Why Nabors Industries Ltd's Stock Skyrocketed 31% in a Quarter: A Deep Dive

Nabors Industries Ltd (NYSE:NBR), a leading player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. The company's stock price has increased by 31.23%, despite a minor setback of 2.83% over the past week. The current market cap of the company stands at $1.21 billion, with the stock price at $126.39. According to the GF Value, a measure defined by GuruFocus.com that calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is fairly valued at $125.17. This is a significant increase from the GF Value of $117.23 three months ago, indicating that the stock was modestly undervalued at that time.

Company Overview

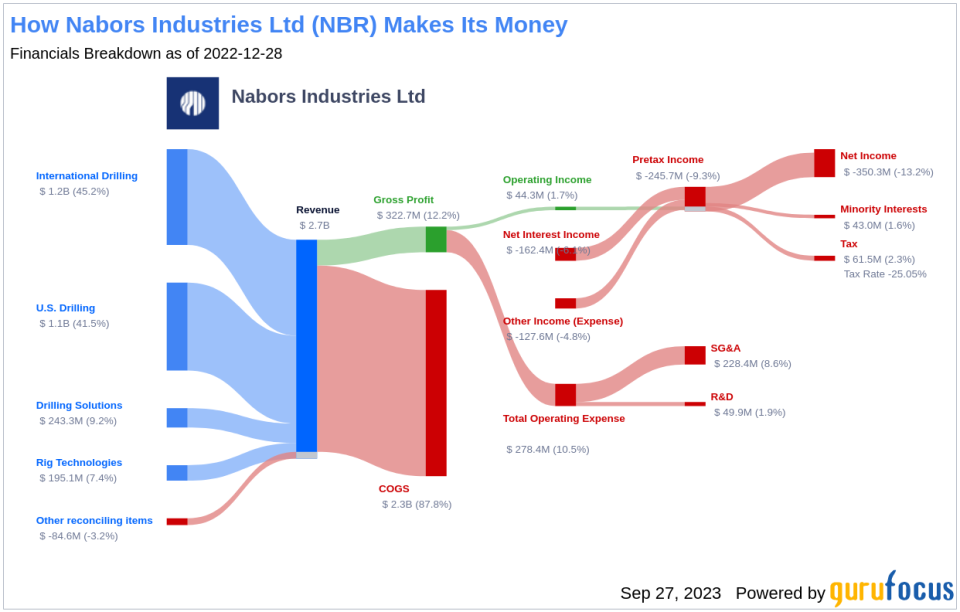

Nabors Industries Ltd operates one of the world's largest land-based drilling rig fleets and provides offshore platform rigs in the U.S. and international markets. The company has operations in over 15 countries and actively markets 300 rigs for land-based drilling operations and 29 rigs for offshore platform drilling operations. Nabors Industries Ltd has five reportable segments: U.S. Drilling, Canada Drilling, International Drilling, Drilling Solutions, and Rig Technologies. The majority of the company's revenue is generated from International Drilling.

