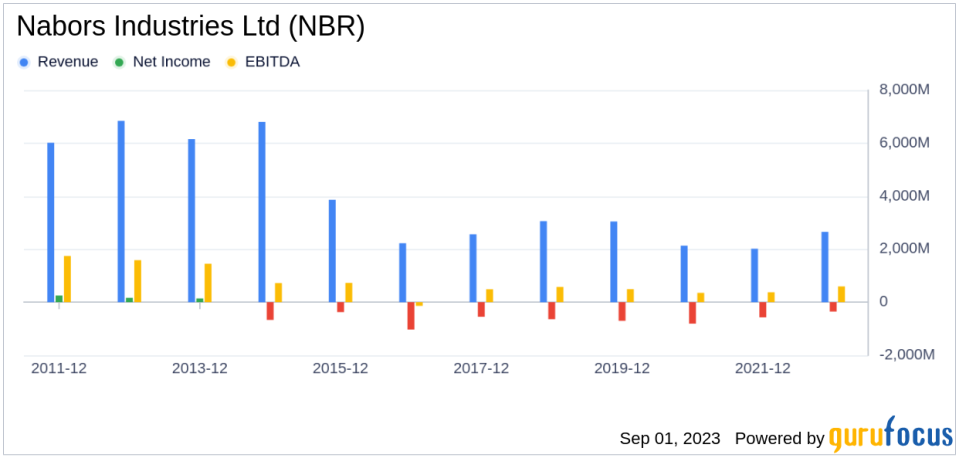

Nabors Industries Ltd's growth rank stands at 3/10 as of today. The company's 3-year and 5-year revenue growth rate per share are -11.70% and -11.10% respectively. However, the company's total revenue growth rate (future 3Y to 5Y est) is estimated at 8.44%, which is better than 67.3% of 263 companies in the same industry. The company's 3-year and 5-year EPS without NRI growth rate are 27.30% and 12.00% respectively, indicating potential for future growth.

Major Stock Holders

The top three holders of Nabors Industries Ltd's stock are Jim Simons (Trades, Portfolio), who holds 1.59% of the company's shares, Steven Cohen (Trades, Portfolio), who holds 0.22%, and Paul Tudor Jones (Trades, Portfolio), who holds 0.21% of the company's shares.

Competitive Landscape

Nabors Industries Ltd faces competition from several companies in the Oil & Gas industry. Its main competitors include Diamond Offshore Drilling Inc (NYSE:DO) with a market cap of $1.57 billion, Vantage Drilling International (VTDRF) with a market cap of $309.234 million, and Independence Contract Drilling Inc (NYSE:ICD) with a market cap of $43.381 million.

Conclusion

In conclusion, Nabors Industries Ltd has demonstrated impressive stock performance over the past three months, with a significant surge in its stock price and market cap. The company's profitability and growth prospects, coupled with its competitive position in the Oil & Gas industry, make it a stock to watch. However, investors should also consider the company's profitability rank, growth rank, and the performance of its competitors when making investment decisions.

This article first appeared on GuruFocus.