Profitability Analysis

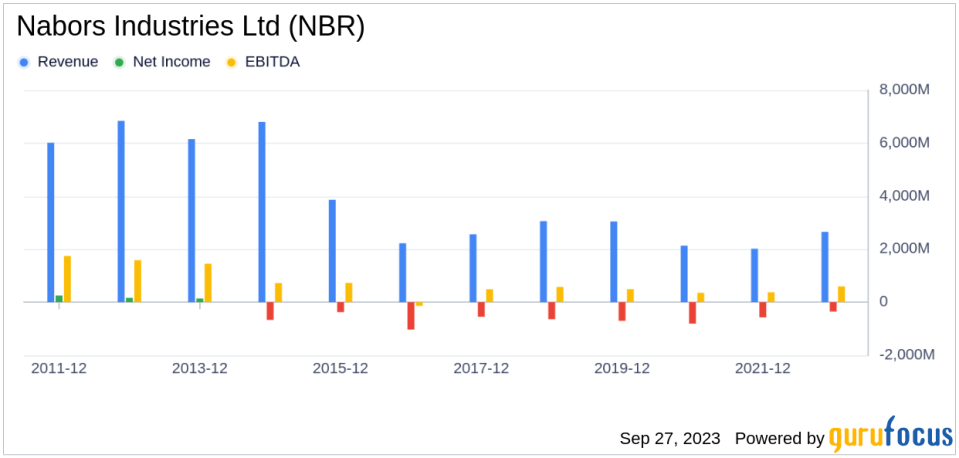

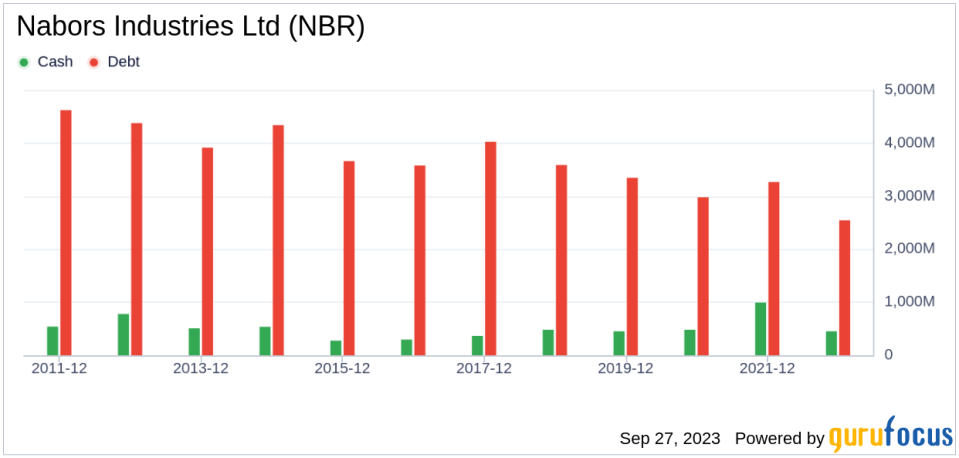

Despite the recent surge in stock price, Nabors Industries Ltd's Profitability Rank stands at 3/10, indicating relatively low profitability. The company's Operating Margin of 7.81% is better than 48.17% of companies in the same industry. However, the company's negative ROE and ROA suggest that it is not generating a positive return on its equity or assets. The company's ROIC of 0.87% is better than 37.61% of companies in the same industry. Over the past 10 years, the company has only had 1 year of profitability, which is better than 10.94% of companies in the industry.

Growth Prospects

Nabors Industries Ltd's Growth Rank is 3/10, indicating relatively low growth. The company's 3-Year and 5-Year Revenue Growth Rates per share are negative, suggesting a decrease in revenue per share. However, the company's future total revenue growth rate estimate of 8.44% is better than 68.58% of companies in the same industry. The company's 3-Year and 5-Year EPS without NRI Growth Rates are better than over half of the companies in the same industry.

Major Stock Holders

The top three holders of Nabors Industries Ltd's stock are Jim Simons (Trades, Portfolio), Steven Cohen (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio). Jim Simons (Trades, Portfolio) holds the largest number of shares, with 152,125 shares, representing 1.59% of the company's stock. Steven Cohen (Trades, Portfolio) holds 21,100 shares, representing 0.22% of the company's stock, while Paul Tudor Jones (Trades, Portfolio) holds 19,572 shares, representing 0.21% of the company's stock.

Competitive Landscape

Nabors Industries Ltd faces competition from several companies in the Oil & Gas industry. The company's main competitors include Diamond Offshore Drilling Inc (NYSE:DO) with a market cap of $1.53 billion, Vantage Drilling International (VTDRF) with a market cap of $330.732 million, and Independence Contract Drilling Inc (NYSE:ICD) with a market cap of $41.130 million.

Conclusion

In conclusion, Nabors Industries Ltd has seen a significant increase in its stock price over the past three months, despite a minor setback over the past week. The company's profitability and growth are relatively low, but it has a strong presence in the Oil & Gas industry and faces competition from several companies. The company's stock is currently fairly valued according to the GF Value, and it has a strong shareholder base. Despite the challenges, the company's future total revenue growth rate estimate is promising, suggesting potential for future performance.

This article first appeared on GuruFocus.